Question: Consider a 1 5 - year, fixed - rate mortgage for $ 2 4 0 , 0 0 0 at an annual rate of 5

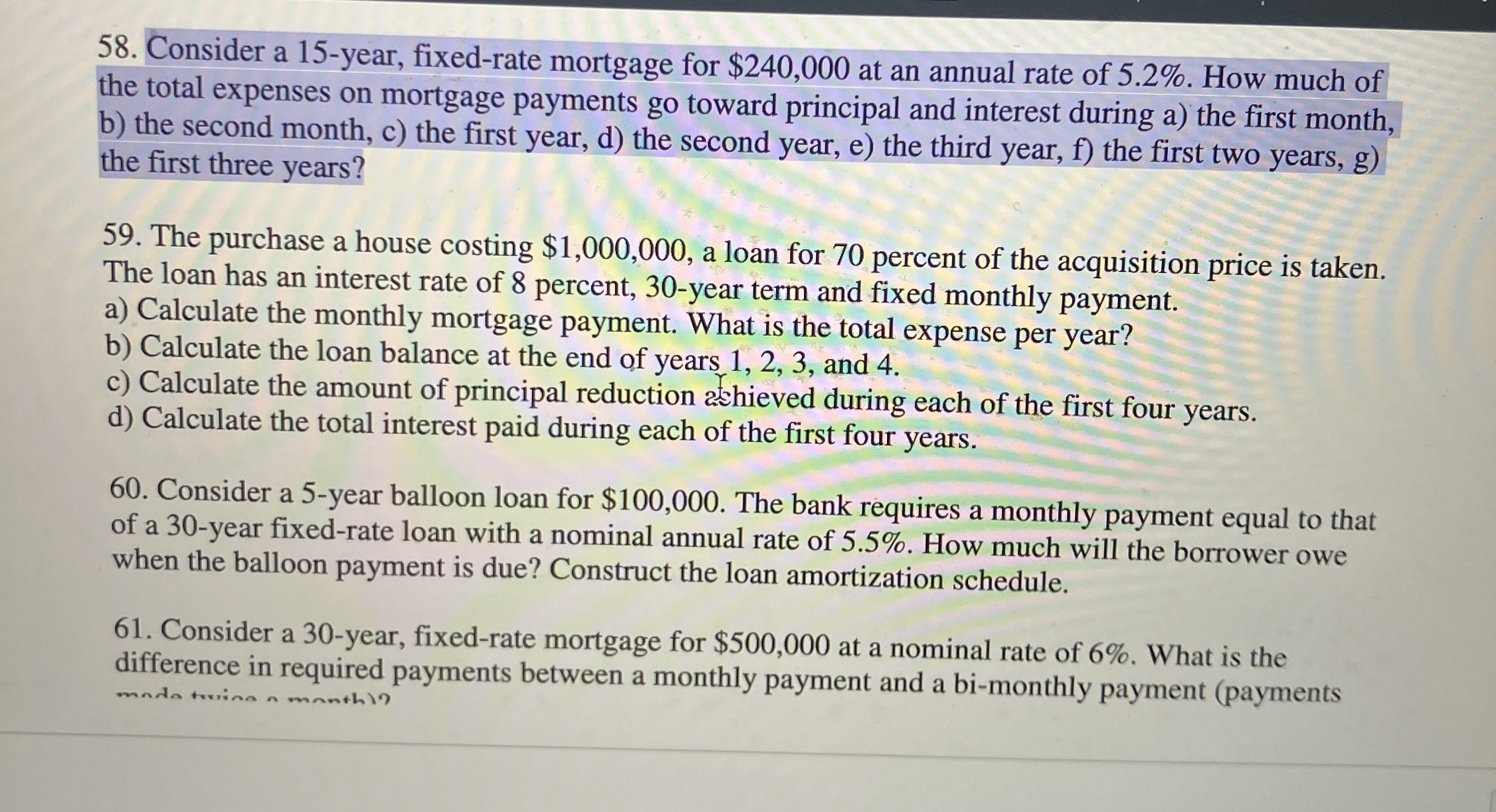

Consider a year, fixedrate mortgage for $ at an annual rate of How much of the total expenses on mortgage payments go toward principal and interest during a the first month, b the second month, c the first year, d the second year, e the third year, the first two years, the first three years?

The purchase a house costing $ a loan for percent of the acquisition price is taken. The loan has an interest rate of percent, year term and fixed monthly payment.

a Calculate the monthly mortgage payment. What is the total expense per year?

b Calculate the loan balance at the end of years and

c Calculate the amount of principal reduction ashieved during each of the first four years.

d Calculate the total interest paid during each of the first four years.

Consider a year balloon loan for $ The bank requires a monthly payment equal to that of a year fixedrate loan with a nominal annual rate of How much will the borrower owe when the balloon payment is due? Construct the loan amortization schedule.

Consider a year, fixedrate mortgage for $ at a nominal rate of What is the difference in required payments between a monthly payment and a bimonthly payment payments

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock