Question: Compute the bottom up beta for Tesla. It operates in three industries Auto&Trucks (70%), Software (Syst&Appl) (20%) and Green and Renewable Energy (10%). Its debt-to-equity

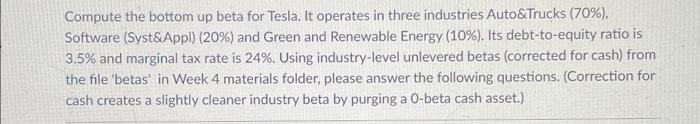

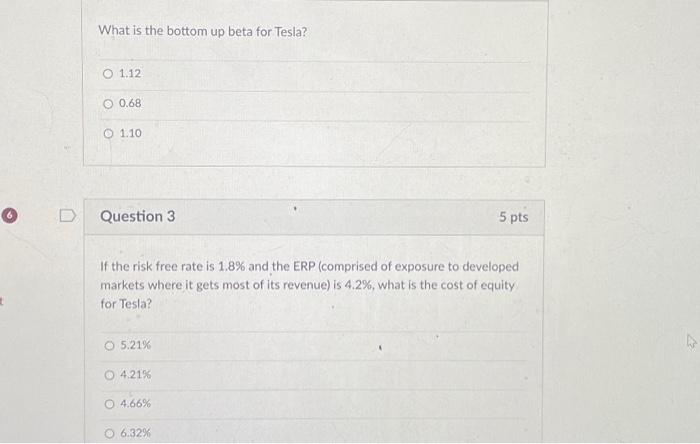

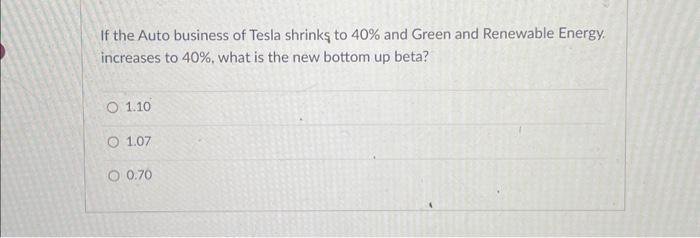

Compute the bottom up beta for Tesla. It operates in three industries Auto\&Trucks (70\%), Software (Syst\&Appl) (20\%) and Green and Renewable Energy (10\%). Its debt-to-equity ratio is 3.5% and marginal tax rate is 24%. Using industry-level unlevered betas (corrected for cash) from the file 'betas' in Week 4 materials folder, please answer the following questions. (Correction for cash creates a slightly cleaner industry beta by purging a 0-beta cash asset.) If the Auto business of Tesla shrink to 40% and Green and Renewable Energy. increases to 40%, what is the new bottom up beta? 1.10 1.07 0.70 What is the bottom up beta for Tesla? 1.12 0.68 1.10 Question 3 5 pts If the risk free rate is 1.8% and the ERP (comprised of exposure to developed markets where it gets most of its revenue) is 4.2%, what is the cost of equity for Tesla? 5.21% 4.21\% 4.66% 6.32%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts