Question: Please help me understand and answer the questions with the red X! Computing Issue Price for Zero-Coupon Bonds Baiman, Inc. issues $400,000 of zero-coupon bonds

Please help me understand and answer the questions with the red X!

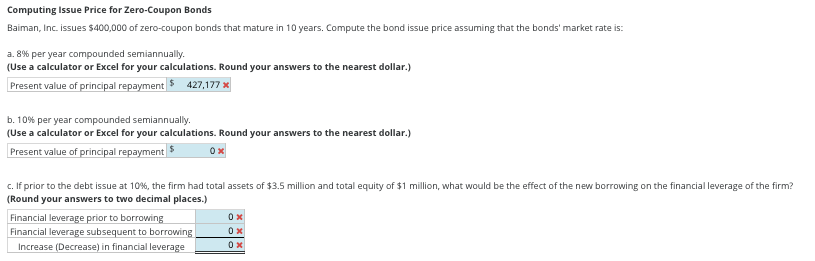

Computing Issue Price for Zero-Coupon Bonds Baiman, Inc. issues $400,000 of zero-coupon bonds that mature in 10 years. Compute the bond issue price assuming that the bonds' market rate is: a. 8\% per year compounded semiannually. (Use a calculator or Excel for your calculations. Round your answers to the nearest dollar.) b. 10\% per year compounded semiannually. (Use a calculator or Excel for your calculations. Round your answers to the nearest dollar.) c. If prior to the debt issue at 10%, the firm had total assets of $3.5 million and total equity of $1 million, what would be the effect of the new borrowing on the financial leverage of the firm? (Round your answers to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts