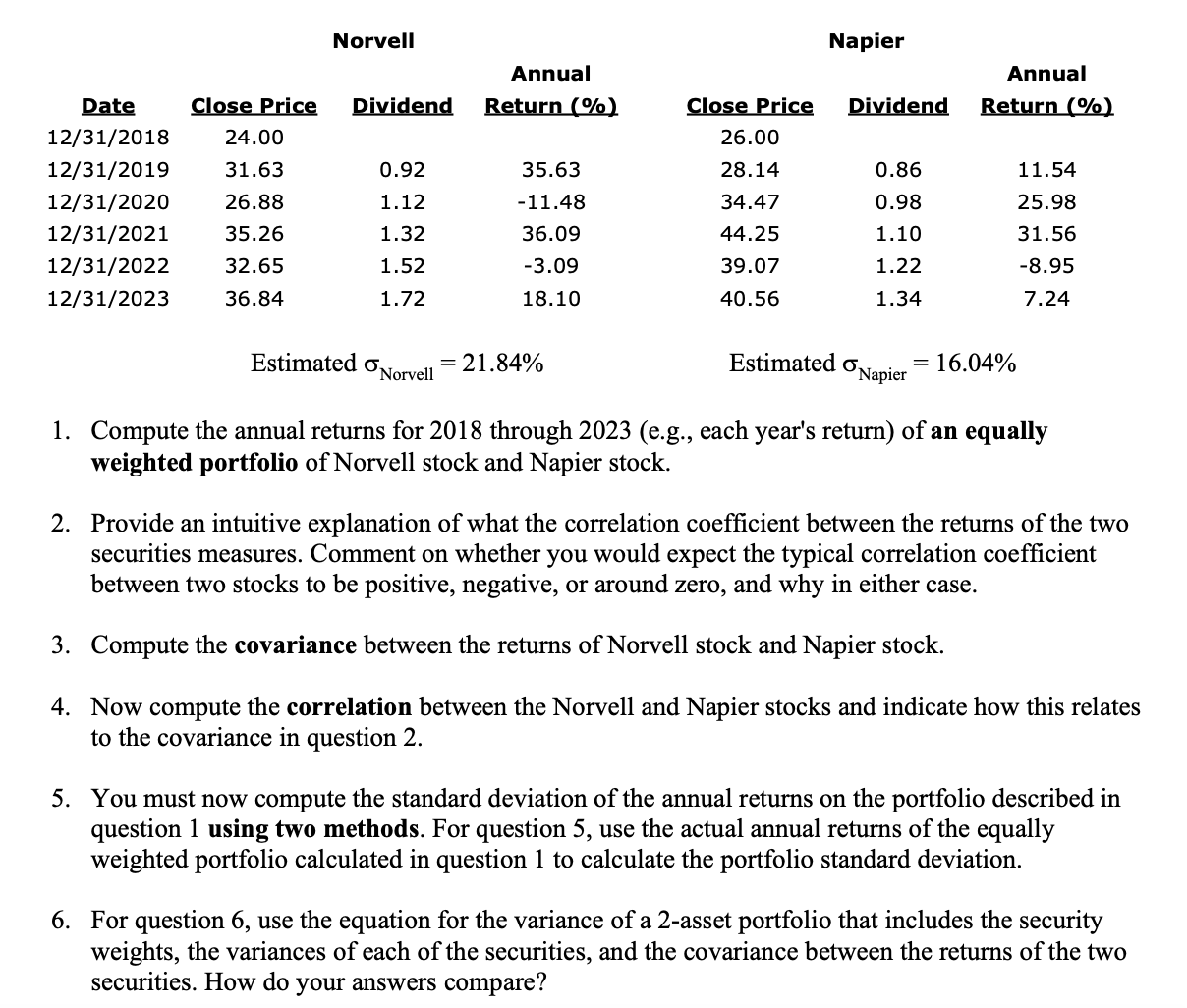

Question: Compute the annual returns for 2 0 1 8 through 2 0 2 3 ( e . g . , each year's return ) of

Compute the annual returns for through eg each year's return of an equally

weighted portfolio of Norvell stock and Napier stock.

Provide an intuitive explanation of what the correlation coefficient between the returns of the two

securities measures. Comment on whether you would expect the typical correlation coefficient

between two stocks to be positive, negative, or around zero, and why in either case.

Compute the covariance between the returns of Norvell stock and Napier stock.

Now compute the correlation between the Norvell and Napier stocks and indicate how this relates

to the covariance in question

You must now compute the standard deviation of the annual returns on the portfolio described in

question using two methods. For question use the actual annual returns of the equally

weighted portfolio calculated in question to calculate the portfolio standard deviation.

For question use the equation for the variance of a asset portfolio that includes the security

weights, the variances of each of the securities and the covariance between the returns of the two

securities How do your answers compare?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock