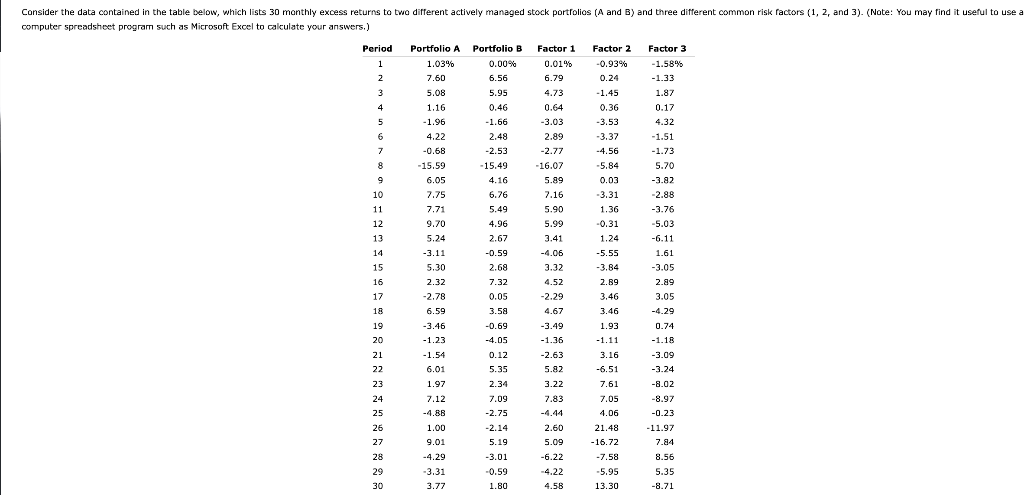

Question: computer spreadsheet program such as Microsoft Excel to calculate your answers.) b. How well does the factor model explain the variation in portfolio returns? On

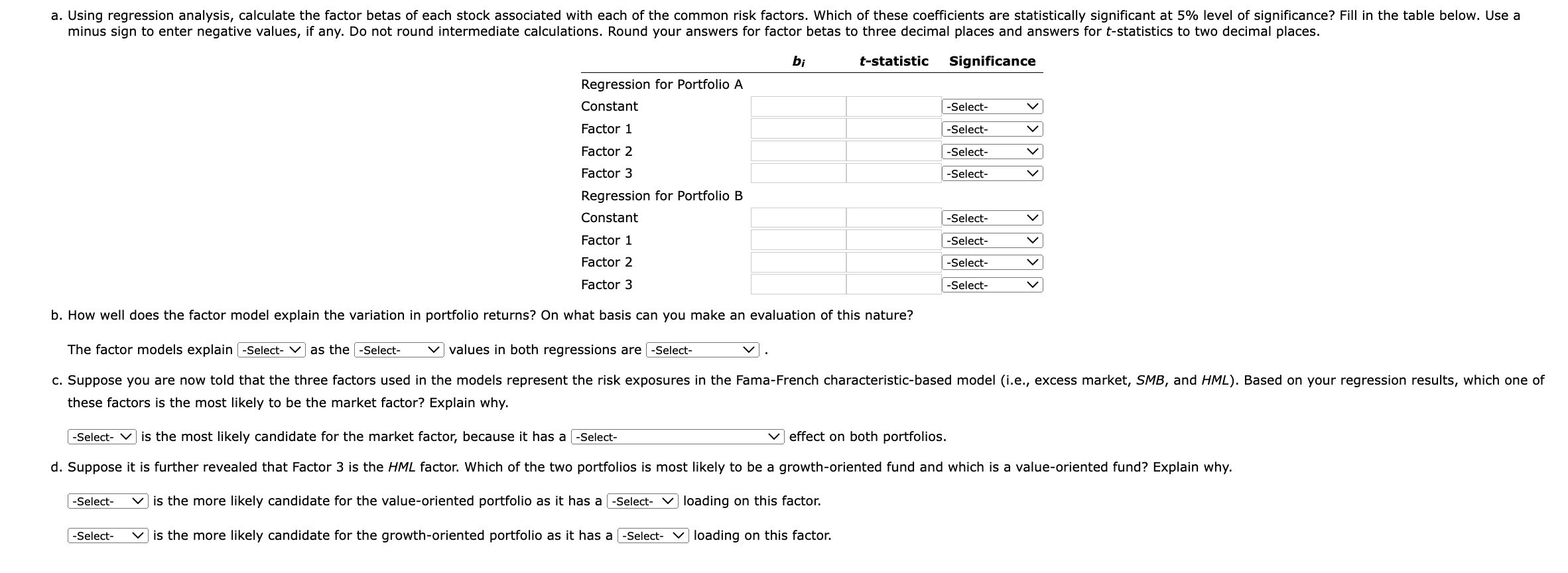

computer spreadsheet program such as Microsoft Excel to calculate your answers.) b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? The factor models explain - -Select- V as the - -Select- V values in both regressions are - Select- ]. these factors is the most likely to be the market factor? Explain why. is the most likely candidate for the market factor, because it has a ] effect on both portfolios. is the more likely candidate for the value-oriented portfolio as it has a loading on this factor. is the more likely candidate for the growth-oriented portfolio as it has a loading on this factor. computer spreadsheet program such as Microsoft Excel to calculate your answers.) b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? The factor models explain - -Select- V as the - -Select- V values in both regressions are - Select- ]. these factors is the most likely to be the market factor? Explain why. is the most likely candidate for the market factor, because it has a ] effect on both portfolios. is the more likely candidate for the value-oriented portfolio as it has a loading on this factor. is the more likely candidate for the growth-oriented portfolio as it has a loading on this factor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts