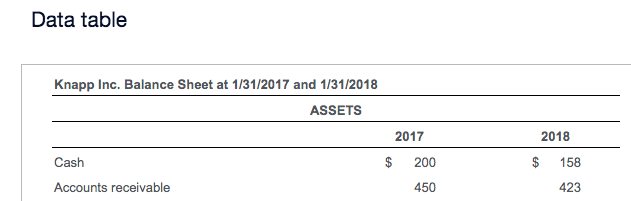

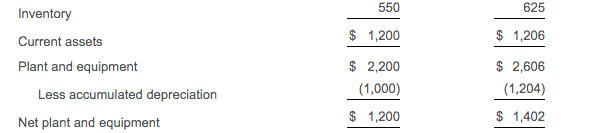

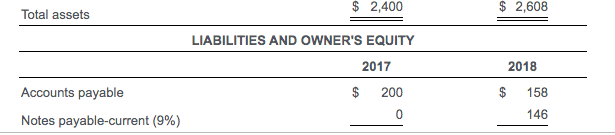

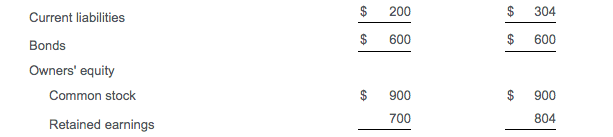

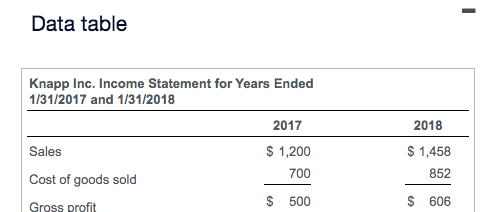

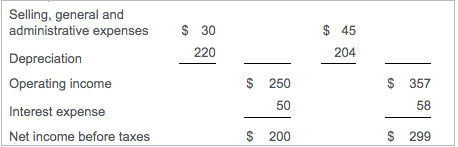

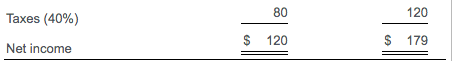

Question: ( Computing free cash flows and financing cash flows ) Use the balance sheet: and income statement, , for Knapp Inc. to compute the firm's

(Computing free cash flows and financing cash

flows) Use the balance sheet:

and income statement,

,

for Knapp Inc. to compute the firm's free cash flows and the financing cash flows.

Question content area bottom

Part 1

Calculate the free cash flows using the following table. (Round to the nearest dollar. NOTE: Input cash inflows as positive values and cash outflows as negative values.)

| FREE CASH FLOWS | ||||

| After-tax cash flows from operations | ||||

| $ | ||||

| After-tax cash flows from operations | $ | |||

| Change in net operating working capital | ||||

| $ | ||||

| Decrease in net operating working capital | $ | |||

| Free cash flows | $ |

Part 2

Calculate the financing cash flows using the following table.(Round to the nearest dollar.

NOTE:

Input cash inflows as positive values and cash outflows as negative values.)

| FINANCING CASH FLOWS | ||||

| $ | ||||

| Cash flows distributed to investors | $ |

Data table \begin{tabular}{lrr} Total owners' equity & $1,704$1,600 \\ Total liabilities and owners' equity & $2,400 & $2,608 \\ \hline \end{tabular} Data table \begin{tabular}{lrr} Taxes (40%) & 12080 \\ Net income & $120 & $179 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts