Question: Compute the following ratios for 2015: (a) Current ratio= Working Capital= (b) Acid-test ratio= (c)Accounts receivable turnover= Average Collection Period (Average Days to Collect)= (d)

Compute the following ratios for 2015:

(a) Current ratio= Working Capital=

(b) Acid-test ratio= (c)Accounts receivable turnover= Average Collection Period (Average Days to Collect)=

(d) Inventory turnover= Days in inventory (Average Days to Sell)= Operating Cycle = Average Days to Sell + Average Days to Collect

'(e ) Profit Margin = (f) Asset turnover = (g) Return on Assets =

| (h) Return on Common Stockholders' Equity = |

| ARID Company |

| Income Statement |

| 2015 | 2014 | ||||||

| Net Sales (all on account) | $930,000 | 820,000 | |||||

| Expenses | |||||||

| Cost of goods sold | 715,000 | 616,000 | |||||

| Selling and administrative | 145,000 | 150,000 | |||||

| Interest expense | 17,000 | 18,000 | |||||

| Income tax expense | 21,000 | 15,000 | |||||

| Total expenses | 898,000 | 799,000 | |||||

| Net income | $32,000 | $21,000 | |||||

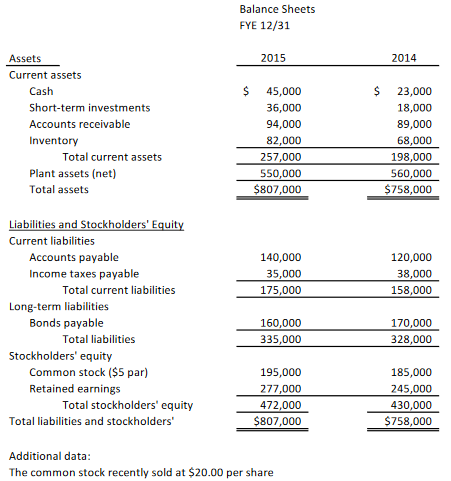

Balance Sheets FYE 12/31 2015 2014 Assets Current assets Cash Short-term investments Accounts receivable Inventory 45,000 36,000 94,000 82,000 257,000 550,000 $807,000 $23,000 18,000 89,000 68,000 198,000 560,000 $758,000 Total current assets Plant assets (net) Total assets Liabilities and Stockholder Current liabilities Accounts payable Income taxes payable 140,000 35,000 175,000 120,000 38,000 158,000 Total current liabilities Long-term liabilities Bonds payable 160,000 335,000 170,000 328,000 Total liabilities Stockholders' equity Common stock ($5 par) Retained earnings 195,000 277,000 472,000 $807.000 185,000 245,000 430,000 $758,000 Total stockholders' equity Total liabilities and stockholders Additional data The common stock recently sold at $20.00 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts