Question: computer type please 1. The Sun Company bonds with a $ 1,200 face value and 11 years to maturity sell in the market for $

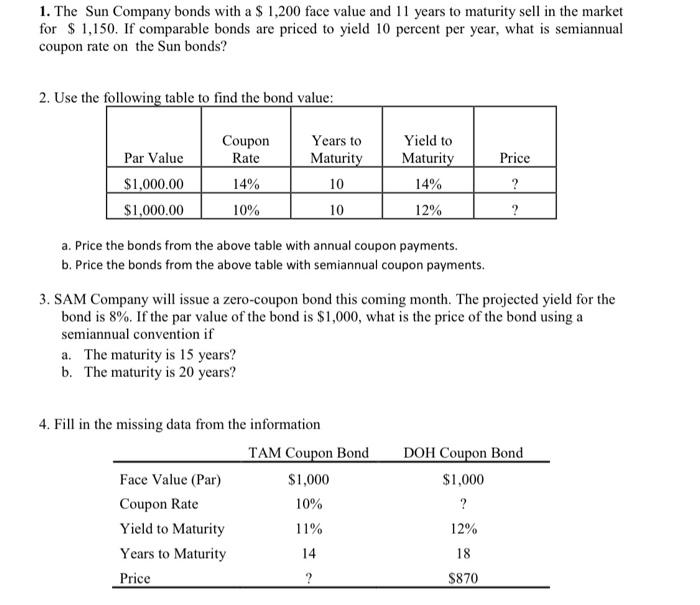

1. The Sun Company bonds with a $ 1,200 face value and 11 years to maturity sell in the market for $ 1,150. If comparable bonds are priced to yield 10 percent per year, what is semiannual coupon rate on the Sun bonds? 2. Use the following table to find the bond value: Coupon Rate Price Par Value $1,000.00 $1,000.00 Years to Maturity 10 10 Yield to Maturity 14% 12% 14% ? 10% ? a. Price the bonds from the above table with annual coupon payments. b. Price the bonds from the above table with semiannual coupon payments. 3. SAM Company will issue a zero-coupon bond this coming month. The projected yield for the bond is 8%. If the par value of the bond is $1,000, what is the price of the bond using a semiannual convention if a. The maturity is 15 years? b. The maturity is 20 years? 4. Fill in the missing data from the information TAM Coupon Bond Face Value (Par) $1,000 Coupon Rate 10% Yield to Maturity 11% Years to Maturity 14 Price ? DOH Coupon Bond $1,000 ? 12% 18 $870

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts