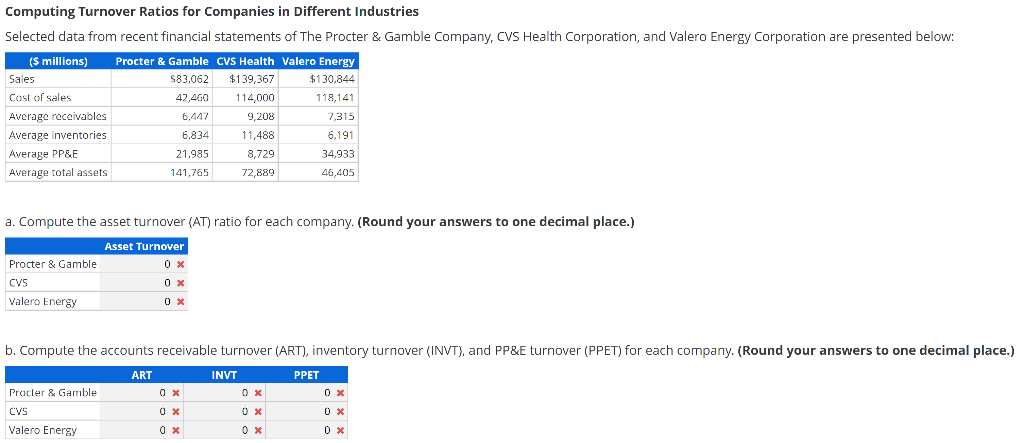

Question: Computing Turnover Ratios for Companies in Different Industries Selected data from recent financial statements of The Procter & Gamble Company, CVS Health Corporation, and Valero

Computing Turnover Ratios for Companies in Different Industries Selected data from recent financial statements of The Procter & Gamble Company, CVS Health Corporation, and Valero Energy Corporation are presented below: ($ millions) Sales Cost of sales Average receivables Average inventories Average PP&E Average total assets Procter & Gamble CVS Health Valero Energy $83,062 $139,367 $130,844 42.4G0114,000 118,141 6,447 9,208 7,315 6,834 11,488 6,191 21,985 8,729 34,933 141,765 72,889 46,405 a. Compute the asset turnover (AT) ratio for each company. (Round your answers to one decimal place.) Asset Turnover Procter & Gamble 0 X CVS 0x Valero Energy OX b. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and PP&E turnover (PPET) for each company. (Round your answers to one decimal place.) ART INVT PPET Practer & Gamble ox 0 CVS OX 0 Valero Energy Ox

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts