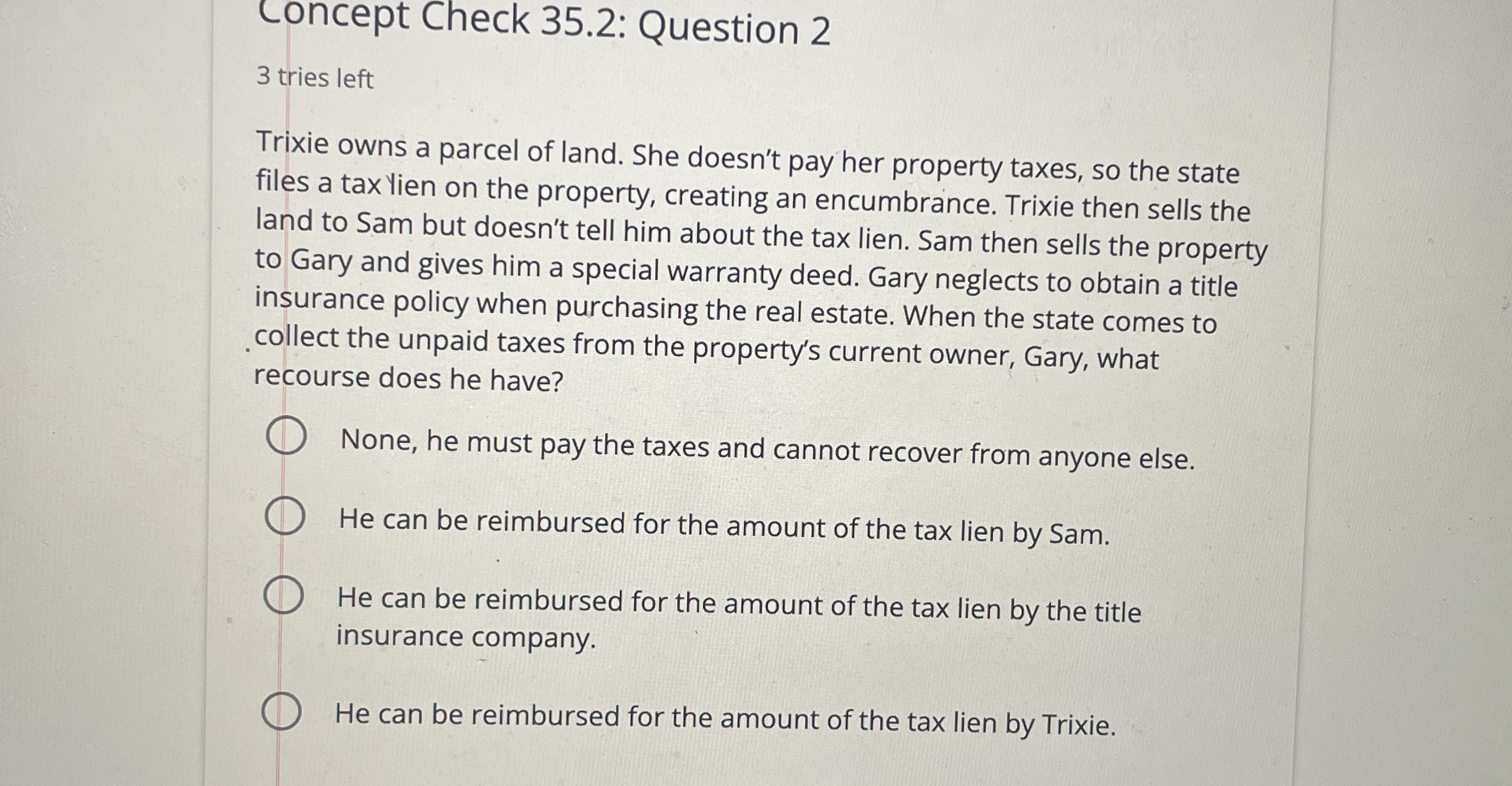

Question: Concept Check 3 5 . 2 : Question 2 3 tries left Trixie owns a parcel of land. She doesn't pay her property taxes, so

Concept Check : Question

tries left

Trixie owns a parcel of land. She doesn't pay her property taxes, so the state

files a tax lien on the property, creating an encumbrance. Trixie then sells the

land to Sam but doesn't tell him about the tax lien. Sam then sells the property

to Gary and gives him a special warranty deed. Gary neglects to obtain a title

insurance policy when purchasing the real estate. When the state comes to

collect the unpaid taxes from the property's current owner, Gary, what

recourse does he have?

None, he must pay the taxes and cannot recover from anyone else.

He can be reimbursed for the amount of the tax lien by Sam.

He can be reimbursed for the amount of the tax lien by the title

insurance company.

He can be reimbursed for the amount of the tax lien by Trixie.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock