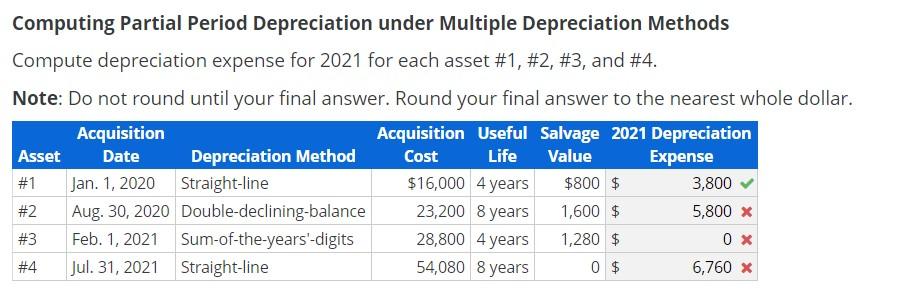

Question: Computing Partial Period Depreciation under Multiple Depreciation Methods Compute depreciation expense for 2021 for each asset #1, #2, #3, and #4. Note: Do not round

Computing Partial Period Depreciation under Multiple Depreciation Methods Compute depreciation expense for 2021 for each asset #1, #2, #3, and #4. Note: Do not round until your final answer. Round your final answer to the nearest whole dollar. Acquisition Acquisition Useful Salvage 2021 Depreciation Asset Date Depreciation Method Cost Life Value Expense #1 Jan. 1, 2020 Straight-line $16,000 4 years $800 $ 3,800 #2 Aug. 30, 2020 Double-declining-balance 23,200 8 years 1,600 $ 5,800 x #3 Feb. 1, 2021 Sum-of-the-years'-digits 28,800 4 years 1,280 $ 0X #4 Jul. 31, 2021 Straight-line 54,080 8 years 0 $ 6,760 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts