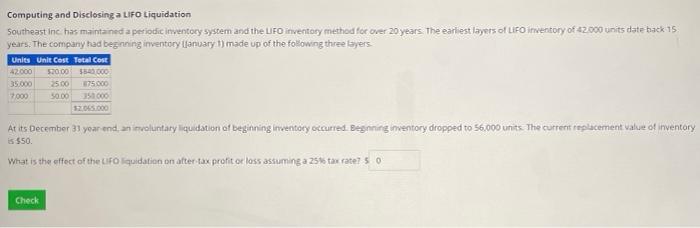

Question: Computing and Disclosing a LIFO tiquidation Southeast inc has maintained a periodic intentory system and the LFO inventafy method for over 20 years. The earlest

Computing and Disclosing a LIFO tiquidation Southeast inc has maintained a periodic intentory system and the LFO inventafy method for over 20 years. The earlest layers of Lifo inventory of s2.000 units date hack 15 years. The company had begnning inventory (lanuary t) made up of the followng three layers. At its December 3) year end, an inoluntary liquidation of beginning inventory occurred. Eegnning inventory dropped to 56.000 units The currerit replacement value of inventory is $50. What is the effect of the clfo liquidation on after-tax profit or loss assuming a 25to tar rate7 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts