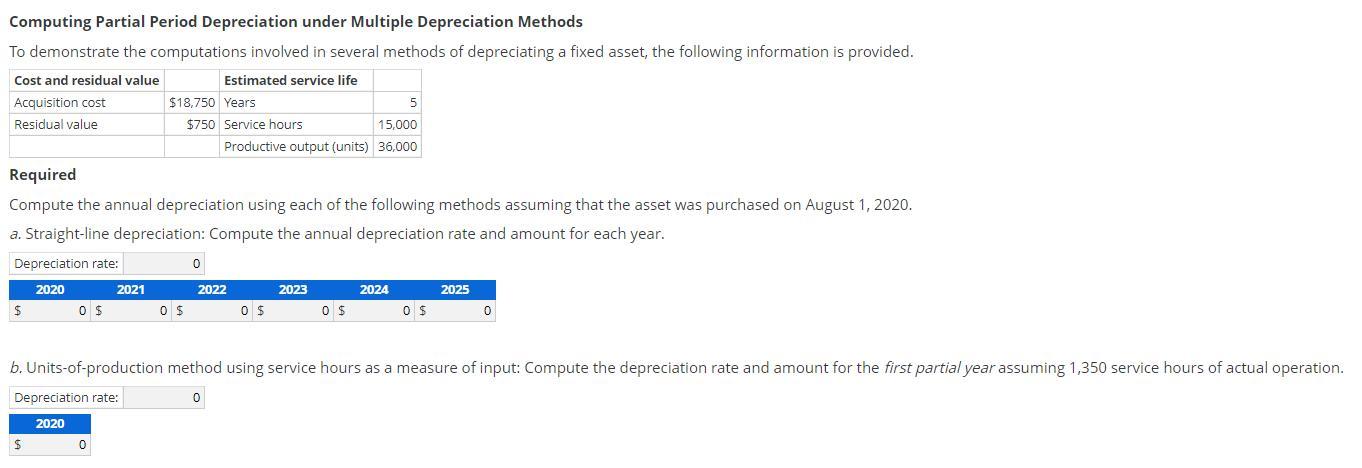

Question: Computing Partial Period Depreciation under Multiple Depreciation Methods To demonstrate the computations involved in several methods of depreciating a fixed asset, the following information

Computing Partial Period Depreciation under Multiple Depreciation Methods To demonstrate the computations involved in several methods of depreciating a fixed asset, the following information is provided. Cost and residual value Estimated service life Acquisition cost Residual value $18,750 Years 5 $750 Service hours 15,000 Productive output (units) 36,000 Required Compute the annual depreciation using each of the following methods assuming that the asset was purchased on August 1, 2020. a. Straight-line depreciation: Compute the annual depreciation rate and amount for each year. Depreciation rate: 2020 2021 0 $ 0 $ 0 2022 2023 2024 2025 0 $ 0 $ 0 $ 0 b. Units-of-production method using service hours as a measure of input: Compute the depreciation rate and amount for the first partial year assuming 1,350 service hours of actual operation. Depreciation rate: 0 2020 $ 0

Step by Step Solution

There are 3 Steps involved in it

Answer a Straightline depreciation The annual depreciation amount for straightline depreciation can be calculated using the formula Depreciation Expense Cost Residual Value Service Life Given Cost 750... View full answer

Get step-by-step solutions from verified subject matter experts