Question: (Computing ratios) Use the information from the balance sheet and income statement in the popup window, to calculate the following ration: a. Current ratio b.

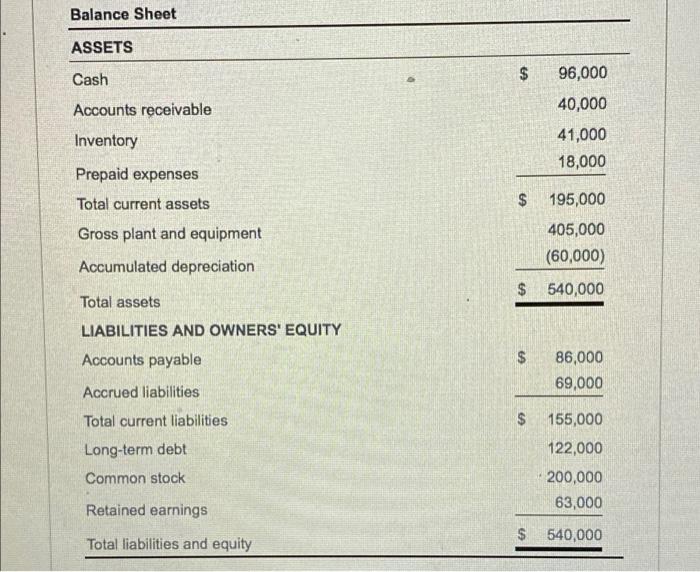

(Computing ratios) Use the information from the balance sheet and income statement in the popup window, to calculate the following ration: a. Current ratio b. Acid-test ratio c. Times interest earned d. Inventory turnover e. Total asset turnover 1. Operating profit margin g. Days in receivables h. Operating return on assets L Debt ratio J. Return on equity k. Fixed asset turnover Balance Sheet ASSETS Cash $ 96,000 40,000 Accounts receivable 41,000 18,000 Inventory Prepaid expenses Total current assets $ Gross plant and equipment Accumulated depreciation 195,000 405,000 (60,000) $ 540,000 Total assets LIABILITIES AND OWNERS' EQUITY Accounts payable $ $ 86,000 69,000 Accrued liabilities Total current liabilities GA $ Long-term debt 155,000 122,000 200,000 63,000 Common stock Retained earnings $ 540,000 Total liabilities and equity (Computing ratios) Use the information from the balance sheet and income statement in the popup window, to calculate the following ration: a. Current ratio b. Acid-test ratio c. Times interest earned d. Inventory turnover e. Total asset turnover 1. Operating profit margin g. Days in receivables h. Operating return on assets L Debt ratio J. Return on equity k. Fixed asset turnover Balance Sheet ASSETS Cash $ 96,000 40,000 Accounts receivable 41,000 18,000 Inventory Prepaid expenses Total current assets $ Gross plant and equipment Accumulated depreciation 195,000 405,000 (60,000) $ 540,000 Total assets LIABILITIES AND OWNERS' EQUITY Accounts payable $ $ 86,000 69,000 Accrued liabilities Total current liabilities GA $ Long-term debt 155,000 122,000 200,000 63,000 Common stock Retained earnings $ 540,000 Total liabilities and equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts