Question: Computing Issue Price for Zero-Coupon Bonds Baiman, Inc. issues $1,000,000 of zero-coupon bonds that mature in 10 years. Compute the bond issue price assuming that

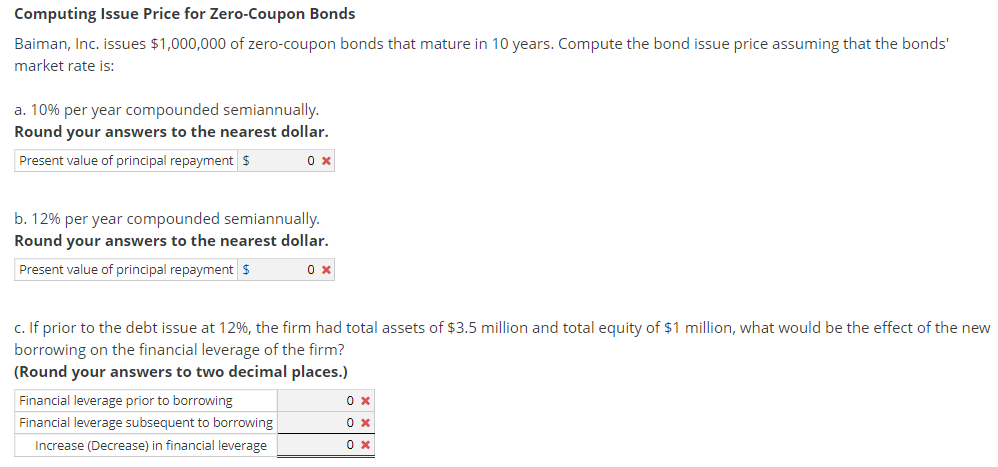

Computing Issue Price for Zero-Coupon Bonds Baiman, Inc. issues $1,000,000 of zero-coupon bonds that mature in 10 years. Compute the bond issue price assuming that the bonds' market rate is: a. 10% per year compounded semiannually. Round your answers to the nearest dollar. Present value of principal repayment $ 0 x b. 12% per year compounded semiannually. Round your answers to the nearest dollar. Present value of principal repayment $ 0 x c. If prior to the debt issue at 12%, the firm had total assets of $3.5 million and total equity of $1 million, what would be the effect of the new borrowing on the financial leverage of the firm? (Round your answers to two decimal places.) Financial leverage prior to borrowing OX Financial leverage subsequent to borrowing Increase (Decrease) in financial leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts