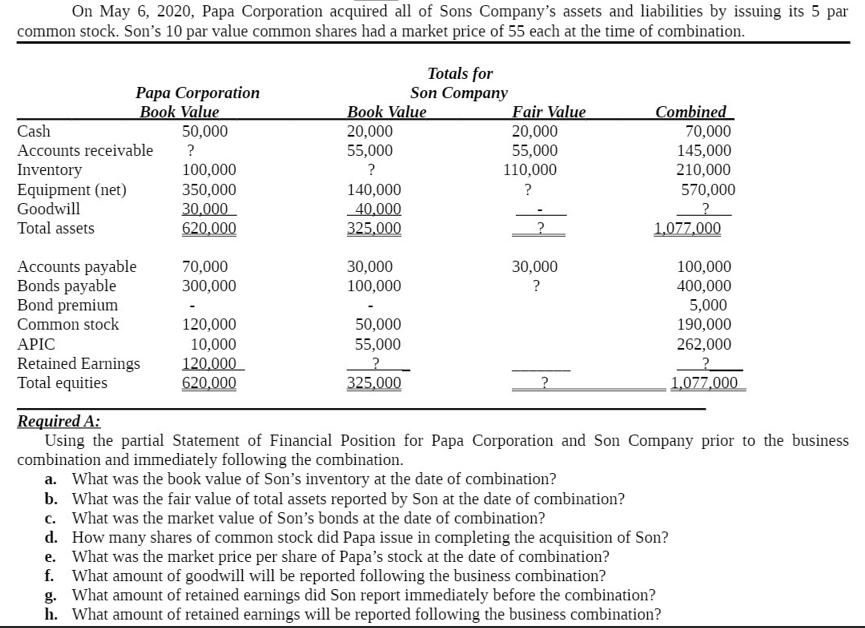

Question: On May 6, 2020, Papa Corporation acquired all of Sons Company's assets and liabilities by issuing its 5 par common stock. Son's 10 par

On May 6, 2020, Papa Corporation acquired all of Sons Company's assets and liabilities by issuing its 5 par common stock. Son's 10 par value common shares had a market price of 55 each at the time of combination. Papa Corporation Book Value 50,000 ? Cash Accounts receivable Inventory Equipment (net) Goodwill Total assets Accounts payable Bonds payable Bond premium Common stock APIC Retained Earnings Total equities 100,000 350,000 30,000 620,000 70,000 300,000 120,000 10,000 120,000 620,000 Book Value 20,000 55,000 ? 140,000 40,000 325,000 30,000 100,000 Totals for Son Company 50,000 55,000 ? 325,000 Fair Value 20,000 55,000 110,000 ? 30,000 ? ? Combined 70,000 145,000 210,000 570,000 ? 1,077,000 100,000 400,000 5,000 190,000 262,000 ? 1,077,000 Required A: Using the partial Statement of Financial Position for Papa Corporation and Son Company prior to the business combination and immediately following the combination. a. What was the book value of Son's inventory at the date of combination? b. What was the fair value of total assets reported by Son at the date of combination? c. What was the market value of Son's bonds at the date of combination? d. How many shares of common stock did Papa issue in completing the acquisition of Son? e. What was the market price per share of Papa's stock at the date of combination? f. What amount of goodwill will be reported following the business combination? g. What amount of retained earnings did Son report immediately before the combination? h. What amount of retained earnings will be reported following the business combination?

Step by Step Solution

3.35 Rating (170 Votes )

There are 3 Steps involved in it

a Sons inventory book value was 210000 b Sons total ... View full answer

Get step-by-step solutions from verified subject matter experts