Question: con&external_browser=0&launchUn=https%253A%252 Homework Oaks Company has completed the payroll for the month of January, reflecting the following data: Salaries and wages earned Employee income taxes withheld

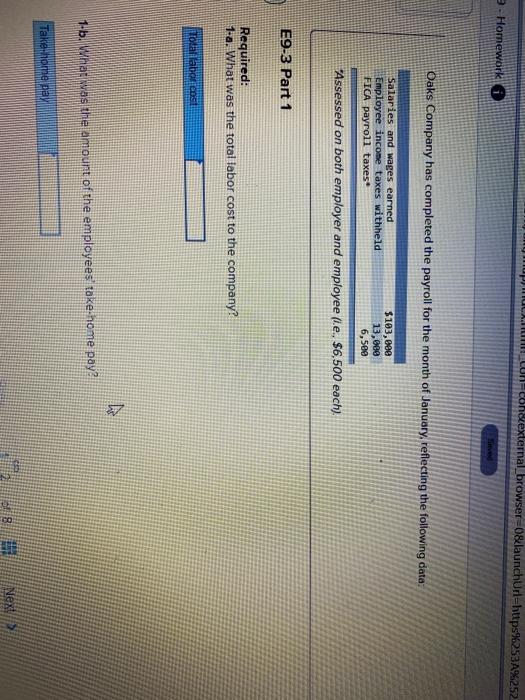

con&external_browser=0&launchUn=https%253A%252 Homework Oaks Company has completed the payroll for the month of January, reflecting the following data: Salaries and wages earned Employee income taxes withheld FICA payroll taxes $103,000 13,000 6,500 "Assessed on both employer and employee (i.e.. $6,500 each). E9-3 Part 1 Required: 1-a. What was the total labor cost to the company? allaboost N 1-5. What was the amount of the employees take home pay? Take home pay 2 8 Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts