Question: Computing the standard deviation for a portfolio of two nisky Investments, Mary Gulott recenty graduated from colage and la evaluating an investment in the companies'

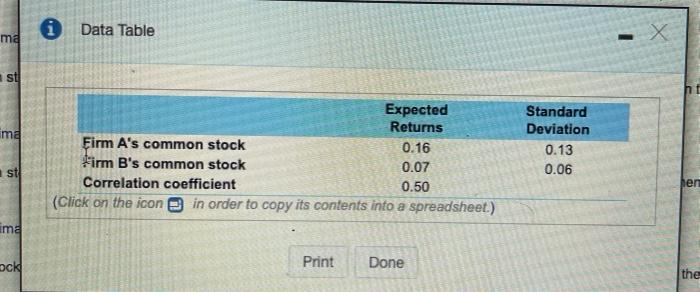

Computing the standard deviation for a portfolio of two nisky Investments, Mary Gulott recenty graduated from colage and la evaluating an investment in the companies' common stock She has alacted her testowing formation or the common stock of Fim And Firme Mary is to invest o percent of her money in Fim As common stock and parents common slockwhat is the recente fun and the standard deviation of the portfolorum? b. Mary di sine percent of her money in Firm Ascommon stookond 10 percent Form icon vec, whes the expedied me of return and the standard deviation of the portfolorum Recompute your pas in both and were the correlation betwee weke 0.50 d. Sume what your anwysis tells you bout portions when combining risky tets in a pontolo Mary decides to invest 10% of her moray in Frm A's common stock and 90% in Form Focommon stock and the condition count bewon the works 0.80.en the expected rite of lumin e portfolio Port to his de places) The standard deviation in the portole (Round to we decimal places) Mary decides to invest of her money in Fim Alwerment and to in Form einen stock and the comincian belum ab och 6, he expected rate of tune in a portato ante decimal places) y actes eu to or money in vom As como las dos noms cannon tan and the stretten commcm teen the two of the two on the parties w us and we The stand deviation in the portfolio Mund to welcome Wayne Warwy come one to m's common to down Winter in the moon and to The window) Amino por butwowych reglemen of wine by inwing higher of the winner i Data Table md X - st ima Expected Returns Firm A's common stock 0.16 Firm B's common stock 0.07 Correlation coefficient 0.50 (Click on the icon in order to copy its contents into a spreadsheet.) Standard Deviation 0.13 0.06 st ber ima ock Print Done the Computing the standard deviation for a portfolio of two nisky Investments, Mary Gulott recenty graduated from colage and la evaluating an investment in the companies' common stock She has alacted her testowing formation or the common stock of Fim And Firme Mary is to invest o percent of her money in Fim As common stock and parents common slockwhat is the recente fun and the standard deviation of the portfolorum? b. Mary di sine percent of her money in Firm Ascommon stookond 10 percent Form icon vec, whes the expedied me of return and the standard deviation of the portfolorum Recompute your pas in both and were the correlation betwee weke 0.50 d. Sume what your anwysis tells you bout portions when combining risky tets in a pontolo Mary decides to invest 10% of her moray in Frm A's common stock and 90% in Form Focommon stock and the condition count bewon the works 0.80.en the expected rite of lumin e portfolio Port to his de places) The standard deviation in the portole (Round to we decimal places) Mary decides to invest of her money in Fim Alwerment and to in Form einen stock and the comincian belum ab och 6, he expected rate of tune in a portato ante decimal places) y actes eu to or money in vom As como las dos noms cannon tan and the stretten commcm teen the two of the two on the parties w us and we The stand deviation in the portfolio Mund to welcome Wayne Warwy come one to m's common to down Winter in the moon and to The window) Amino por butwowych reglemen of wine by inwing higher of the winner i Data Table md X - st ima Expected Returns Firm A's common stock 0.16 Firm B's common stock 0.07 Correlation coefficient 0.50 (Click on the icon in order to copy its contents into a spreadsheet.) Standard Deviation 0.13 0.06 st ber ima ock Print Done the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts