Question: Conduct a SWOT analysis of Canopy Growth Corp. What limitations does Canopy need to consider in deciding whether or not to expand internationally? Ivey Publishing

Conduct a SWOT analysis of Canopy Growth Corp. What limitations does Canopy need to consider in deciding whether or not to expand internationally?

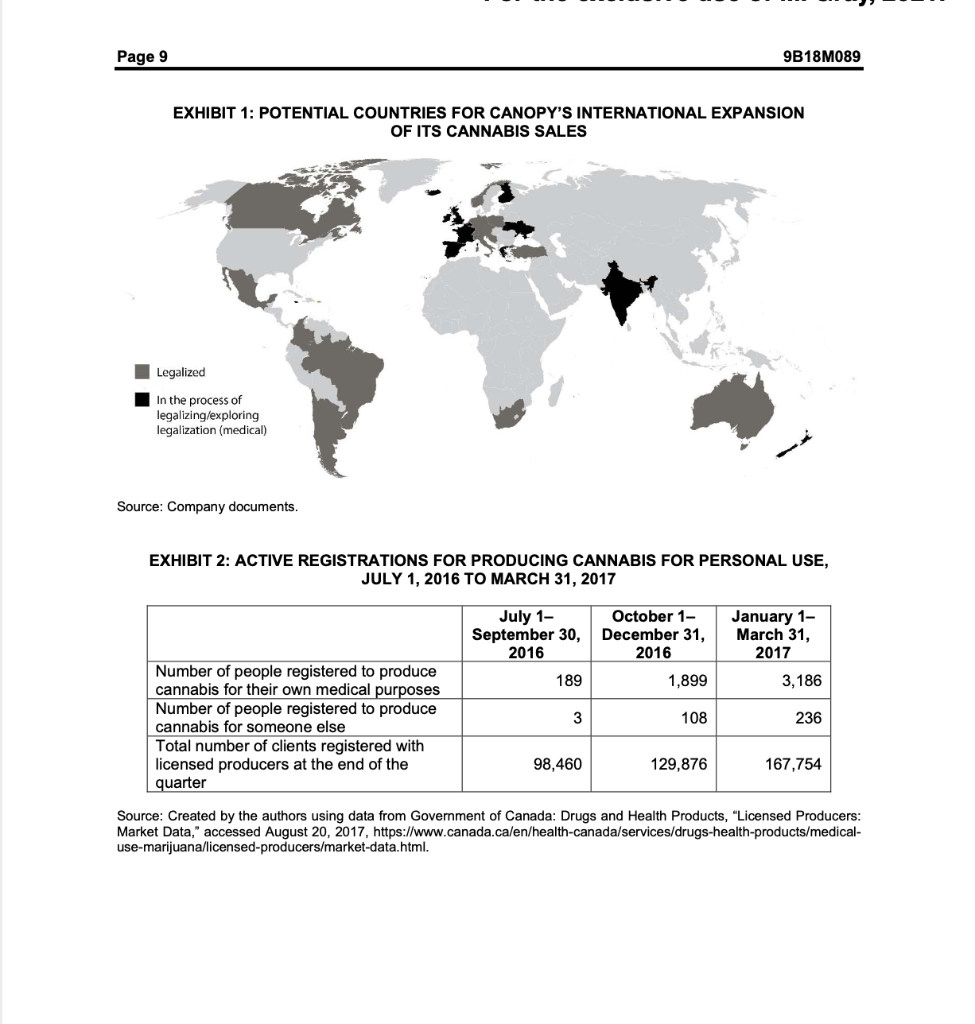

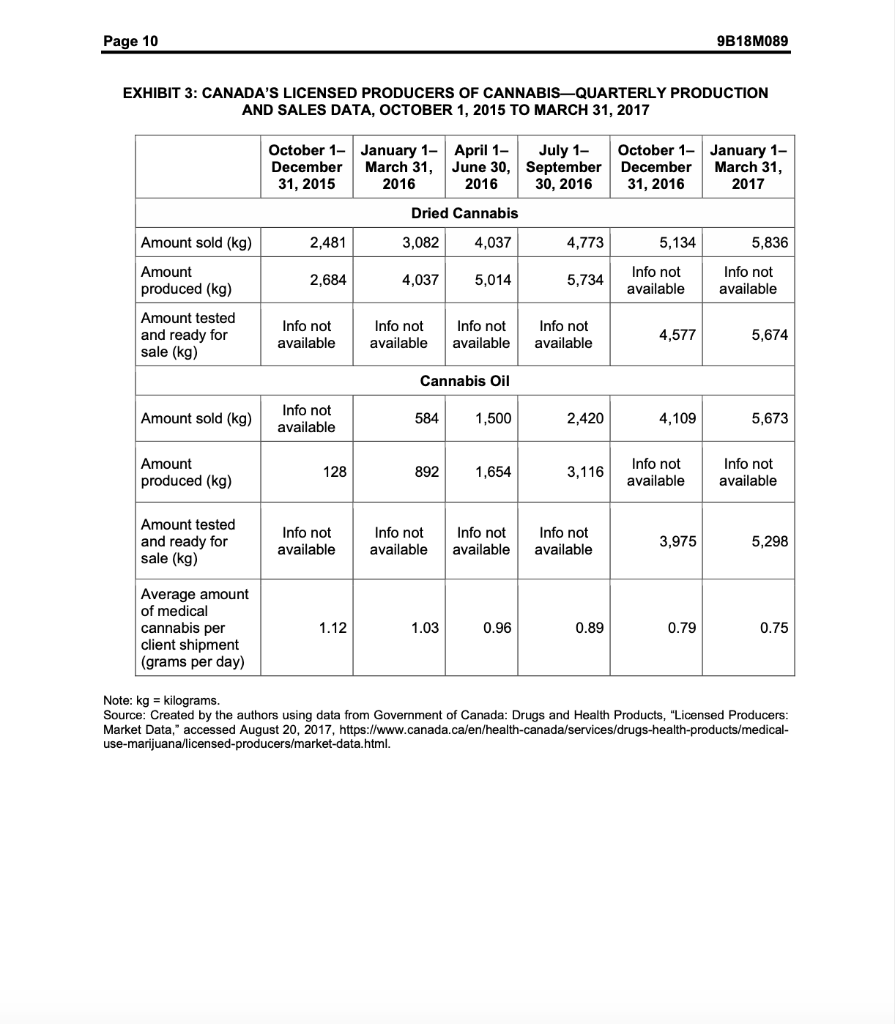

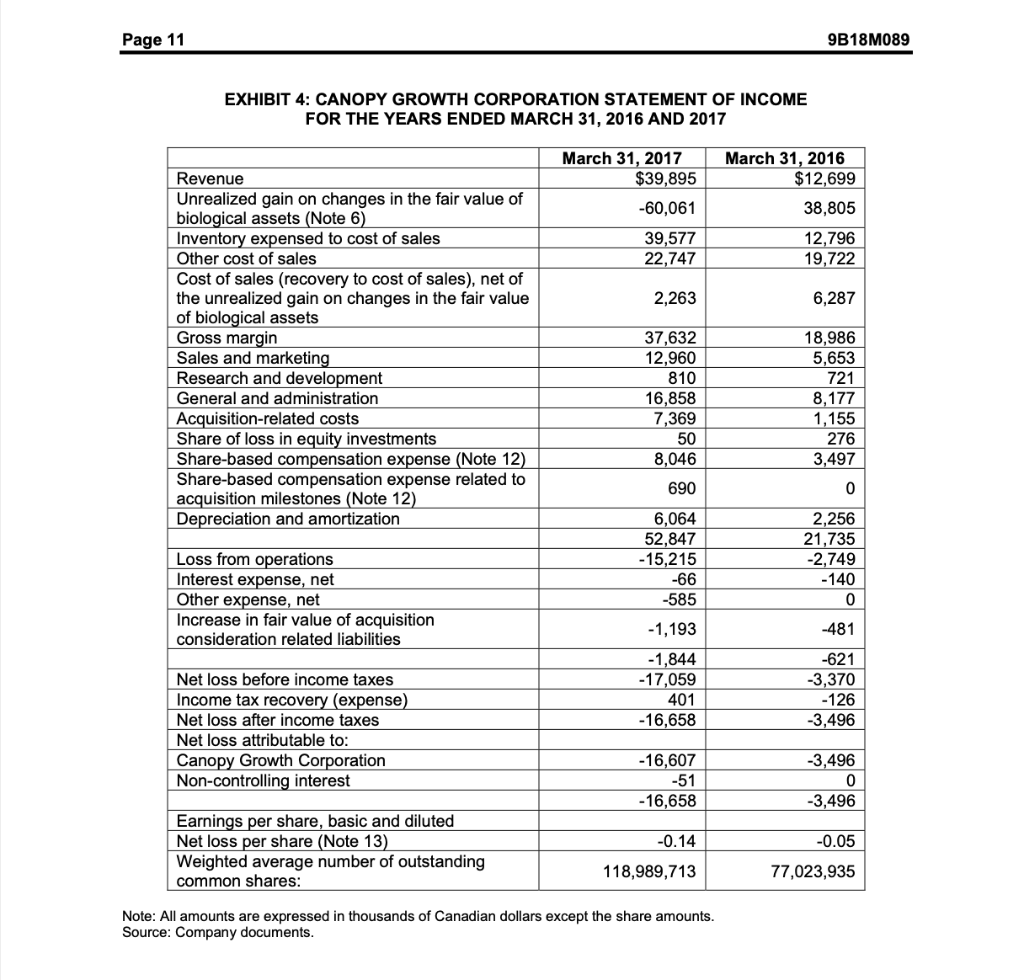

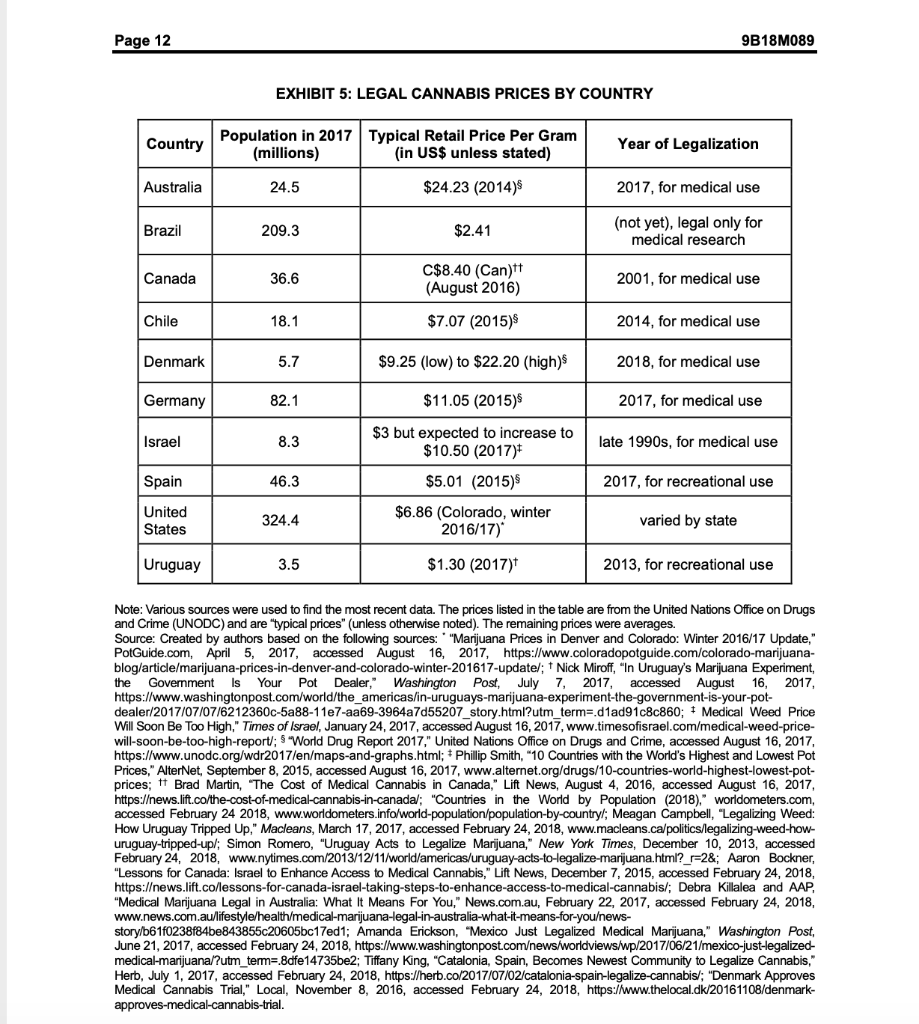

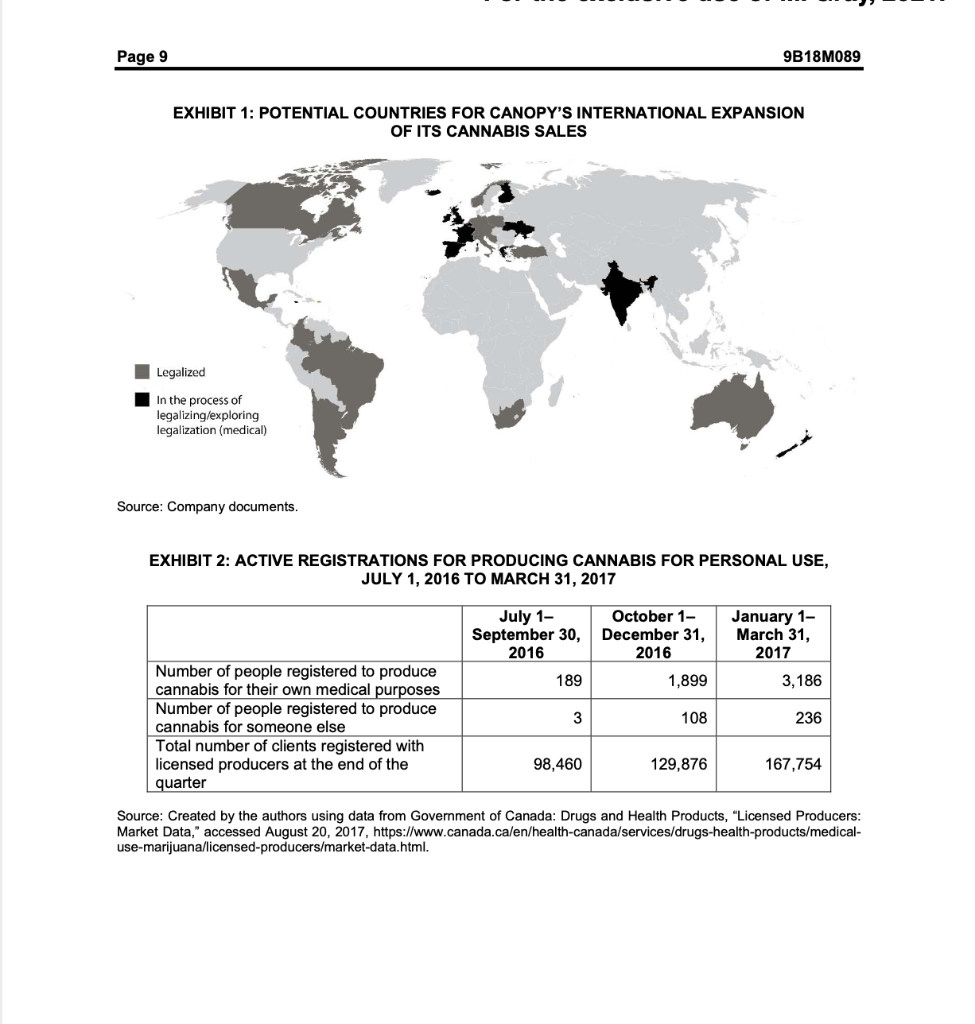

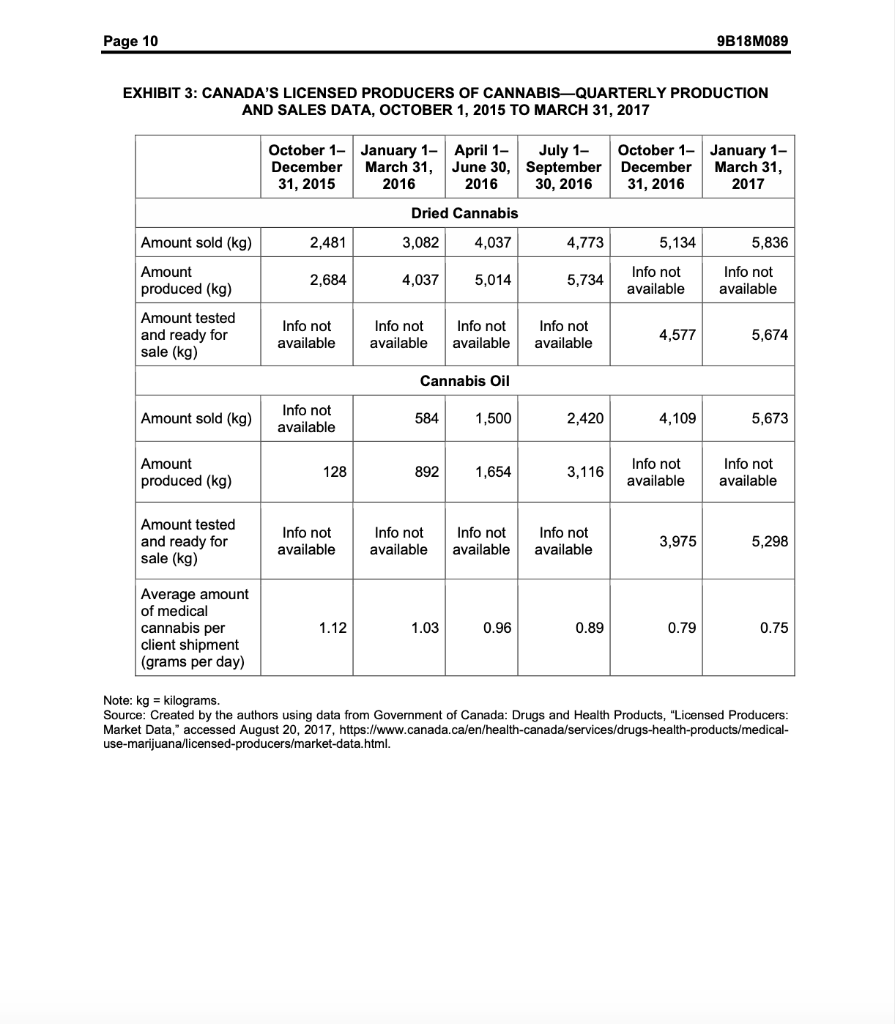

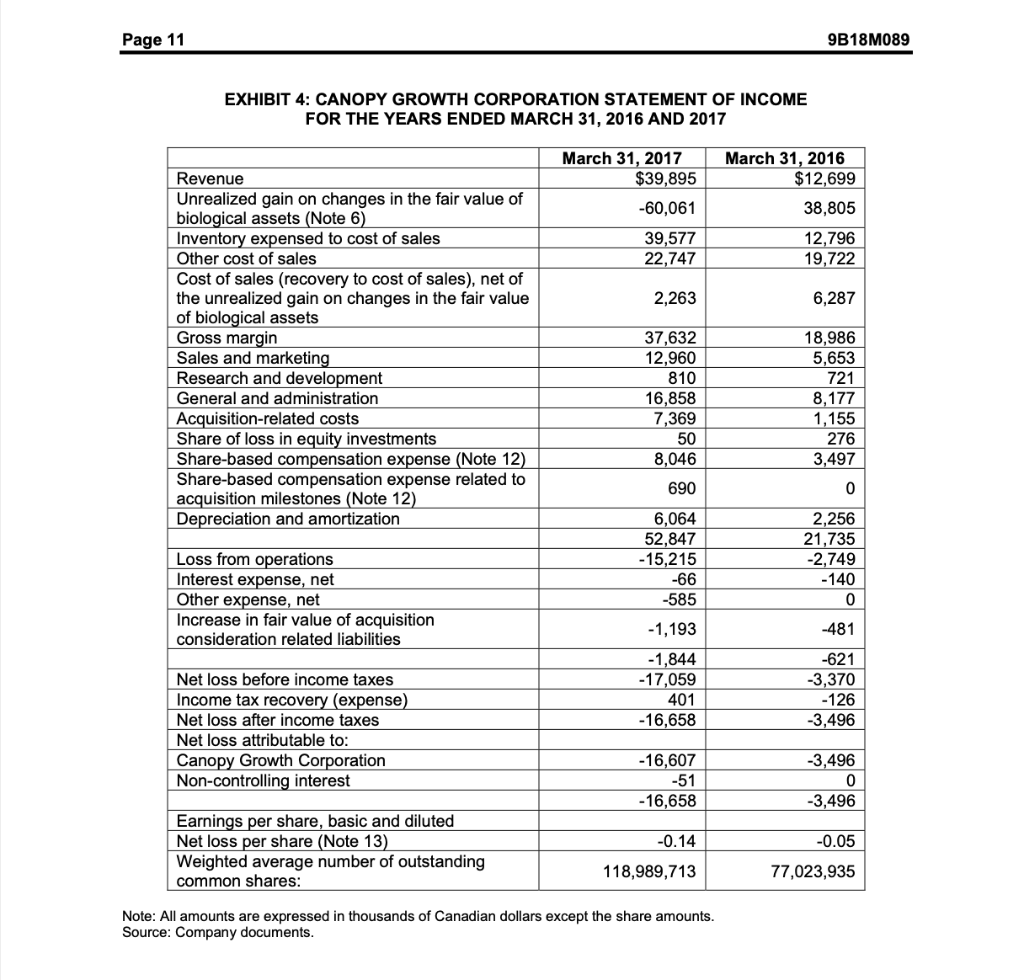

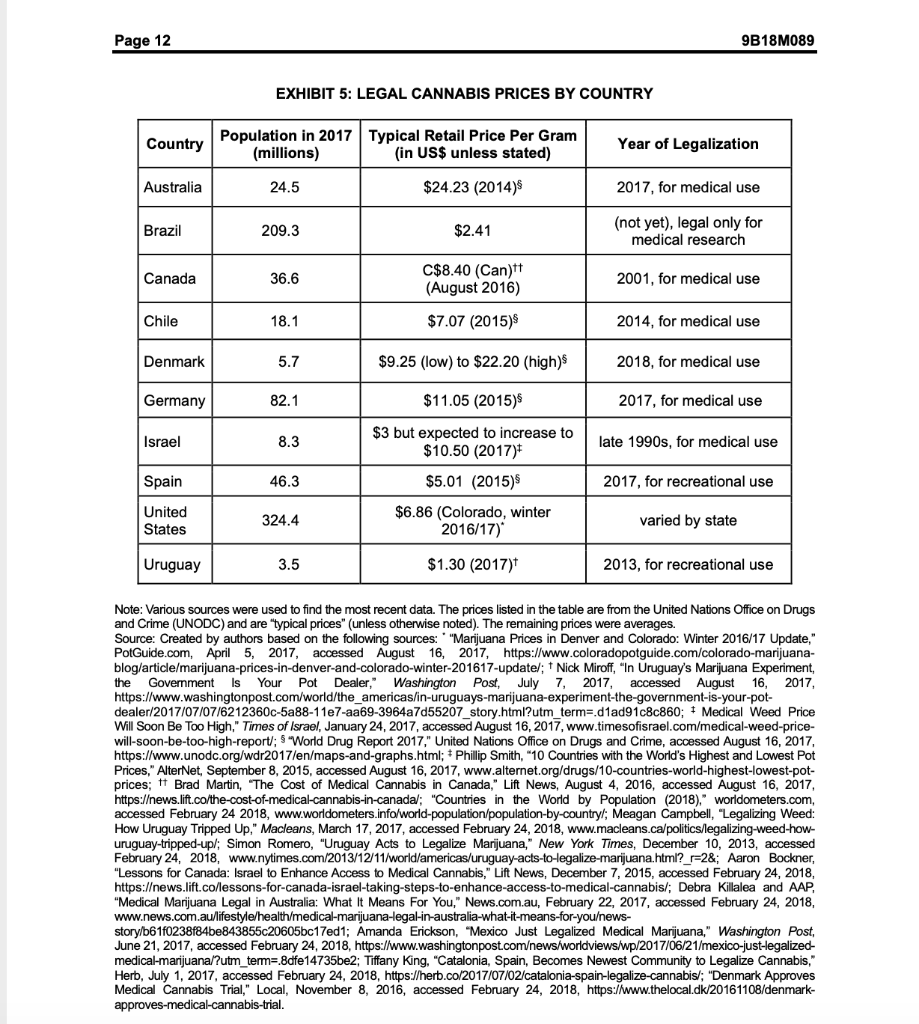

Ivey Publishing W18339 CANOPY GROWTH CORPORATION: CANADA FIRST AND THE WORLD NEXT Opal Leung and Mark MacIsaac wrote this case solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G ON1; (t) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com. Copyright 2018, Ivey Business School Foundation Version: 2018-06-08 You don't want me to win the warm-up. What you want me to do is to not just be in Canada. You want me to dominate in Germany, to be super successful in South America, in a place like Brazil, to take the Canadian policy and the Canadian products and the Canadian learning and it's one of the first times we actually have everything first-and go do the best everywhere. And so if we can be a many-billion-dollar, very competent company that's Canadian-based, I think we'll actually be quite proud of that. Canopy Growth CEO Bruce Linton On April 13, 2017, the Canadian federal government introduced legislation to legalize cannabis for adult use, to take effect during the summer of 2018. When passed, the legislation would make Canada the first G7 country to legalize recreational cannabis at the federal level. Predictions about the size of the Canadian recreational market (including the ancillary market and tourism revenue) were as high as CA$22.6 billion." Simultaneously, the changing cannabis laws in other countries presented new opportunities (see Exhibit 1). The global medical cannabis market was predicted to reach $55.8 billion by 2025. Canopy Growth Corporation (Canopy), based in Smiths Falls, Ontario, had already been working with firms in Brazil, Australia, and Germany. According to Canopy's chief executive officer (CEO), Bruce Linton, "The companies that are the best in Canada, have the best chance of expanding and of being very capable and successful in each of the other countries." The plan was for Canopy to be everywhere it was federally legal and where a sustainable business could be created. On August, 20, 2017, Linton reasoned, "the more rules we have and the more rigorously they are applied, the better the opportunity I have on a global basis to have fewer competitors, which [kind of] leads into, I would say, the international expansion ... the public policy in Canada's driving it." Would Canopy be able to produce enough cannabis to supply Canadian patients and recreational users and the rest of the world? Already, much work needed to be done to prepare for the legalization of recreational cannabis. Was Canopy ready to pursue further international expansion opportunities? If so, what factors should Linton consider when deciding whether to expand? Page 2 9B18M089 THE CANADIAN REGULATED CANNABIS MARKETS Medical marijuana was legalized and regulated at the federal level by Health Canada, starting in 2001, when the Canadian government enacted the Marihuana Medical Access Regulations (MMAR), thereby allowing patients (or a designated individual) to either grow their own cannabis plants or buy dried cannabis from Health Canada. In April 2014, the Harper government replaced the MMAR with the Marihuana for Medical Purposes Regulations (MMPR), which allowed only licensed producers (LPs) to produce, distribute, and sell medical cannabis to patients. The intent was to create tighter controls on the medical cannabis supply. Patients were no longer permitted to grow their own plants, and LPs became the only legal suppliers of medical cannabis. Two years later, the Access to Cannabis for Medical Purposes Regulations (ACMPR) once again allowed patients to grow their own plants because a Canadian federal court case (Allard v. Canada) concluded that the requirement for individuals to obtain their cannabis only from LPs "violated liberty and security rights protected by section 7 of the Canadian Charter of Rights and Freedoms."6 The ACMPR had a possession limit for patients of 150 grams or a 30-day supply, (whichever was less) regardless of whether the patient grew or bought it. Anyone growing plants (either for themselves or for someone else) was required to register with Health Canada (see Exhibit 2). Patients who purchased their cannabis from an LP could be registered with only one LP per prescription at a time. The regulations did not permit companies to sell cannabis derivatives such as edibles (i.e., cannabis-infused food products) or cannabis resins. Only fresh or dried cannabis plants and cannabis oils were permitted. The oils could not be sold in any dosage form other than a capsule similar dosage form."? The Canadian Legal Medical Marijuana Market The amount of legal cannabis (both dried cannabis and cannabis oil) sold by LPs had been growing consistently each quarter. Cannabis oils were first offered in the third quarter of 2015 and quickly became popular (see Exhibit 3). In addition to being one of Canada's first LPs under the MMPR, Canopy Growth was the first company to be awarded a licence to both produce and sell cannabis oils, which required specialized machinery to extract the active ingredients (i.e., tetrahydrocannabinol, or THC, and cannabidiol, or CBD). Critics raised concerns about preventing children from accessing cannabis and the efficacy of medical cannabis. Nevertheless, the total number of clients, industry-wide, was growing from quarter to quarter. For the quarter ending March 31, 2017, 167,754 clients were registered, and the average amount of dried cannabis authorized per client was 2.4 grams per day (see Exhibit 3).'' Due to the expected demand for recreational cannabis in mid-2018, Health Canada announced on May 26, 2017, that it would be improving the process for licensing medical cannabis producers, to increase the number of LPs producing cannabis." In the same announcement, Health Canada disclosed that the average number of registered clients had been growing by 10 per cent a month, sales of dried cannabis had been growing by 6 per cent a month, and sales of cannabis oils had been growing by 16 per cent a month. The processing of licence applications would be streamlined by allocating more resources to the intake, screening, and review stages. In May 2017, 187 applications were at the review stage. As of August 21, 2017, Canada had 54 authorized LPs, seven of which were owned by Canopy (one at Agripharm, and two each at Mettrum, Bedrocan, and Tweed). Linton emphasized that one of the differences between the legal and illegal cannabis markets was that the legal product complied with quality control regulations. At the end of 2016 and during first of half of 2017, media accounts surfaced of unauthorized pesticides being found in cannabis, which led to Health Page 3 9B18M089 Canada instituting mandatory pesticide testing requirements in May 2017.12 While it was a temporary setback for the companies that sold cannabis, the stories highlighted the importance of testing cannabis for impurities, especially the medical cannabis intended for patients. Cannabis obtained from the black market was not regulated or monitored in the same way that legal cannabis was. As players in a relatively new industry, companies needed to learn how to construct and operate large growing operations while keeping costs down. Some of the larger licensed producers managed to lower their cannabis production costs to less than $2 per gram, which they attributed to economies of scale. Canopy's production costs were $1.28 per gram (preshipping and fulfilment). Because the plants were grown indoors, the product achieved higher consistency as a result of the accurate control of lighting, soil, and other inputs. It also meant that electricity costs could be high, depending on the provincially legislated electricity costs where the LP was located. One of the challenges that the industry as a whole faced was a shortage of medical cannabis in Canada. 13 With the legalization of recreational cannabis on the horizon, Canada could potentially face a larger shortage of supply if the LPs did not develop and expand their grow spaces quickly enough for the rollout in 2018.14 Simultaneously, some of Canada's medical cannabis companies, including Canopy, were looking at opportunities for international expansion. Making the decision to expand internationally created an additional layer of complexity because the cannabis laws of many countries were changing. Was it worth the effort at this point in time to engage in more international expansion activities, or was it time to concentrate on Canada's rollout of recreational cannabis in July 2018? Regulated Home Growing: A Possible Threat? Cannabis was believed to be a "weed" and therefore easy to grow anywhere. The ACMPR allowed patients to grow their own plants or to have a designated person grow the plants. If people could grow their own plants, why would they spend so much money to buy cannabis from the LPs? THC Biomed, another LP, was already selling clones (starter plants) to medical marijuana patients within Canada, and had bought Clone Shipper,'s a specially designed container for shipping plants through the mail. Aurora Cannabis Inc., Canna Farms, Delta 9 Bio-Tech, Maricann Group Inc., Peace Naturals Project, WeedMD, and Whistler Medical Marijuana Corporation also had licences to sell plants. CannTrust and Tweed were also licensed to sell cannabis seeds.16 Even if patients and future recreational cannabis clients were allowed to grow their own plants, doing so would take a lot of effort. People could grow fruits and vegetables or make their own wine at home, but most people did not. Companies that could achieve economies of scale could produce cannabis for a lower per unit cost than most home growers, mainly due the electricity costs required for controlling the indoor lighting and temperature conditions. Also, growing the plants required space, and quality control issues needed to be considered. Pests and mould could lead to a bad crop." Cannabis plants also produced a strong smell, which could be a deterrent to growers in densely populated areas. According to Linton: Having a cannabis plant grow is not all that hard. ... The problem is that it gets stressed by ... light, water, heat or mildews on it or moulds.... I would suggest that we view people who wish to grow out of their home, I would love if they bought the seeds and/or any nutrients or components that we could develop.... Because I will give them a coupon for 15 per cent off their purchase of product in the event that when they grow themselves, isn't quite as good as we do, and we'd be delighted to help them out. I think probably about 90 per cent of the time, they'll be coming back to us. Page 4 9B18M089 CANOPY GROWTH CORPORATION Canopy was a holding company with Tweed, Bedrocan Canada, and Mettrum being its three main brands. Tweed was Canopy's lifestyle brand that was described on the company's website as being "approachable and friendly, yet reliable and trusted. Linton was a co-founder of Tweed Marijuana Inc. and created Canopy with Bedrocan BV, a Dutch firm that was purely focused on medical cannabis research and creating standardized strains. Bedrocan Canada had the exclusive licensing rights to supply the Bedcrocan strains to the American continent. Mettrum was acquired by Canopy in early 2017 and had a brand identity focused on natural health and wellness. As Canada's largest medical marijuana company, Canopy had the overall vision, according to Linton, to "constantly evolve upward in the value chain, not to be in agro-business." Each brand had its own set of licences from Health Canada. Among its main brands (Bedrocan, Tweed, and Mettrum), Canopy had five facilities with cultivation and sales licences and one Bedrocan facility with a sales licence. Four of those facilities were also licensed for the production and sale of cannabis oil. Additionally, Agripharm had licences for the sale and production of both the dried plant and oils. However, the brands also shared a few common points. For example, all of the brands were sold at Tweed Mainstreet (https://www.tweedmainstreet.com), which was the online shopping portal. Similarly, all of the products were shipped from a common platform and used common finance and information technology (IT) systems. Production methods and operating practices could also be shared between the LPs' growing facilities, except for Bedrocan's, which came with a proprietary production methodology that could not be shared with the other LPs. Canopy's patient base was more than 58,000 as of June 27, 2017, representing approximately a third of all registered patients at that time. In a BNN interview in the summer of 2017, Linton revealed that Canopy was creating logistics and distribution channels across Canada to prepare for the anticipated recreational market in 2018. In terms of production for the recreational market, the plan was to have test stores collect data on consumer preferences and purchases. Canopy's Milestones Linton was aware of the public perception of Canopy and the rest of the cannabis industry. For example, when Canopy decided to list publicly on the Canadian Venture Exchange (under the ticker symbol CGC), the goal was not merely to attract capital but also to differentiate Canopy from its competitors in the eyes of customers." It was also a way to legitimize its business in the eyes of the public. Acquiring Bedrocan was also meant to send a signal to the public. In this instance, the signal was that consolidation was already happening, and thus, the industry was maturing. Similarly, the Mettrum acquisition signalled further consolidation. Challenges and Issues One of the main challenges that all medical cannabis companies faced was that physicians were often hesitant to write prescriptions for cannabis because, according to Canadian Medical Association representative Dr. Jeff Blackmer,20 there had not been much rigorous scientific medical research on the adverse effects and the efficacy of medical marijuana. Without scientific evidence showing the efficacy of cannabis, it was challenging for insurance companies to justify covering medical cannabis prescriptions. Linton explained, There have been no broad studies because there were no cannabis) companies and in 2014, there were only four countries where you could do this." Page 5 9B18M089 Despite the aforementioned challenges, the operational challenge was to have enough supply in 2018 for both medical patients and adult recreational customers. To address the possibility of too little supply, Canopy Rivers was created to finance and advise smaller grow operations in Canada in return for a percentage of the grower's output. LPs such as Canada's Island Garden in Prince Edward Island were part of Canopy's Craftgrow collection, which were the growers financed by Canopy Rivers. With a finite amount of vault space in Canopy's facilities, one solution was to convert dried cannabis to cannabis oils because the latter took only 1/10 of the storage space that the former occupied. From their early experiences building their own growing operations, the Canopy team knew that it took time to be efficient due to the trial and error necessary. As Linton said, There is no book that you can read to learn how to build a massive cannabis company." Furthermore, there were financial challenges inherent in running a cannabis business. In the summer of 2017, the fourth quarter results were released, showing a greater net loss for 2017 than 2016. The loss was mainly due to "biological asset change, which represented all plants that were in the process of growing (see Exhibit 4). Raising capital was also a concern. According to Linton: Everything gets funded principally by the issuance of equity. We have a 1.3 or 1.4 billion dollar market cap, probably 3 to 4 hundred million dollars of what you could say are tangible assets, which include the licensed value of the facilities and I have about $13 million in debt. The debt instruments for this sector have been withheld by banks, unless it's Tier 2 banks and if you're dealing with a Tier 2 or Tier 3 bank, their ability to actually organize real debt packages is pretty limited. So, most of the things are funded by equity issuances. In addition to the reduced access to debt packages from banks, there were limitations on the number of institutional investors that could invest in cannabis companies. Large American investment firms such as Putnam and Fidelity could not invest in Canopy or any other cannabis firms because of the cultural stigma attached to the cannabis industry and the fact that, at the federal level, cannabis was still illegal in the United States. The lack of institutional investors meant that there were more shares exchanged at the retail level (i.e., between individual investors). Would this lack of institutional investors be a limitation for Canopy's international expansion possibilities? THE INTERNATIONAL CANNABIS INDUSTRY Several countries had already legalized medical or recreational cannabis, and more countries were expected to legalize cannabis by the end of 2018. However, import and export laws could constrain the flow of cannabis products between countries. Bedrocan Canada was both a part of Canopy and a subsidiary of Bedrocan International, a Dutch firm. Joint ventures with local firms were a way to manoeuvre around the import and export laws, but they also required more investment and therefore represented greater risk for the company. A Health Canada bulletin posted on August 24, 2016, made clear that the Canadian cannabis regulations were "neither intended to make Canada an exporter of cannabis, nor to enable importation as an alternative of domestic production."21 Furthermore, "importation and exportation would be permitted under very limited circumstances, such as, importing starting materials for a new LP or exporting a unique marijuana strain for scientific investigation in a foreign laboratory."22 Canopy had already exported cannabis to Germany and Brazil. When asked about the Health Canada bulletin, Linton replied: Page 6 9B18M089 I think every country in the world will limit or eliminate imports because if you ask the United Nations-for what I suspect, will be the rest of our lives it will be governed as a narcotic and the reason is, the United Nations has a lot of members and a lot of those members are in geographies and religions and cultures that are not going to change their view on cannabis, not in the next 50 years. Furthermore, politicians in target countries would also likely prefer domestic cannabis growing operations because of the tax revenue and job creation opportunities. Linton explained, I'm pretty sure, if you're running for re-election and you close Smiths Falls because you're importing from Uruguay, the people in Uruguay are unlikely [to] vote for you. It seemed that Canada was poised to be a leader in the global cannabis industry because of its history and reputation in the world. According to Linton: Being Canada and considered to be a pretty normal, bland, governed, tax-paying, rule-following entity helps because we've done it first and we actually have a prime minister now that is of some visibility, it seems to be never challenged as weird or stupid ... the fact that we were the second country in the world to have adult access to legal cannabis for medical purposes. ... And because that started in 2001 with really bad policy, the Health Canada bureaucrats and the physicians had about 12 years of terrible experience to learn what they wanted to do in the next generation of policy. And so that was reflected in the policy released in June of 2013. The reason why other countries are copying that as their baseline is they never had access to legal cannabis because of a court ruling. With more countries legalizing cannabis year after year, Linton was looking at many possibilities for international expansion: Two years ago, I spent a lot of time hosting delegations from the world over and from transnational regulators to show them how things can be done and what the enactment of the regulations looks like. And then I didn't see them for a year, year and a half. And they all went off and wrote their German version or the Chilean version or the Colombian version or their Danish version or their Australian version and on and on and on of what we've got. And so now, my problem is that they're all coming out at the same time and I can't keep up! International Legal Issues While Canopy and other Canadian cannabis companies had already been exporting cannabis to countries such as Germany and Brazil, concerns were raised about whether the legalization of recreational cannabis might violate UN Treaties such as the Single Convention on Narcotic Drugs, 1961 and the United Nations Convention Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, 1988.23 The Trudeau government's response was that with adequate restrictions on the production and sale of cannabis, Canada would be staying within the guidelines of the treaties. Article 28 of the 1961 treaty seemed to allow for the cultivation of cannabis as long as it was strictly controlled by the government.24 Furthermore, Uruguay was also a member of both treaties and had already legalized recreational cannabis at the federal level. Cannabis in the United States As Canada's closest geographic neighbour, the United States seemed to be an obvious choice for international expansion. However, cannabis was legal in many but not all states. Other Canadian-based companies such as Friday Night Inc. had set up cannabis businesses in states such as Nevada, where Page 7 9B18M089 recreational cannabis was legalized in July 2017. The fact that marijuana was still illegal at the federal level in the United States meant that the regulatory environment limited the activities of Canadian-based cannabis companies in the United States.? U.S. Attorney General Jeff Sessions also made his position clear when he said, "Good people don't smoke marijuana. "26 American investors were interested in Canadian cannabis stocks because the major American stock exchanges (i.e., the New York Stock Exchange and NASDAQ) would not accept listings for cannabis companies since they were engaging in a federally illegal business. By not engaging in federally illegal activities, Linton was ensuring that Canopy was engaging in only purely legal activities. Cannabis in South America In 2015, the Supreme Court of Brazil was debating the decriminalization of drug possession (for personal use). In November 2016, Bedrocan Canada exported 10 kilograms of dried cannabis to Brazil for research purposes. Bedrocan Canada and Entourage Phytolab formed a joint venture, Bedrocan Brasil, in late 2016 to develop an epilepsy and pain management drug to be registered in Brazil for Brazilian patients. Medical marijuana was legalized in Chile in 2015. Canadian LP Tilray had partnered with the Chilean government-licensed firm, Alef Biotechnology, to supply Chilean patients with cannabis products. Tilray's products had an average sale price of $310 for a one-month supply. Canopy established the brand Spectrum Chile SpA for entry into the Chilean market.30 Known as the "Switzerland of South America,"3] Uruguay was the first country in the world to legalize marijuana (both medical and recreational) in 2013.32 The government set the price at $1.30 per gram (see Exhibit 5 for national retail prices), and only registered users over the age of 18 were allowed to buy up to 40 grams per month at a participating pharmacy. The purpose of the regulated low price was to lure customers away from the black market. The regulations did not allow for the sale of any derivative products. Consumers could obtain cannabis by growing their own or going to a cannabis club, where they could buy strains that had higher THC levels than were available in pharmacies. Some South American countries had decriminalized the possession of small amounts of cannabis, including Paraguay, Peru, and Ecuador.34 However, companies could not start selling in those countries because large-scale cultivation in some of those countries was still either illegal or not clearly legal. For example, in Peru, medical marijuana was not legalized yet. 35 Cannabis in Europe In March 2017, Germany legalized medical marijuana and relied on imports because little cannabis was grown in Germany.36 Canopy announced on July 25, 2016, that it was working with MedCann Gmbh Pharma and Nutraceuticals, a privately held German firm that imported and manufactured pharmaceuticals, to introduce Tweed products to German patients. The plan was to start with two strains and then add more varieties later. In late November 2016, Canopy announced that it would be acquiring MedCann GmbH,98 which was renamed Spektrum Cannabis Germany GmbH in June 2017. As of August 2017, Canopy was in the second stage of a three-stage request for proposal to set up a growing operation in Germany. If Canopy succeeded in making it through phase 2, the last stage would be mainly a negotiation for the price of supply. Other Canadian LPs were also interested in the nascent German market. On October 12, 2016, Cronos Group's subsidiary, Peace Naturals Projects Inc., announced that it had made its first export to a German Page 8 9B18M089 firm, Pedanios GmbH, a distributor for more than 200 pharmacies. On May 26, 2017, Aurora Cannabis Inc., another large Canadian LP, acquired Pedanios GmbH." On April 28, 2017, Maricann Group Inc., a smaller Canadian LP, announced it had established a subsidiary, Maricann GmbH, in Munich, with a five- person advisory board." The early entry into the German market was also intended to be a starting point for entering other European nations that had recently legalized cannabis for either medicinal or recreational use, including Denmark, Italy, Czech Republic, Catalonia"? (Spain), and Switzerland. Cannabis in Australia In September 2015, Australia's Therapeutic Goods Administration announced that medical cannabis would become a legally controlled drug starting in November 2016.43 However, how the licensing system would work was not yet clear. Also, each state had its own laws. For example, any patient (no age limit) in Queensland could be prescribed medical cannabis for cancer, epilepsy, or Acquired Immune Deficiency Syndrome (AIDS), but only adult patients in New South Wales could be prescribed medical cannabis for end-of-life illnesses.44 On May 20, 2016, Canopy announced that it would be acquiring equity holdings in AusCann in exchange for consultation services in areas including production, quality assurance and operations, and strategic advisory services.45 This acquisition was the first international partnership between an Australian and a Canadian firm in the cannabis industry.46 Cannabis in Israel Dr. Raphael Mechoulam was the Israeli scientist who discovered THC, the psychoactive component in cannabis. Since his discovery, Israel one of the first countries to legalize medical marijuana, and the country with the highest percentage of cannabis users in the world had become a global leader in marijuana research, with the "world's highest percentage of financial resources devoted to research."948 In March 2017, Israel decriminalized the use of recreational cannabis. 49 NEXT STEPS Canopy was already enjoying its status as Canada's largest cannabis company. There were new markets to explore, but at the same time, Canada had a shortage of product in the medical cannabis market and recreational cannabis was expected to be legalized in Canada by July 2018. Meanwhile, Canopy's competitors were also engaging in international business. Aurora was already exporting cannabis to Germany, and Aphria Medical Cannabis had invested $25 million in a Florida dispensary.S! Was it too early to explore more international opportunities, or should Canopy "strike while the iron was hot" in countries where the cannabis regulations had just been changed? Where in the world should Canopy go from here? Page 9 9B18M089 EXHIBIT 1: POTENTIAL COUNTRIES FOR CANOPY'S INTERNATIONAL EXPANSION OF ITS CANNABIS SALES Legalized In the process of legalizing/exploring legalization (medical) Source: Company documents. EXHIBIT 2: ACTIVE REGISTRATIONS FOR PRODUCING CANNABIS FOR PERSONAL USE, JULY 1, 2016 TO MARCH 31, 2017 July 1- September 30, 2016 189 October 1- December 31, 2016 1,899 January 1- March 31, 2017 3,186 3 108 236 Number of people registered to produce cannabis for their own medical purposes Number of people registered to produce cannabis for someone else Total number of clients registered with licensed producers at the end of the quarter 98,460 129,876 167,754 Source: Created by the authors using data from Government of Canada: Drugs and Health Products, Licensed Producers: Market Data," accessed August 20, 2017, https://www.canada.ca/en/health-canada/services/drugs-health-products/medical- use-marijuana/licensed-producers/market-data.html. Page 10 9B18M089 EXHIBIT 3: CANADA'S LICENSED PRODUCERS OF CANNABIS-QUARTERLY PRODUCTION AND SALES DATA, OCTOBER 1, 2015 TO MARCH 31, 2017 October 1- January 1- April 1- July 1- December March 31, June 30, September 31, 2015 2016 2016 30, 2016 October 1- January 1- December March 31, 31, 2016 2017 Dried Cannabis Amount sold (kg) 2,481 3,082 4,037 4,773 5,134 5,836 2,684 4,037 5,014 5,734 Info not available Info not available Amount produced (kg) Amount tested and ready for sale (kg) Info not available Info not available Info not available Info not available 4,577 5,674 Cannabis Oil Amount sold (kg) Info not available 584 1,500 2,420 4,109 5,673 Amount produced (kg) 128 892 1,654 3,116 Info not available Info not available Amount tested and ready for sale (kg) Info not available Info not available Info not available Info not available 3,975 5,298 Average amount of medical cannabis per client shipment (grams per day) 1.12 1.03 0.96 0.89 0.79 0.75 Note: kg = kilograms. Source: Created by the authors using data from Government of Canada: Drugs and Health Products, "Licensed Producers: Market Data, accessed August 20, 2017, https://www.canada.ca/en/health-canada/services/drugs-health-products/medical- use-marijuana/licensed-producers/market-data.html. Page 11 9B18M089 EXHIBIT 4: CANOPY GROWTH CORPORATION STATEMENT OF INCOME FOR THE YEARS ENDED MARCH 31, 2016 AND 2017 March 31, 2017 $39,895 March 31, 2016 $12,699 -60,061 38,805 39,577 22,747 12,796 19,722 2,263 6,287 Revenue Unrealized gain on changes in the fair value of biological assets (Note 6) Inventory expensed to cost of sales Other cost of sales Cost of sales (recovery to cost of sales), net of the unrealized gain on changes in the fair value of biological assets Gross margin Sales and marketing Research and development General and administration Acquisition-related costs Share of loss in equity investments Share-based compensation expense (Note 12) Share-based compensation expense related to acquisition milestones (Note 12) Depreciation and amortization 37,632 12,960 810 16,858 7,369 50 8,046 18,986 5,653 721 8,177 1,155 276 3,497 690 0 Loss from operations Interest expense, net Other expense, net Increase in fair value of acquisition consideration related liabilities 6,064 52,847 - 15,215 -66 -585 2,256 21,735 -2,749 -140 0 -1,193 -481 -1,844 -17,059 401 - 16,658 -621 -3,370 -126 -3,496 Net loss before income taxes Income tax recovery (expense) Net loss after income taxes Net loss attributable to: Canopy Growth Corporation Non-controlling interest -16,607 -51 - 16,658 -3,496 0 -3,496 -0.14 -0.05 Earnings per share, basic and diluted Net loss per share (Note 13) Weighted average number of outstanding common shares: 118,989,713 77,023,935 Note: All amounts are expressed in thousands of Canadian dollars except the share amounts. Source: Company documents. Page 12 9B18M089 EXHIBIT 5: LEGAL CANNABIS PRICES BY COUNTRY Country Population in 2017 Typical Retail Price Per Gram (millions) (in US$ unless stated) Year of Legalization Australia 24.5 $24.23 (2014) 2017, for medical use Brazil 209.3 $2.41 (not yet), legal only for medical research Canada 36.6 2001, for medical use C$8.40 (Can) (August 2016) $7.07 (2015) Chile 18.1 2014, for medical use Denmark 5.7 $9.25 (low) to $22.20 (high) 2018, for medical use Germany 82.1 2017, for medical use Israel 8.3 $11.05 (2015) $3 but expected to increase to $10.50 (2017) $5.01 (2015) late 1990s, for medical use Spain 46.3 2017, for recreational use United States 324.4 $6.86 (Colorado, winter 2016/17) varied by state Uruguay 3.5 $1.30 (2017) 2013, for recreational use Note: Various sources were used to find the most recent data. The prices listed in the table are from the United Nations Office on Drugs and Crime (UNODC) and are "typical prices" (unless otherwise noted). The remaining prices were averages. Source: Created by authors based on the following sources: "Marijuana Prices in Denver and Colorado: Winter 2016/17 Update," PotGuide.com, April 5, 2017, accessed August 16, 2017, https://www.coloradopotguide.com/colorado-marijuana- blog/article/marijuana-prices-in-denver-and-colorado-winter-201617-update/; * Nick Miroff, "In Uruguay's Marijuana Experiment, the Government Is Your Pot Dealer," Washington Post, July 7, 2017, accessed August 16, 2017, https://www.washingtonpost.com/world/the_americas/in-uruguays-marijuana-experiment-the-government-is-your-pot- dealer/2017/07/07/6212360c-5a88-11e7-aa69-3964a7d55207_story.html?utm_term=.d1ad91c8c860; + Medical Weed Price Will Soon Be Too High," Times of Israel, January 24, 2017, accessed August 16, 2017, www.timesofisrael.com/medical-weed-price- will-soon-be-too-high-report/; 5 "World Drug Report 2017," United Nations Office on Drugs and Crime, accessed August 16, 2017, https://www.unodc.org/wdr2017/en/maps-and-graphs.html; * Phillip Smith, "10 Countries with the World's Highest and Lowest Pot Prices," AlterNet, September 8, 2015, accessed August 16, 2017, www.alternet.org/drugs/10-countries-world-highest-lowest-pot- prices; + Brad Martin, "The Cost of Medical Cannabis in Canada," Lift News, August 4, 2016, accessed August 16, 2017, https:/ews.lift.co/the-cost-of-medical-cannabis-in-canadal; "Countries in the World by Population (2018)," worldometers.com, accessed February 24 2018, www.worldometers.info/world-population/population-by-country'; Meagan Campbell, "Legalizing Weed: How Uruguay Tripped Up," Macleans, March 17, 2017, accessed February 24, 2018, www.macleans.ca/politics/legalizing-weed-how- uruguay-tripped-up/; Simon Romero, "Uruguay Acts to Legalize Marijuana," New York Times, December 10, 2013, accessed February 24, 2018, www.nytimes.com/2013/12/11/world/americas/uruguay-acts-to-legalize-marijuana.html?_r=2&; Aaron Bockner, "Lessons for Canada: Israel to Enhance Access to Medical Cannabis," Lift News, December 7, 2015, accessed February 24, 2018, https:/ews.lift.co/lessons-for-canada-israel-taking-steps-to-enhance-access-to-medical-cannabisl; Debra Killalea and AAP, "Medical Marijuana Legal in Australia: What It Means For You," News.com.au, February 22, 2017, accessed February 24, 2018, www.news.com.au/lifestyle/health/medical-marijuana-legal-in-australia-what-it-means-for-youews- story/b61f0238f84be843855c20605bc17ed1; Amanda Erickson, "Mexico Just Legalized Medical Marijuana," Washington Post, June 21, 2017, accessed February 24, 2018, https://www.washingtonpost.comews/worldviews/wp/2017/06/21/mexico-just-legalized medical-marijuana/?utm_term=.8dfe14735be2; Tiffany King, "Catalonia, Spain, Becomes Newest Community to Legalize Cannabis," Herb, July 1, 2017, accessed February 24, 2018, https://herb.co/2017/07/02/catalonia-spain-legalize-cannabis/; "Denmark Approves Medical Cannabis Trial," Local, November 8, 2016, accessed February 24, 2018, https://www.thelocal.dk/20161108/denmark- approves-medical-cannabis-trial