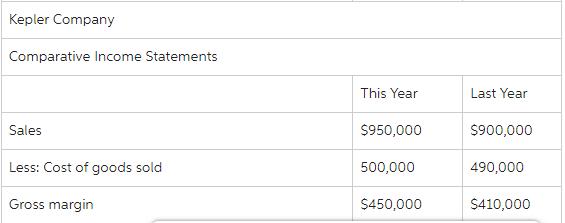

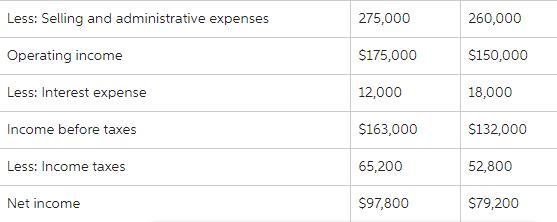

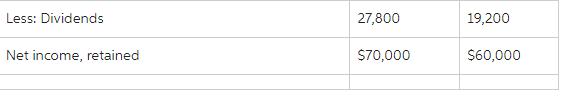

Question: Compute the below profitability ratios: Return on assets Return on stockholders equity Earnings per share Price-earnings ratio Dividend yield Dividend payout ratio Based upon the

Compute the below profitability ratios:

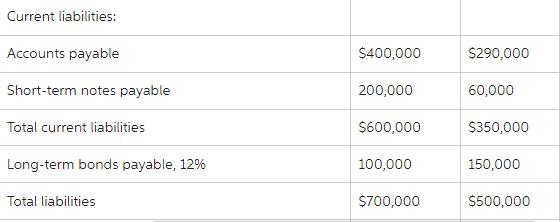

Return on assets

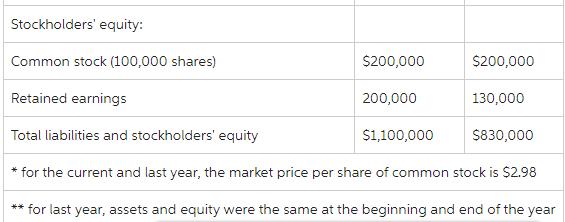

Return on stockholders’ equity

Earnings per share

Price-earnings ratio

Dividend yield

Dividend payout ratio

Based upon the profitability ratios, explain whether or not you would recommend investing in the common stock of Kepler.

Use the assignment rubric to guide your efforts.

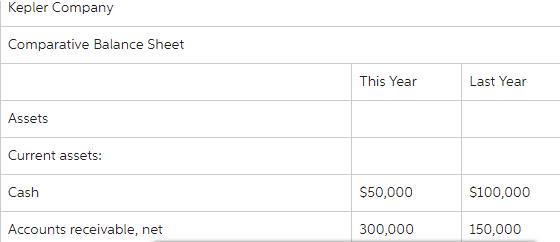

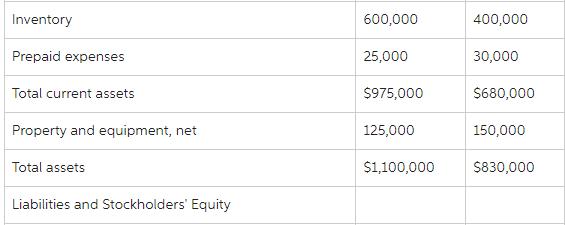

Kepler Company Comparative Balance Sheet Assets Current assets: Cash Accounts receivable, net This Year $50,000 300,000 Last Year $100,000 150,000

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Return on Assets ROA Net Income This Year 97800 Total Assets This Year 1100000 Total Assets Last Year 830000 Average Total Assets Total Assets This Year Total Assets Last Year 2 1100000 830000 2 96500... View full answer

Get step-by-step solutions from verified subject matter experts