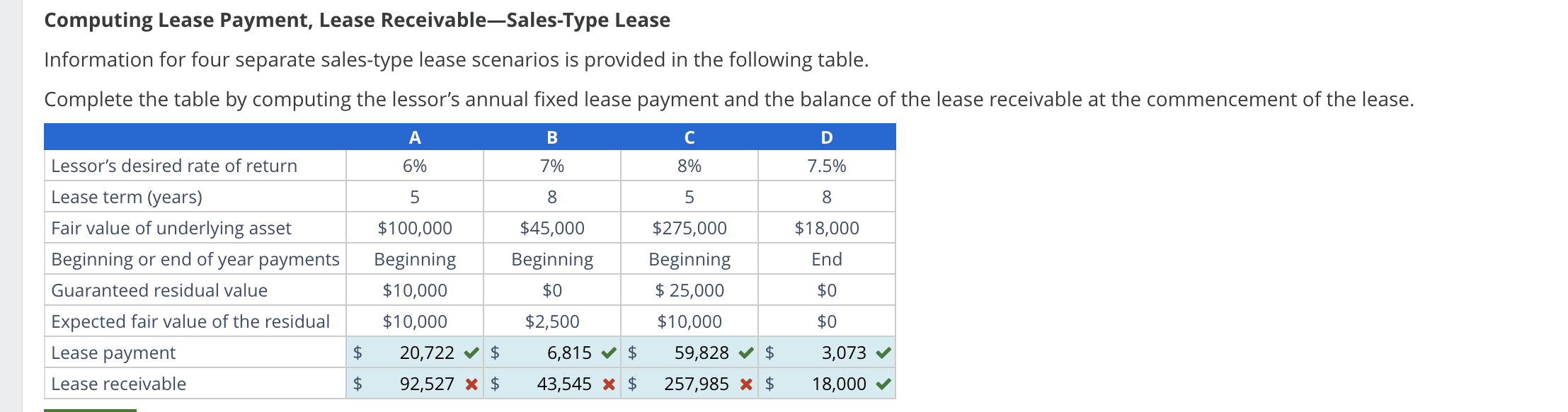

Question: Computing Lease Payment, Lease Receivable - Sales - Type Lease Information for four separate sales - type lease scenarios is provided in the following table.

Computing Lease Payment, Lease ReceivableSalesType Lease

Information for four separate salestype lease scenarios is provided in the following table.

Complete the table by computing the lessor's annual fixed lease payment and the balance of the lease receivable at the commencement of the lease.

begintabularccccc

hline & A & B & c & D

hline Lessor's desired rate of return & & & &

hline Lease term years & & & &

hline Fair value of underlying asset & $ & $ & $ & $

hline Beginning or end of year payments & Beginning & Beginning & Beginning & End

hline Guaranteed residual value & $ & $ & $ & $

hline Expected fair value of the residual & $ & $ & $ & $

hline Lease payment & $ v & $ v & $ v & $ v

hline Lease receivable & $ times & $ times & $ x & $ v

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock