Question: (Computing free cash flows and financing cash flows) Use the balance sheet, E, and income statement, :, for Abrahams Manufacturing Company to compute the firm's

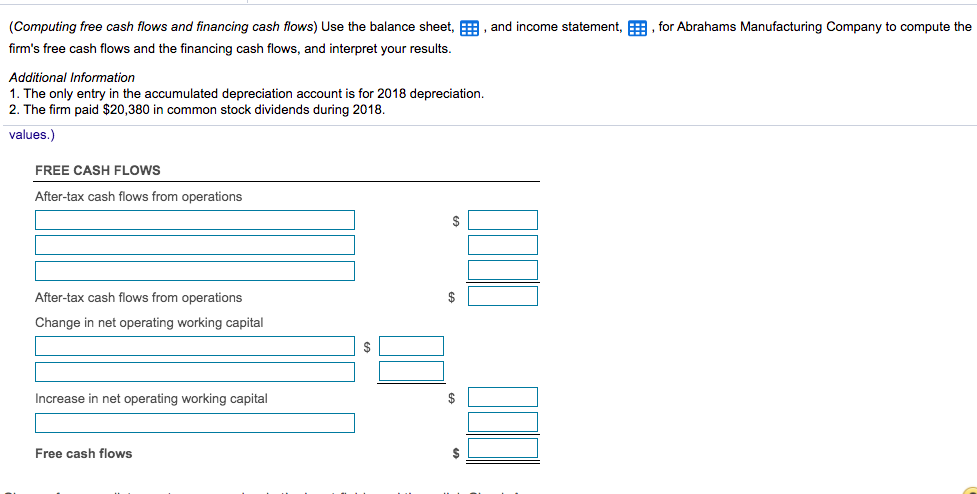

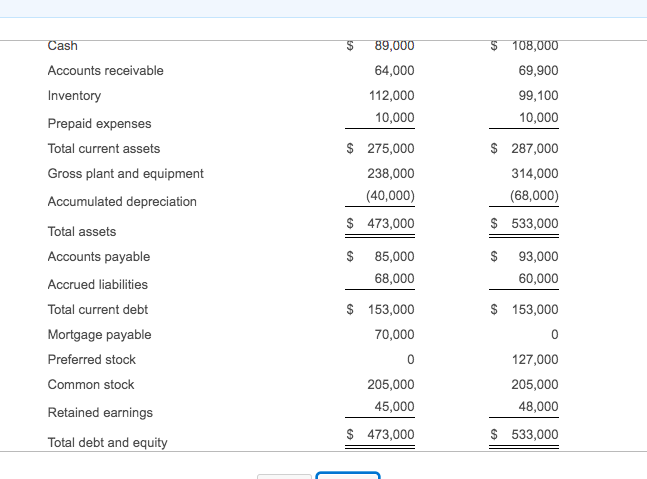

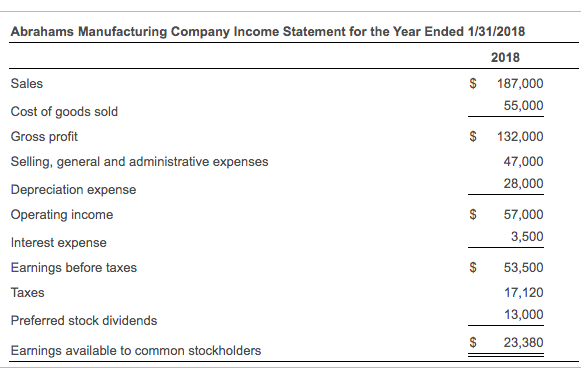

(Computing free cash flows and financing cash flows) Use the balance sheet, E, and income statement, :, for Abrahams Manufacturing Company to compute the firm's free cash flows and the financing cash flows, and interpret your results. Additional Information 1. The only entry in the accumulated depreciation account is for 2018 depreciation. 2. The firm paid $20,380 in common stock dividends during 2018. values.) FREE CASH FLOWS After-tax cash flows from operations $ After-tax cash flows from operations $ Change in net operating working capital $ Increase in net operating working capital $ III Free cash flows $ Cash $ 108,000 69,900 Accounts receivable Inventory 89,000 64,000 112,000 10,000 99,100 10,000 $ 275,000 238,000 (40,000) $ 287,000 314,000 (68,000) $ 473,000 $ 533,000 $ $ Prepaid expenses Total current assets Gross plant and equipment Accumulated depreciation Total assets Accounts payable Accrued liabilities Total current debt Mortgage payable Preferred stock Common stock Retained earnings 85,000 68,000 93,000 60,000 $ 153,000 70,000 0 205,000 45,000 $ 473,000 $ 153,000 0 127,000 205,000 48,000 $ 533,000 Total debt and equity Abrahams Manufacturing Company Income Statement for the Year Ended 1/31/2018 2018 Sales $ 187,000 55,000 Cost of goods sold Gross profit 132,000 Selling, general and administrative expenses 47,000 Depreciation expense 28,000 Operating income $ 57,000 Interest expense 3,500 Earnings before taxes 53,500 Taxes 17,120 Preferred stock dividends 13,000 23,380 Earnings available to common stockholders (Computing free cash flows and financing cash flows) Use the balance sheet, E, and income statement, :, for Abrahams Manufacturing Company to compute the firm's free cash flows and the financing cash flows, and interpret your results. Additional Information 1. The only entry in the accumulated depreciation account is for 2018 depreciation. 2. The firm paid $20,380 in common stock dividends during 2018. values.) FREE CASH FLOWS After-tax cash flows from operations $ After-tax cash flows from operations $ Change in net operating working capital $ Increase in net operating working capital $ III Free cash flows $ Cash $ 108,000 69,900 Accounts receivable Inventory 89,000 64,000 112,000 10,000 99,100 10,000 $ 275,000 238,000 (40,000) $ 287,000 314,000 (68,000) $ 473,000 $ 533,000 $ $ Prepaid expenses Total current assets Gross plant and equipment Accumulated depreciation Total assets Accounts payable Accrued liabilities Total current debt Mortgage payable Preferred stock Common stock Retained earnings 85,000 68,000 93,000 60,000 $ 153,000 70,000 0 205,000 45,000 $ 473,000 $ 153,000 0 127,000 205,000 48,000 $ 533,000 Total debt and equity Abrahams Manufacturing Company Income Statement for the Year Ended 1/31/2018 2018 Sales $ 187,000 55,000 Cost of goods sold Gross profit 132,000 Selling, general and administrative expenses 47,000 Depreciation expense 28,000 Operating income $ 57,000 Interest expense 3,500 Earnings before taxes 53,500 Taxes 17,120 Preferred stock dividends 13,000 23,380 Earnings available to common stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts