Question: urgent please help will thumbs up Computing and Disclosing a LIFO Liquidation Southeast Inc. has maintained a periodic inventory system and the LIFO inventory method

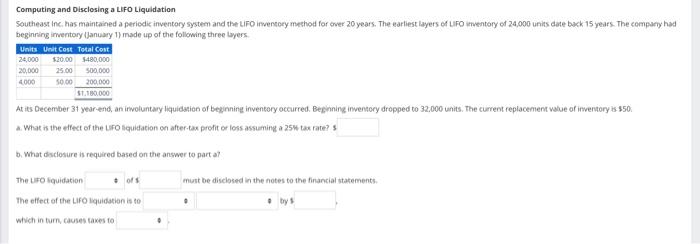

Computing and Disclosing a LIFO Liquidation

Southeast Inc. has maintained a periodic inventory system and the LIFO inventory method for over 20 years. The earliest layers of LIFO inventory of 24,000 units date back 15 years. The company had beginning inventory (January 1) made up of the following three layers.

Units Unit Cost Total Cost

24,000

$20.00 $480,000

20,000

25.00

500,000

4,000

50.00

200,000

$1,180,000

At its December 31 year-end, an involuntary liquidation of beginning inventory occurred. Beginning inventory dropped to 32,000 units. The current replacement value of inventory is $50.

- What is the effect of the LIFO liquidation on after-tax profit or loss assuming a 25% tax rate? $

- What disclosure is required based on the answer to part a?

The LIFO liquidation

of $

must be disclosed in the notes to the financial statements.

The effect of the LIFO liquidation is to which in turn, causes taxes to

Computing and Disclosing a LiFO Liquidation Southeast inc. has maintained a periodic inventory system and the LiFo imventory method for over 20 years. The earliest layers of ufo imentory of 24,000 units date back 15 years. The compary hat beginring inventory (January 1 ) made up of the following three lyyers. A. What is the effect of the LFo squidation on after-tax profit or loss assuming a 25% tax rate? s b. What dosclosure is required based on the answer to part a? The ufo iquidation of 1 must be disclosed in the notes to the financial statements. The effect of the Lifo bquidation is to mis which in turn, causes taxes to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts