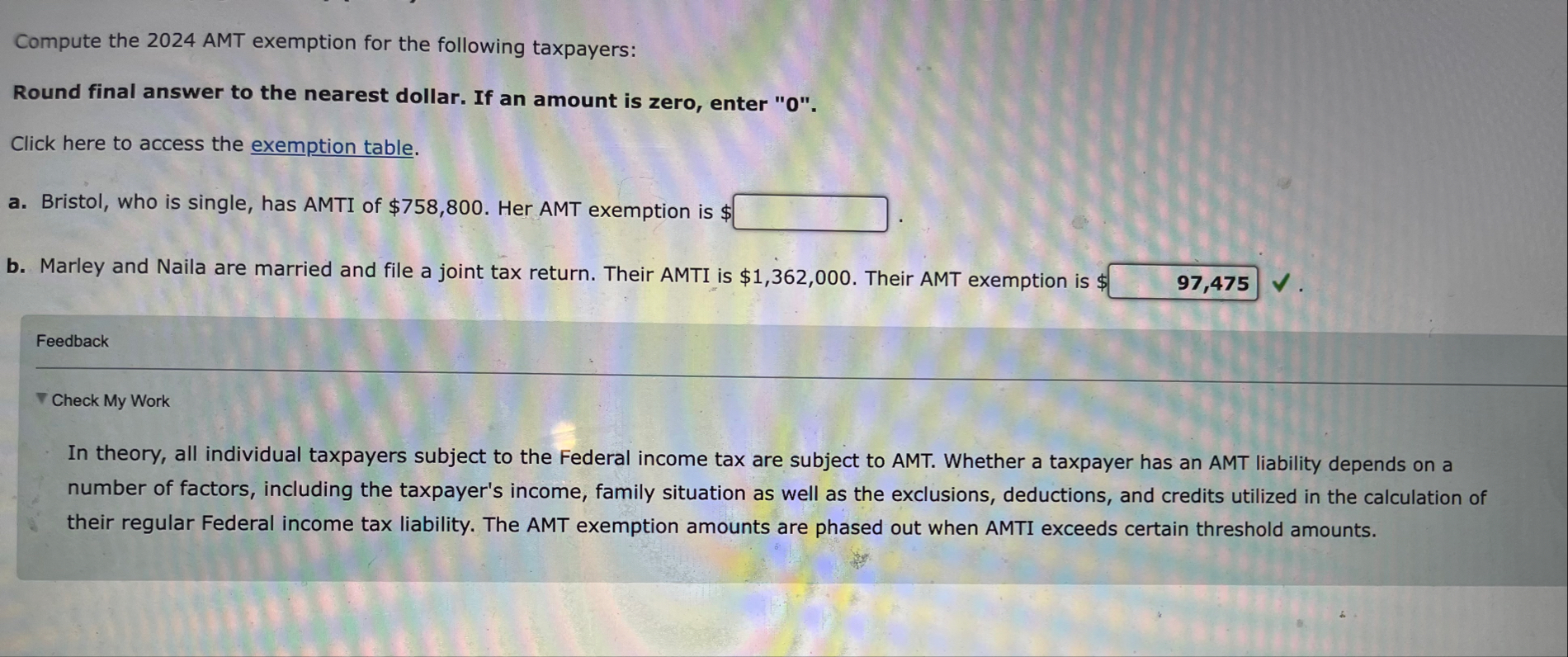

Question: Compute the 2 0 2 4 AMT exemption for the following taxpayers: Round final answer to the nearest dollar. If an amount is zero, enter

Compute the AMT exemption for the following taxpayers:

Round final answer to the nearest dollar. If an amount is zero, enter

Click here to access the exemption table.

a Bristol, who is single, has AMTI of $ Her AMT exemption is $

b Marley and Naila are married and file a joint tax return. Their AMTI is $ Their AMT exemption is $

Feedback

Check My Work

In theory, all individual taxpayers subject to the Federal income tax are subject to AMT. Whether a taxpayer has an AMT liability depends on a number of factors, including the taxpayer's income, family situation as well as the exclusions, deductions, and credits utilized in the calculation of

their regular Federal income tax liability. The AMT exemption amounts are phased out when AMTI exceeds certain threshold amounts.

tableStatusExemption,PhaseoutBegins atEnds atMarried joint,$$$Single or head of household,Married separate,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock