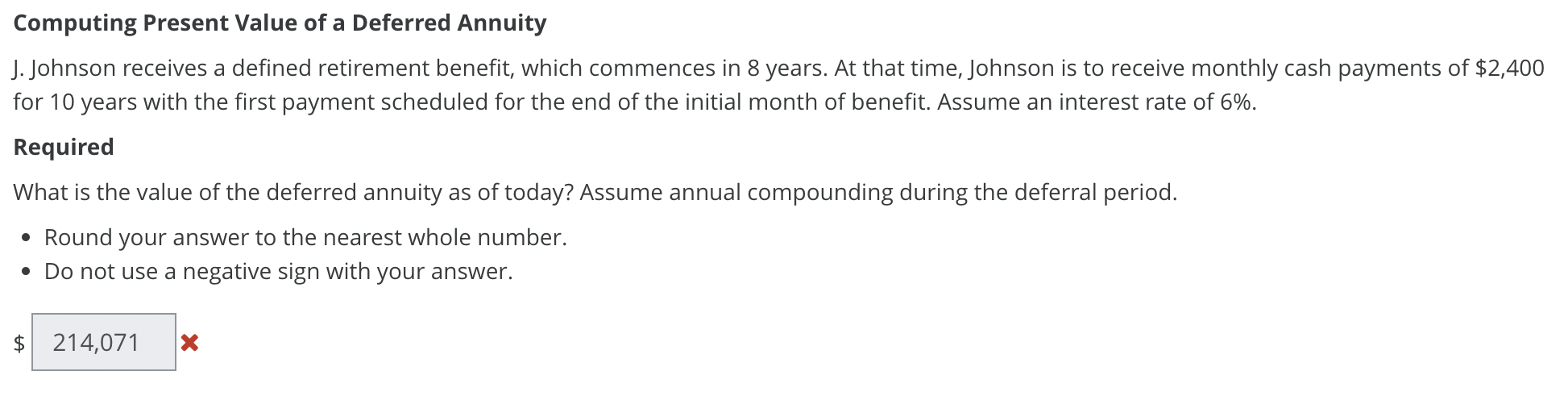

Question: Computing Present Value of a Deferred Annuity J . Johnson receives a defined retirement benefit, which commences in 8 years. At that time, Johnson is

Computing Present Value of a Deferred Annuity

J Johnson receives a defined retirement benefit, which commences in years. At that time, Johnson is to receive monthly cash payments of $

for years with the first payment scheduled for the end of the initial month of benefit. Assume an interest rate of

Required

What is the value of the deferred annuity as of today? Assume annual compounding during the deferral period.

Round your answer to the nearest whole number.

Do not use a negative sign with your answer.

$

Solve for the unknown variables in each of the four separate investment scenarios. Assume interest is compounded annually in each case.

Round final answer to the nearest whole number or percentage point.

Use a negative sign only for an amount related to PV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock