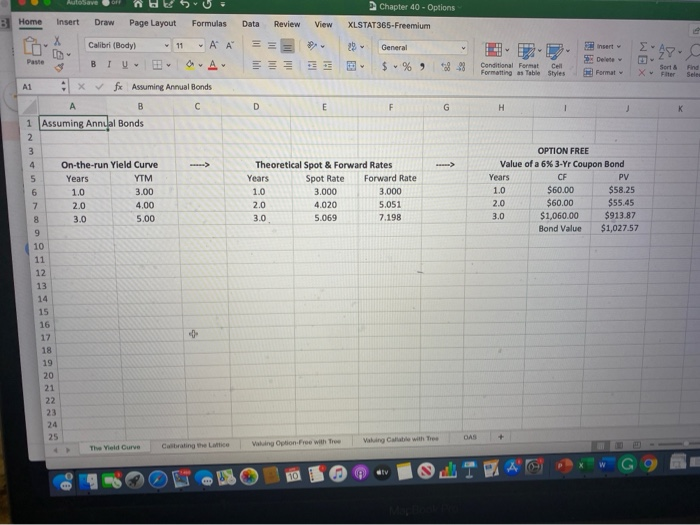

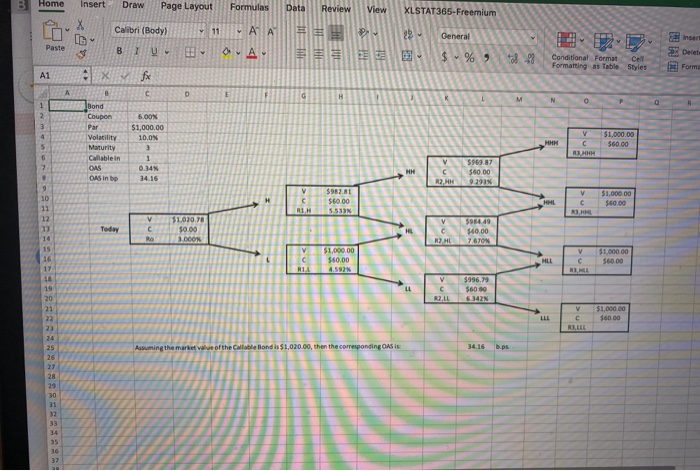

Question: Using excel and create a tree . i tried uploading excel but can only upload pictures of what the tree should look like. Assuming that

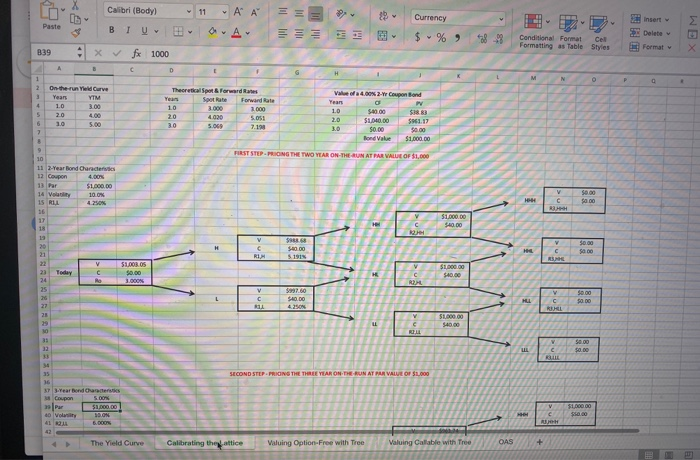

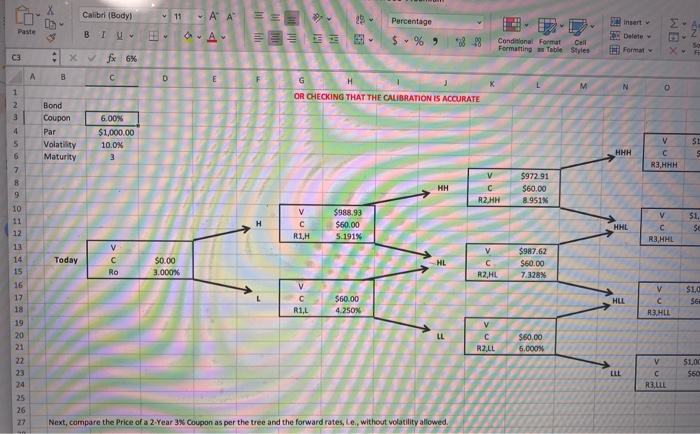

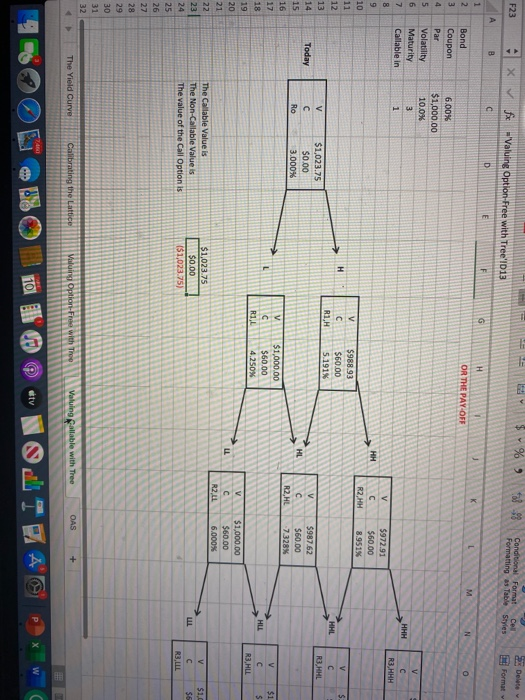

AutoSave Insert Draw b Page Layout u Formulas 3 Home Chapter 40 - Options XLSTAT365-Freemium Data Review View E E 29 P EI General $ % 78 -98 nert Delete Format .C Conditional Format Formatting as Table Cell Styles -2 son Filer X and Seles Calibri (Body) 11 A A Paste BTUEAA A1 | x f x Assuming Annual Bonds A B C 1 Assuming Annual Bonds D On-the-run Yield Curve Years YTM 3.00 4.00 3.0 5.00 Theoretical Spot & Forward Rates Years Spot Rate Forward Rate 1.0 3.000 3.000 2.0 4.020 5.051 3.0 5.069 7.198 OPTION FREE Value of a 6% 3-Yr Coupon Bond Years PV 1.0 $60.00 $58.25 2.0 $60.00 $55.45 3.0 $1,060.00 $913.87 Bond Value $1,027.57 2.0 v lig ble with the CAS The Vield Curve Vahing Option.Free with Tre Cabrating the attice 29 Paste 839 Calibri (Body) 11 A A B IUDA E fx 1000 Currency $ % . 8 9 Conditional Format Formatting as Table Cell Styles Delete Format X x On the run Ye Curve V S100.00 F CS Par $1.000.00 41 R26 .000 The Yield Curve Calibrating thegatti Option 12 Tree V aluing Callable with Tree OAS + 11 A A E 19 Percentage $ % 3 3 LU Paste c3 A B Calibri (Body) BLUE x fx 6% co & WEX Conditional Format Formatting Table Delete Format Cell Styles OR CHECKING THAT THE CALIBRATION IS ACCURATE Bond Coupon 6.00% $1,000.00 10.0% 3 Volatility Maturity R3,HHH C R2 HH $972.91 $60.00 8-951% $988.93 V $1, HHL CS R3,HHL $987.62 $60.00 7328% R2,HL $60.00 4.250 V HLLC R3HLL S1. $6 000% V $1.00 $60 LLLC R3L Next, compare the price of a 2 Year 3x Coupon as per the tree and the forward rates, Le., without volatility allowed. $ % F23 A x fx Valuing Option Free with Tree'1013 Conditional Format Formatting Table Cor Styles Format B MN OR THE PAY-OFF Bond Coupon Par 6.00% $1,000.00 10.0% Volatility Maturity Callable in R3,HHH 5972.91 $60.00 8.951% R2,HH $988.93 $60.00 S. 191% Today $1,023.75 $0.00 3.000% $987.62 $60.00 -7.328% $1,000.00 $60.00 4.250% $1,000.00 $60.00 6.000% R2.LL $1.4 The Callable Value is The Non-Callable Value is The value of the Call Option is $1,023.75 $0.00 151,023.75) The Yield Curve Calibrating the Lattice | Voor Option-Free with The valuing gallable with Tree OAS + Insert Draw Page Layout Formulas View XLSTAT365-Freemium 11 AA 123 Calibri (Body) BIU General - $ % 0 Conditional Format Formatting as Table Cell Styles Delet: Forma x L M N x BC Bond Coupon 600N $1,000.00 Volatility 10.0% Maturity Callable in OAS 0.34% DAS in bp 34.16 1 C 22. 5969.87 560.00 9.2013 & 560.00 V 74 598449 560.00 7.670 10 57 15 HUL 1.000.00 $60.00 17 19 $60.00 AutoSave Insert Draw b Page Layout u Formulas 3 Home Chapter 40 - Options XLSTAT365-Freemium Data Review View E E 29 P EI General $ % 78 -98 nert Delete Format .C Conditional Format Formatting as Table Cell Styles -2 son Filer X and Seles Calibri (Body) 11 A A Paste BTUEAA A1 | x f x Assuming Annual Bonds A B C 1 Assuming Annual Bonds D On-the-run Yield Curve Years YTM 3.00 4.00 3.0 5.00 Theoretical Spot & Forward Rates Years Spot Rate Forward Rate 1.0 3.000 3.000 2.0 4.020 5.051 3.0 5.069 7.198 OPTION FREE Value of a 6% 3-Yr Coupon Bond Years PV 1.0 $60.00 $58.25 2.0 $60.00 $55.45 3.0 $1,060.00 $913.87 Bond Value $1,027.57 2.0 v lig ble with the CAS The Vield Curve Vahing Option.Free with Tre Cabrating the attice 29 Paste 839 Calibri (Body) 11 A A B IUDA E fx 1000 Currency $ % . 8 9 Conditional Format Formatting as Table Cell Styles Delete Format X x On the run Ye Curve V S100.00 F CS Par $1.000.00 41 R26 .000 The Yield Curve Calibrating thegatti Option 12 Tree V aluing Callable with Tree OAS + 11 A A E 19 Percentage $ % 3 3 LU Paste c3 A B Calibri (Body) BLUE x fx 6% co & WEX Conditional Format Formatting Table Delete Format Cell Styles OR CHECKING THAT THE CALIBRATION IS ACCURATE Bond Coupon 6.00% $1,000.00 10.0% 3 Volatility Maturity R3,HHH C R2 HH $972.91 $60.00 8-951% $988.93 V $1, HHL CS R3,HHL $987.62 $60.00 7328% R2,HL $60.00 4.250 V HLLC R3HLL S1. $6 000% V $1.00 $60 LLLC R3L Next, compare the price of a 2 Year 3x Coupon as per the tree and the forward rates, Le., without volatility allowed. $ % F23 A x fx Valuing Option Free with Tree'1013 Conditional Format Formatting Table Cor Styles Format B MN OR THE PAY-OFF Bond Coupon Par 6.00% $1,000.00 10.0% Volatility Maturity Callable in R3,HHH 5972.91 $60.00 8.951% R2,HH $988.93 $60.00 S. 191% Today $1,023.75 $0.00 3.000% $987.62 $60.00 -7.328% $1,000.00 $60.00 4.250% $1,000.00 $60.00 6.000% R2.LL $1.4 The Callable Value is The Non-Callable Value is The value of the Call Option is $1,023.75 $0.00 151,023.75) The Yield Curve Calibrating the Lattice | Voor Option-Free with The valuing gallable with Tree OAS + Insert Draw Page Layout Formulas View XLSTAT365-Freemium 11 AA 123 Calibri (Body) BIU General - $ % 0 Conditional Format Formatting as Table Cell Styles Delet: Forma x L M N x BC Bond Coupon 600N $1,000.00 Volatility 10.0% Maturity Callable in OAS 0.34% DAS in bp 34.16 1 C 22. 5969.87 560.00 9.2013 & 560.00 V 74 598449 560.00 7.670 10 57 15 HUL 1.000.00 $60.00 17 19 $60.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts