Question: Compute two cash flow ratios (c) Compute two cash flow ratios. (Round ratios to 2 decimal places, eg. 0.62.) :1 Current cash debt coverage ratio

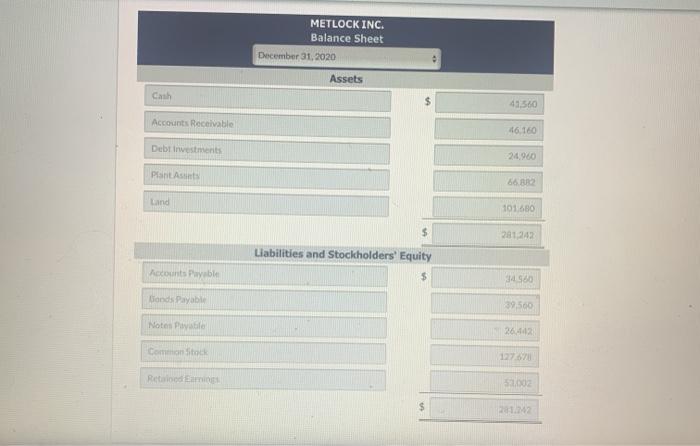

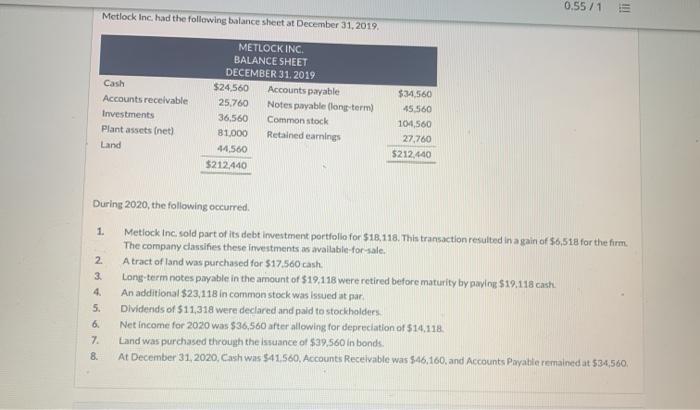

(c) Compute two cash flow ratios. (Round ratios to 2 decimal places, eg. 0.62.) :1 Current cash debt coverage ratio Cash debt coverage ratio :1 e Textbook and Media METLOCK INC. Balance Sheet December 31, 2020 Assets Cash 41560 Accounts Receivable 46.160 Debt investments 24.900 Plant Asunts 66.BR Land 101680 Liabilities and Stockholders' Equity Accounts Payable $ 34.580 Conds Payable 39.500 Notes Patie 264 Common toch 127 51002 0.55/1 Metlock Inc. had the following balance sheet at December 31, 2019. Cash Accounts receivable Investments Plant assets Inet) Land METLOCK INC. BALANCE SHEET DECEMBER 31, 2019 $24.560 Accounts payable 25.760 Notes payable long-term) 36,560 Common stock 81.000 Retained earnings 44.560 $212.440 $34.560 45.560 104,560 27,760 5212440 During 2020, the following occurred. 1. 3 4 5. 6. 7 8 Metlock Inc. sold part of its debt investment portfolio for $18.118. This transaction resulted in a gain of $6,518 for the firm. The company cassifies these investments as available for sale. A tract of land was purchased for 517.560 cash. Long-term notes payable in the amount of $19,118 were retired before maturity by paying $19.118 cash. An additional $23,118 in common stock was issued at par Dividends of $11,318 were declared and paid to stockholders Net income for 2020 was $36,560 after allowing for depreciation of 514,118 Land was purchased through the issuance of $39,560 in bonds. At December 31, 2020, Cash was $41560. Accounts Receivable was $46,160, and Accounts Payable remained at $34,560

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts