Question: Compute the yield to maturity for a zero coupon bond with a maturity of 15 years and a face value of $1000. The bond is

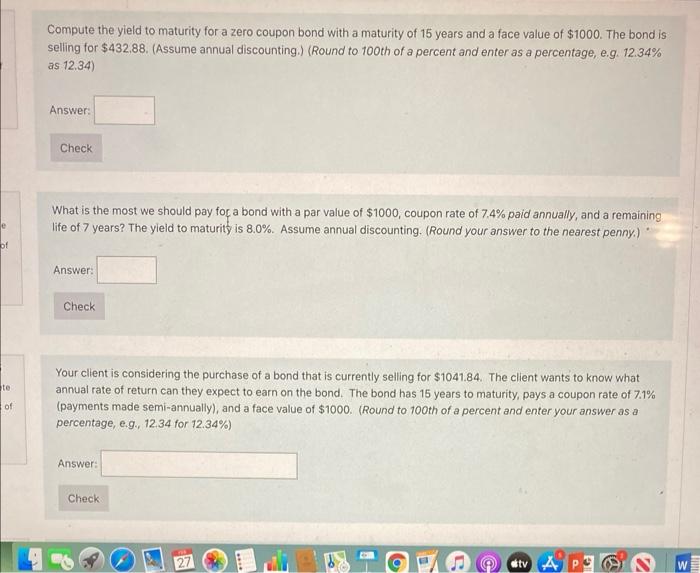

Compute the yield to maturity for a zero coupon bond with a maturity of 15 years and a face value of $1000. The bond is selling for $432.88. (Assume annual discounting.) (Round to 100th of a percent and enter as a percentage, e.g. 12.34% as 12.34) Answer: Check What is the most we should pay for a bond with a par value of $1000, coupon rate of 7.4% paid annually, and a remaining life of 7 years? The yield to maturity is 8.0%. Assume annual discounting. (Round your answer to the nearest penny.) le of Answer: Check te Your client is considering the purchase of a bond that is currently selling for $1041.84. The client wants to know what annual rate of return can they expect to earn on the bond. The bond has 15 years to maturity, pays a coupon rate of 7.1% (payments made semi-annually), and a face value of $1000. (Round to 100th of a percent and enter your answer as a percentage, e.g. 12.34 for 12.34%) of Answer: Check 27 ctv A PO WE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts