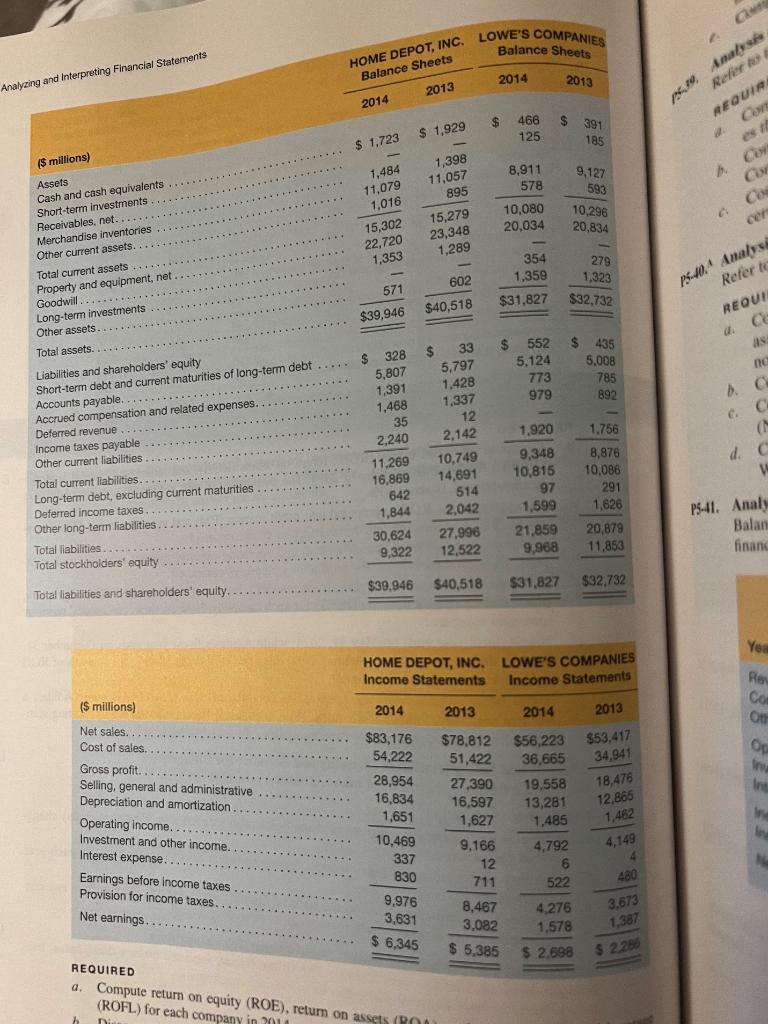

Question: Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for each company in 2014. Disaggregate the ROAs computed into

- Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for each company in 2014.

- Disaggregate the ROAs computed into profit margin (PM) and asset turnover (AT) components. Which of these factors drives ROA for each company?

- Compute the gross profit margin (GPM) and operating expense to sales ratios for each company. How do these companies profitability measures compare?

- Compute the accounts receivable turnover (ART), inventory turnover (INVT), and property, plant, and equipment turnover (PPET) for each company. How do these companies turnover measures compare?

- Compare and evaluate these competitors performance in 2014.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock