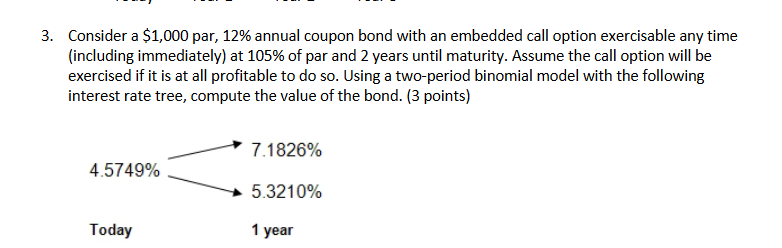

Question: Consider a $ 1 , 0 0 0 par, 1 2 % annual coupon bond with an embedded call option exercisable any time ( including

Consider a $ par, annual coupon bond with an embedded call option exercisable any time

including immediately at of par and years until maturity. Assume the call option will be

exercised if it is at all profitable to do so Using a twoperiod binomial model with the following

interest rate tree, compute the value of the bond. pointsConsider a $ par, annual coupon bond with an embedded call option exercisable any time

including immediately at of par and years until maturity. Assume the call option will be

exercised if it is at all profitable to do so Using a twoperiod binomial model with the following

interest rate tree, compute the value of the bond. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock