Question: Computing Present Value of a Deferred Annuity J. Johnson receives a defined retirement benefit, which commences in 8 years. At that time, Johnson is to

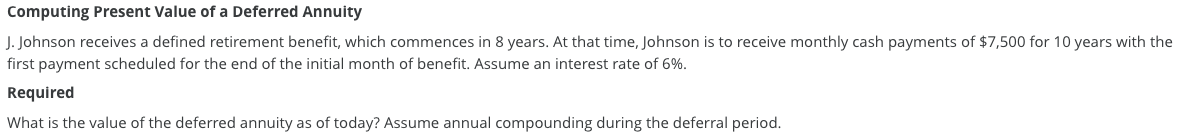

Computing Present Value of a Deferred Annuity J. Johnson receives a defined retirement benefit, which commences in 8 years. At that time, Johnson is to receive monthly cash payments of $7,500 for 10 years with the first payment scheduled for the end of the initial month of benefit. Assume an interest rate of 6%. Required What is the value of the deferred annuity as of today? Assume annual compounding during the deferral period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts