Question: explain the steps taken to get to that solution given 9. Portfolio manager Max Gaines needs to develop an investment portfolio for his clients who

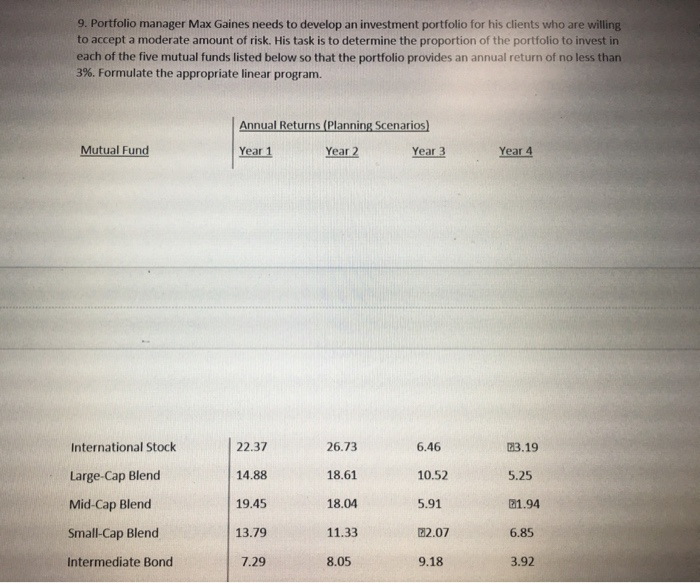

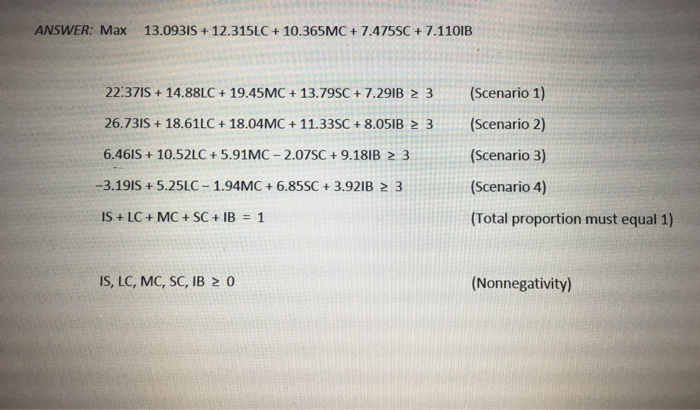

9. Portfolio manager Max Gaines needs to develop an investment portfolio for his clients who are willing! to accept a moderate amount of risk. His task is to determine the proportion of the portfolio to invest in each of the five mutual funds listed below so that the portfolio provides an annual return of no less than 3%. Formulate the appropriate linear program. Annual Returns (Planning Scenarios) Mutual Fund Year 1 Year 2 Year 3 Year 4 International Stock 26.73 133.19 6.46 10.52 Large-Cap Blend 18.61 5.25 22.37 14.88 19.45 13.79 18.04 5.91 21.94 Mid-Cap Blend Small-Cap Blend 11.33 22.07 6.85 Intermediate Bond 7.29 8.05 9.18 3.92 ANSWER: Max 13.09315 + 12.315LC + 10.365MC +7.475SC + 7.1101B 22:371S + 14.88LC + 19.45MC + 13.79SC +7.291B 2 3 26.731S + 18.61LC + 18.04MC +11.33SC + 8.051B 2 3 6.4615 +10.52LC + 5.91MC - 2.075C + 9.181B > 3 (Scenario 1) (Scenario 2) (Scenario 3) (Scenario 4) (Total proportion must equal 1) -3.1915 +5.25LC - 1.94MC + 6.855C + 3.921B 2 3 IS + LC + MC +SC+IB = 1 IS, LC, MC, SC, IB > 0 (Nonnegativity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts