Question: Use the attached template (you can add more items) to show Cost of Capital and Capital Budgeting analysis feom the scenario. Please replace your insert

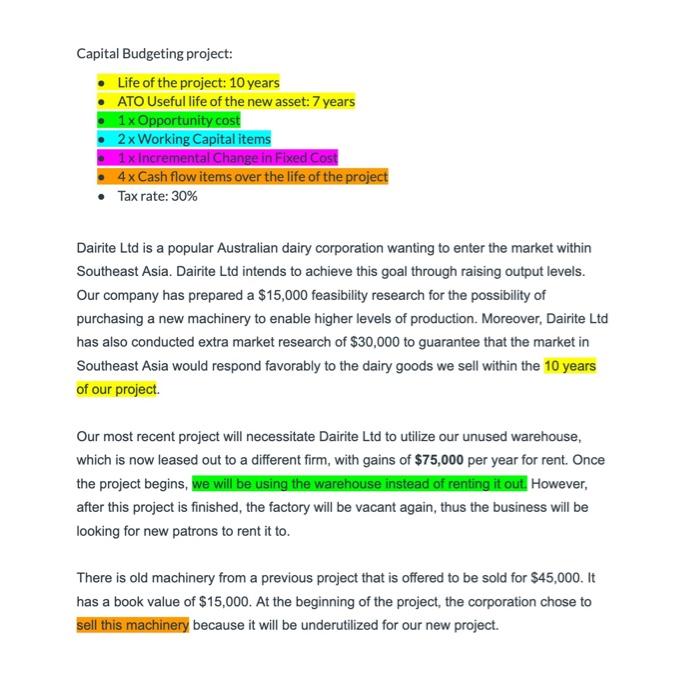

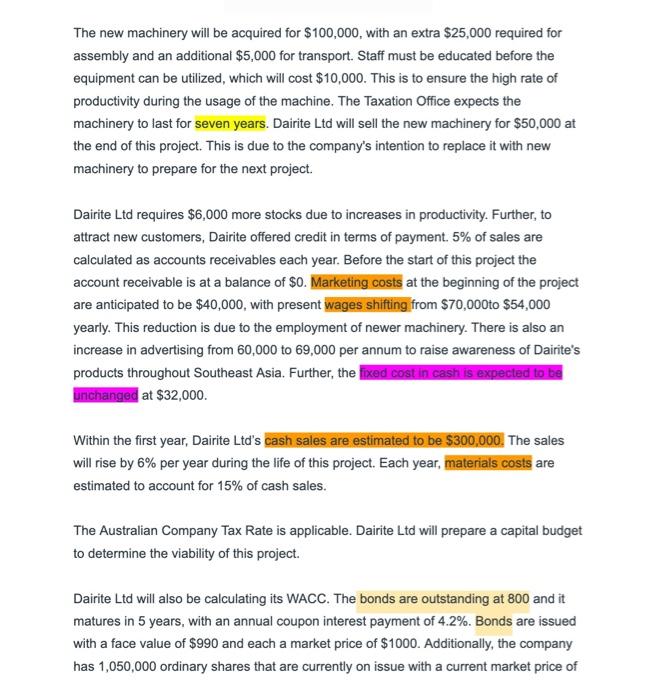

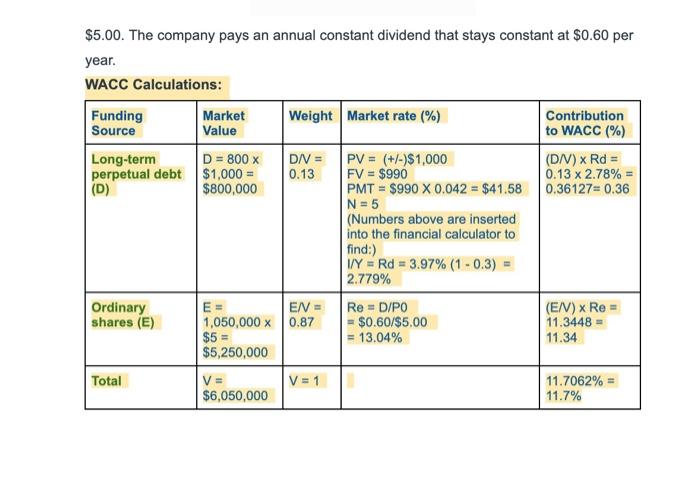

Capital Budgeting project: Life of the project: 10 years ATO Useful life of the new asset: 7 years 1 x Opportunity cost 2xWorking Capital items 1x incremental Change in Fixed Cost 4x Cash flow items over the life of the project Tax rate: 30% Dairite Ltd is a popular Australian dairy corporation wanting to enter the market within Southeast Asia. Dairite Ltd intends to achieve this goal through raising output levels. Our company has prepared a $15,000 feasibility research for the possibility of purchasing a new machinery to enable higher levels of production. Moreover, Dairite Ltd has also conducted extra market research of $30,000 to guarantee that the market in Southeast Asia would respond favorably to the dairy goods we sell within the 10 years of our project. Our most recent project will necessitate Dairite Ltd to utilize our unused warehouse, which is now leased out to a different firm, with gains of $75,000 per year for rent. Once the project begins, we will be using the warehouse instead of renting it out. However, after this project is finished, the factory will be vacant again, thus the business will be looking for new patrons to rent it to. There is old machinery from a previous project that is offered to be sold for $45,000. It has a book value of $15,000. At the beginning of the project, the corporation chose to sell this machinery because it will be underutilized for our new project. The new machinery will be acquired for $100,000, with an extra $25,000 required for assembly and an additional $5,000 for transport. Staff must be educated before the equipment can be utilized, which will cost $10,000. This is to ensure the high rate of productivity during the usage of the machine. The Taxation Office expects the machinery to last for seven years. Dairite Ltd will sell the new machinery for $50,000 at the end of this project. This is due to the company's intention to replace it with new machinery to prepare for the next project. Dairite Ltd requires $6,000 more stocks due to increases in productivity. Further, to attract new customers, Dairite offered credit in terms of payment. 5% of sales are calculated as accounts receivables each year. Before the start of this project the account receivable is at a balance of $0. Marketing costs at the beginning of the project are anticipated to be $40,000, with present wages shifting from $70,000to $54,000 yearly. This reduction is due to the employment of newer machinery. There is also an increase in advertising from 60,000 to 69,000 per annum to raise awareness of Dairite's products throughout Southeast Asia. Further, the fixed cost in cash is expected to be unchanged at $32,000. Within the first year, Dairite Ltd's cash sales are estimated to be $300,000. The sales will rise by 6% per year during the life of this project. Each year, materials costs are estimated to account for 15% of cash sales. The Australian Company Tax Rate is applicable. Dairite Ltd will prepare a capital budget to determine the viability of this project. Dairite Ltd will also be calculating its WACC. The bonds are outstanding at 800 and it matures in 5 years, with an annual coupon interest payment of 4.2%. Bonds are issued with a face value of $990 and each a market price of $1000. Additionally, the company has 1,050,000 ordinary shares that are currently on issue with a current market price of $5.00. The company pays an annual constant dividend that stays constant at $0.60 per year. Weight Market rate (%) WACC Calculations: Funding Market Source Value Long-term D = 800 x perpetual debt $1,000 = (D) $800,000 D/V = 0.13 Contribution to WACC (%) (D/V) x Rd = 0.13 X 2.78% = 0.36127=0.36 PV = (+/-)$1,000 FV = $990 PMT = $990 X 0.042 = $41.58 N = 5 (Numbers above are inserted into the financial calculator to find:) 1/Y = Rd = 3.97% (1 -0.3) = 2.779% Re = D/PO = $0.60/$5.00 = 13.04% Ordinary shares (E) E= EN = 1,050,000 x 0.87 $5 = $5,250,000 (E/V) x Re 11.3448 = 11.34 Total V = 1 V= $6,050,000 11.7062% = 11.7% Capital Budgeting Template-1.xlsx Downla Step Working out your weighted Average cost of Capital (WACC) based on your funding sources Funding source Contribution to Market Weight Market WACC Year Year 1 Year 2 Year 4 Years Yew Year Year Year Year 10 Step 2: Performing your Capital Budgeting analysis Insert your incremental Cash flow item here Insert your incremental Cash flow item here Insert your incremental Cash flow item here Insert your incremental Cashew item here Insert your incremental Cash flow item here Insert your internet Cash flow item here Imert your incremental Cash flow temere mert your incremental Cash flow item here Insert your incremental Cash flow om here Imert your incremental Cash flow item here Insert your incremental Cash flow item here Insert your incremental Cash How itembre Insert your incremental Cash flow temere Insert your incremento Cashew item here Before dow Lantas Alte Cow All To affect from din Sale of Procede Tusen tale Total Clow Font Value in your NPV Step Providing your recommendation and reason Recommendation Reason

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts