Question: Conduct a price to multiple model for NFLX. Instructions: 1. Insert portfolio weights in the yellow highlighted area. 2. Portfolio Standard Deviation is calculated below

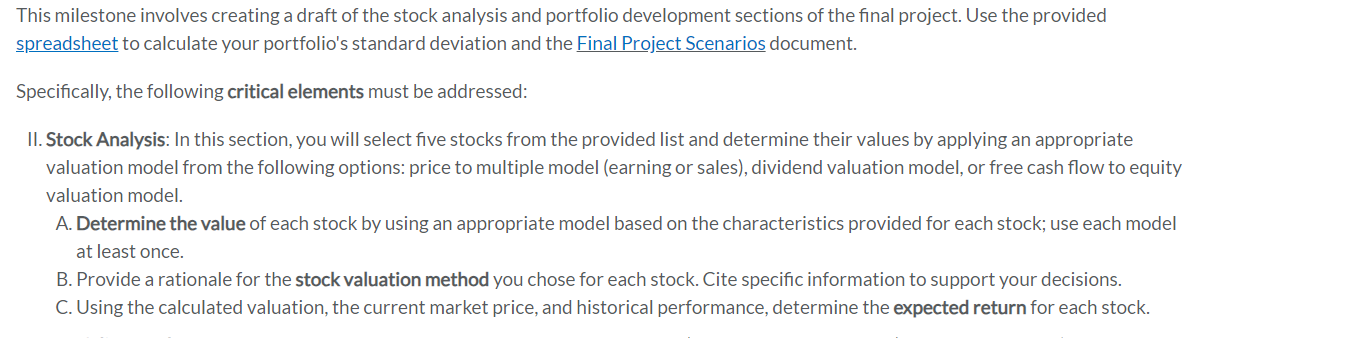

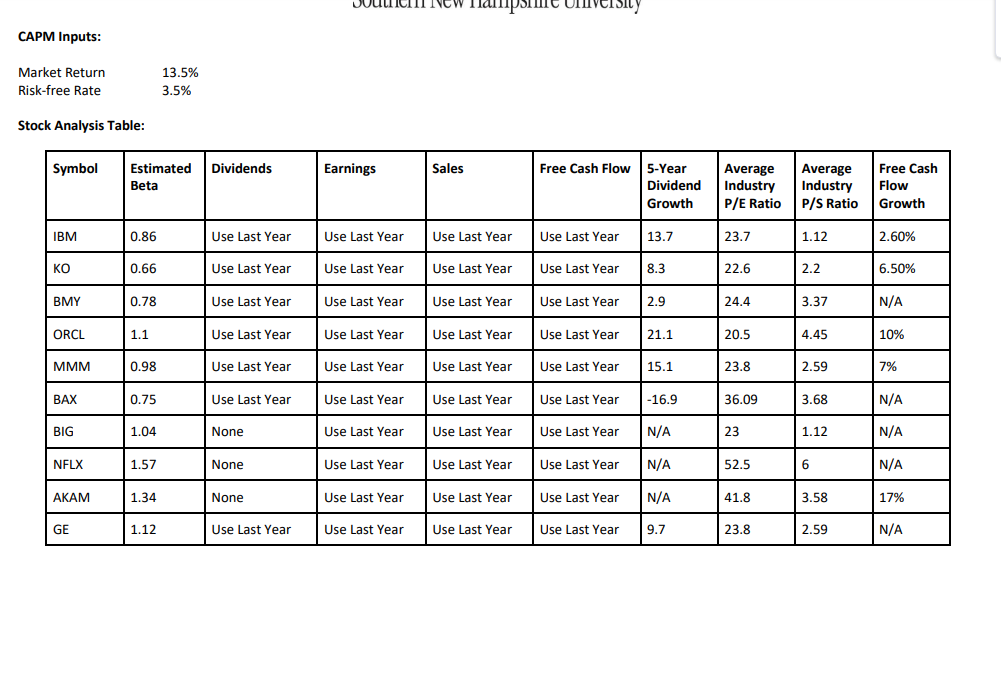

Conduct a price to multiple model for NFLX.

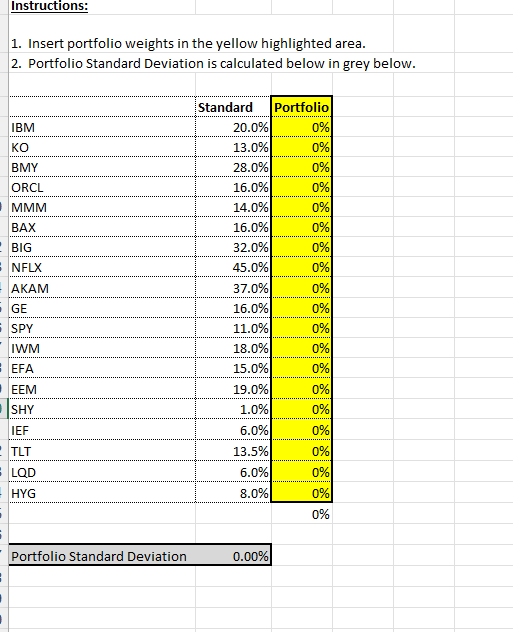

Instructions: 1. Insert portfolio weights in the yellow highlighted area. 2. Portfolio Standard Deviation is calculated below in grey below. Standard Portfolio IBM 20.0% 0% KO 13.0% 0% BMY 28.0% 0% ORCL 16.0% 0% MMM 14.0% 0% BAX 16.0% 0% BIG 32.0% 0% NFLX 45.0% 0% AKAM 37.0% 0% GE 16.0% 0% SPY 11.0% 0% IWM 18.0% 0% EFA 15.0% 0% EEM 19.0% 0% SHY 1.0% 0% IEF 6.0% 0% TLT 13.5% 0% LQD 6.0% 0% HYG 8.0% 0% 0% Portfolio Standard Deviation 0.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts