Question: Computing Depreciation, Asset Book Value, and Gain or Loss on Asset Sale Sloan Company uses its own executive charter plane that originally cost $750,000. It

Computing Depreciation, Asset Book Value, and Gain or Loss on Asset Sale

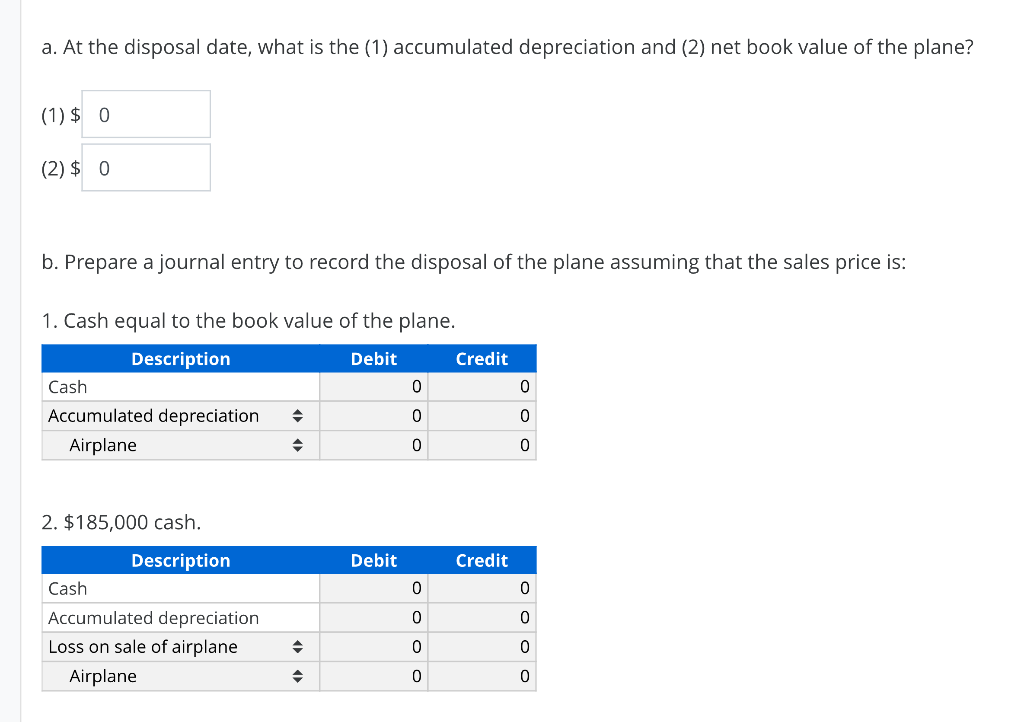

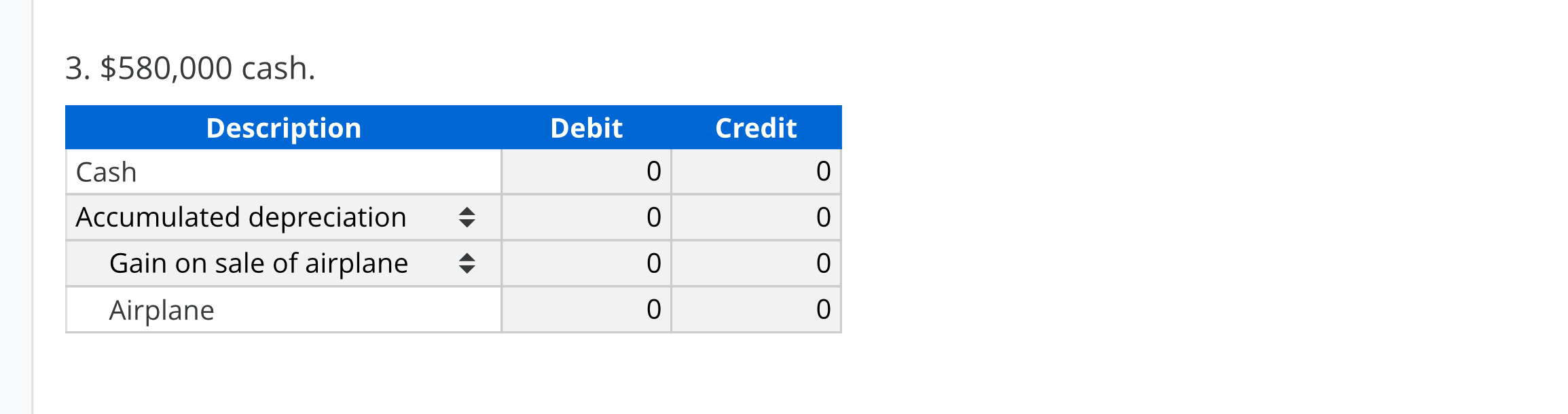

Sloan Company uses its own executive charter plane that originally cost $750,000. It has recorded straight-line depreciation on the plane for 6 full years, with a $70,000 expected salvage value at the end of its estimated 10-year useful life. Sloan disposes of the plane at the end of the sixth year.

\

\

a. At the disposal date, what is the (1) accumulated depreciation and (2) net book value of the plane? (1) $ 0 (2) $ 0 b. Prepare a journal entry to record the disposal of the plane assuming that the sales price is: 1. Cash equal to the book value of the plane. Description Debit Credit Cash 0 Accumulated depreciation 0 Airplane 0 0 0 0 2. $185,000 cash. Debit Credit 0 Description Cash Accumulated depreciation Loss on sale of airplane Airplane 0 Oo oo 0 0 3. $580,000 cash. Description Debit Credit Cash 0 0 o 0 Accumulated depreciation Gain on sale of airplane 0 0 Airplane 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts