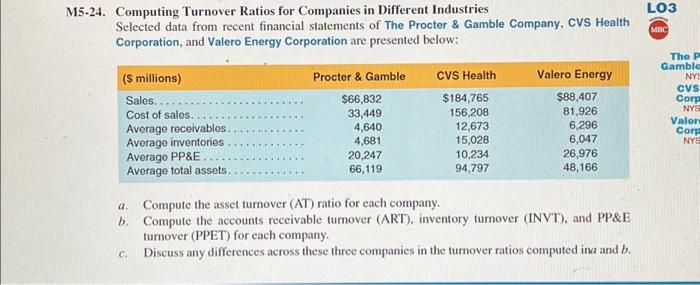

Question: M5-24. Computing Turnover Ratios for Companies in Different Industries Selected data from recent financial statements of The Procter & Gamble Company, CVS Health Corporation, and

M5-24. Computing Turnover Ratios for Companies in Different Industries Selected data from recent financial statements of The Procter & Gamble Company, CVS Health Corporation, and Valero Energy Corporation are presented below: ($ millions) Sales..... Cost of sales. Average receivables. Average inventories Average PP&E. Average total assets. Procter & Gamble $66,832 33,449 4,640 4,681 20,247 66,119 C. CVS Health $184,765 156,208 12,673 15,028 10,234 94,797 Valero Energy $88,407 81,926 6,296 6,047 26,976 48,166 a. Compute the asset turnover (AT) ratio for each company. b. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and PP&E turnover (PPET) for each company. Discuss any differences across these three companies in the turnover ratios computed ina and b. LO3 HATICKOFF MBC The P Gamble NYS CVS Corp NYS Valer Corp NYS

24. Computing Turnover Ratios for Companies in Different Industries Selected data from recent financial statements of The Procter \& Gamble Company, CVS Health Corporation, and Valero Energy Corporation are presented below: a. Compute the asset tumover (AT) ratio for each company. b. Compute the accounts receivable tumover (ART), inventory tumover (INVT), and PP\&E turnover (PPET) for each company. c. Discuss any differences across these three companies in the turnover ratios computed in a and b

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock