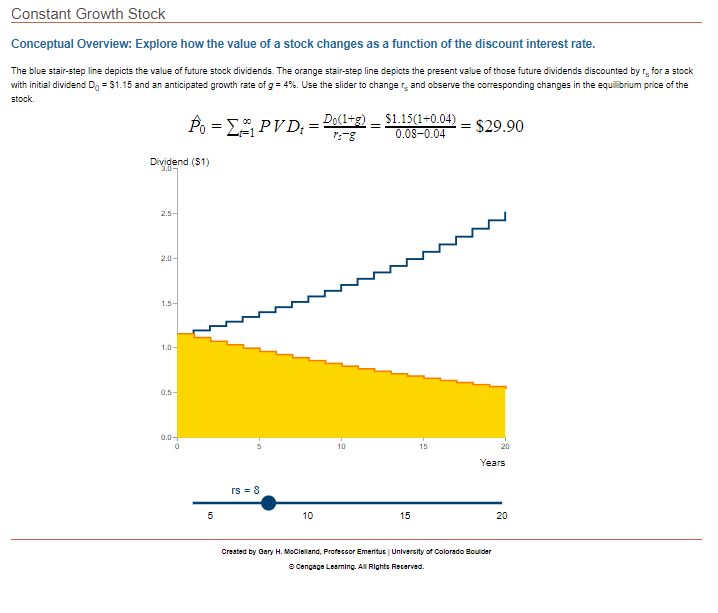

Question: Conceptual Overview: Explore how the value of a stock changes as a function of the discount interest rate. The blue stair-step line depicts the value

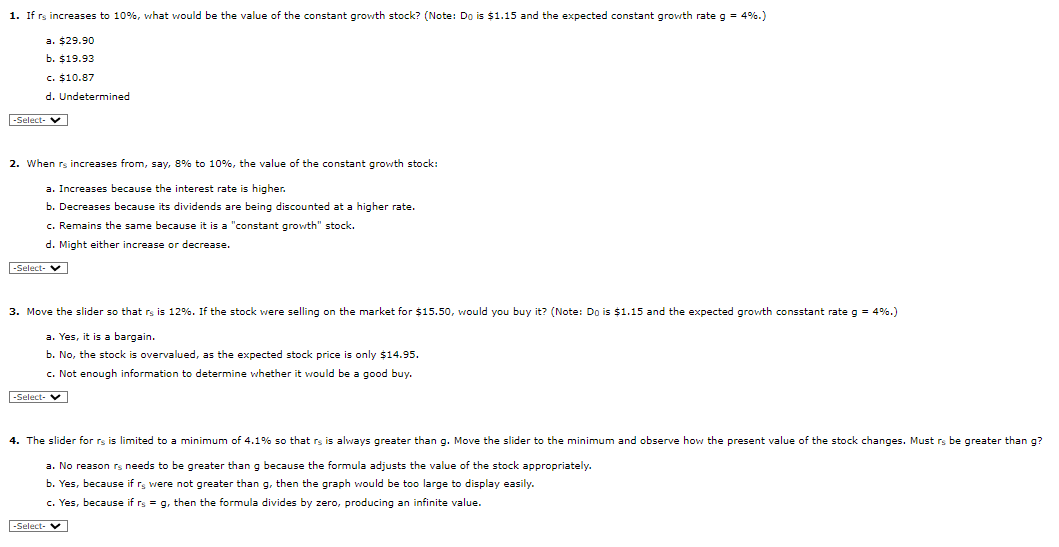

Conceptual Overview: Explore how the value of a stock changes as a function of the discount interest rate. The blue stair-step line depicts the value of future stock dividends. The orange stair-step line depicts the present value of those future dividends discounted by r5 for a stock with initial dividend D0=$1.15 and an anticipated growth rate of g=4%. Use the slider to change r5 and observe the corresponding changes in the equil brium price of the stock. P0=t=1PVDt=rsgD0(1+g)=0.080.04$1.15(1+0.04)=$29.90 Crastad by Gary H. Moclelland, Profaccor Emerituc Univerelty of Colorado Eouldar Q Congage Lourning. All Fights Fosarved. 1. If rs increases to 10%, what would be the value of the constant growth stock? (Note: Do is $1.15 and the expected constant grow/th rate g=4% ) a. $29.90 b. $19.93 c. $10.87 d. Undetermined 2. When rs increases from, say, 8% to 10%, the value of the constant growth stock: a. Increases because the interest rate is higher. b. Decreases because its dividends are being discounted at a higher rate. c. Remains the same because it is a "constant growth" stock. d. Might either increase or decrease. a. Yes, it is a bargain. b. No, the stock is overvalued, as the expected stock price is only $14.95. c. Not enough information to determine whether it would be a good buy. a. No reason r needs to be greater than g because the formula adjusts the value of the stock appropriately. b. Yes, because if rs were not greater than g, then the graph would be too large to display easily. c. Yes, because if rs=g, then the formula divides by zero, producing an infinite value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts