Question: ? X - 5 Sign In DE .. . FILE HOME INSERT Calibri - B I U . 8 - Bond prices and Interest Rate

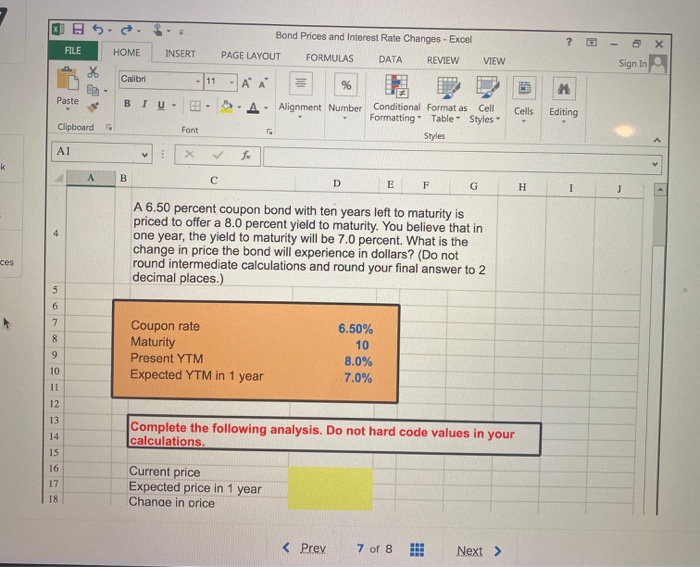

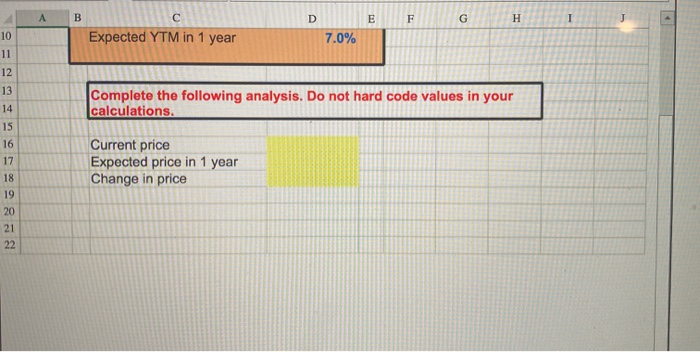

? X - 5 Sign In DE .. . FILE HOME INSERT Calibri - B I U . 8 - Bond prices and Interest Rate Changes - Excel PAGE LAYOUT FORMULAS DATA REVIEW VIEW A A. Alignment Number Conditional Format as Cell Formatting" Table Styles Styles Paste Cells Clipboard H A 6.50 percent coupon bond with ten years left to maturity is priced to offer a 8.0 percent yield to maturity. You believe that in one year, the yield to maturity will be 7.0 percent. What is the change in price the bond will experience in dollars? (Do not round intermediate calculations and round your final answer to 2 decimal places.) 6.50% 10 Coupon rate Maturity Present YTM Expected YTM in 1 year 8.0% 7.0% Complete the following analysis. Do not hard code values in your calculations. Current price Expected price in 1 year Change in orice A Expected YTM in 1 year 7.0% Complete the following analysis. Do not hard code values in your calculations. Current price Expected price in 1 year Change in price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts