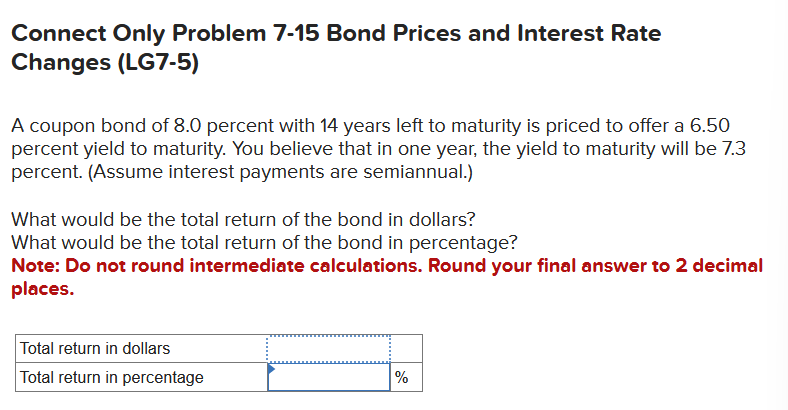

Question: Connect Only Problem 7 - 1 5 Bond Prices and Interest Rate Changes ( LG 7 - 5 ) A coupon bond of 8 .

Connect Only Problem Bond Prices and Interest Rate Changes LG

A coupon bond of percent with years left to maturity is priced to offer a percent yield to maturity. You believe that in one year, the yield to maturity will be percent. Assume interest payments are semiannual.

What would be the total return of the bond in dollars?

What would be the total return of the bond in percentage?

Note: Do not round intermediate calculations. Round your final answer to decimal places.A coupon bond of percent with years left to maturity is priced to offer a

percent yield to maturity. You believe that in one year, the yield to maturity will be

percent. Assume interest payments are semiannual.

What would be the total return of the bond in dollars?

What would be the total return of the bond in percentage?

Note: Do not round intermediate calculations. Round your final answer to decimal

places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock