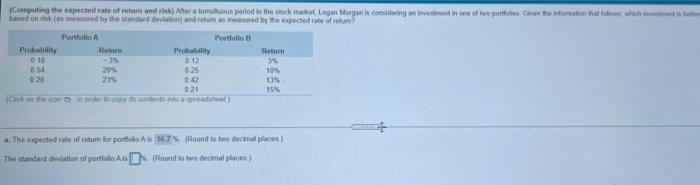

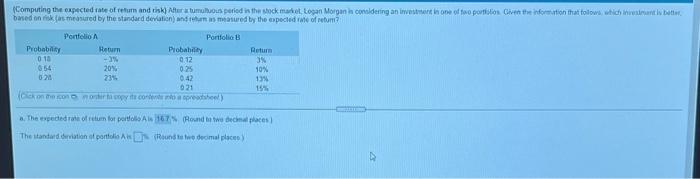

Question: Computing the expected to return antik Anete tumutoon period in the stock market Logan Morgan in coming an investment in one of two parto Civetta

Computing the expected to return antik Anete tumutoon period in the stock market Logan Morgan in coming an investment in one of two parto Civetta intors that the whole boredo (smered by the standard deviationsmatered by the expected rate ofrutom Portfolio Probably Probability 010 -3% 012 0:54 201 0.25 10% 20 295 020 15% con cordo con content and 13% The speed rate of totum for portfolio 1675 Round to two decimal places) The standard deviation of portfolio AC Mound to non decimal phone) Computing the expected rate of return and risk Altertumultuous period in the stock market Logan Morgan considering an investment in one of two ports Given the information that flows what is bet. based on kas measured by the standard deviation and thus masured by the expected we of retum? Portfolio Portfolio Probability Return Probability Return 018 - 0.12 3 654 20% 0.25 10% 0.24 0.42 139 621 15% (ockon conocopy it comes to a crashe The speed rate of return for portfolio A 675 Round between places The standard deviation of partido Als (Round two decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts