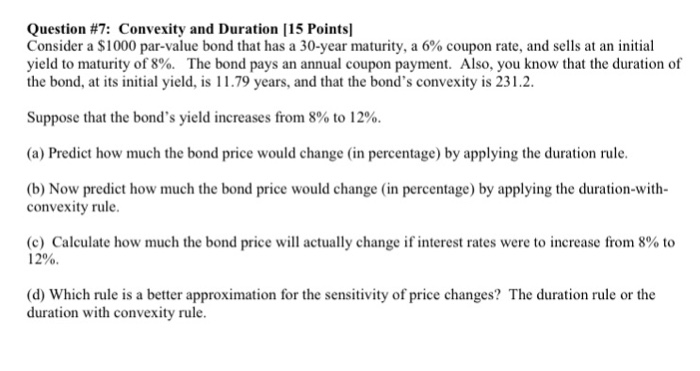

Question: Consider a $1000 par-value bond that has a 30-year maturity, a 6% coupon rate, and sells at an initial yield to maturity of 8%. The

Consider a $1000 par-value bond that has a 30-year maturity, a 6% coupon rate, and sells at an initial yield to maturity of 8%. The bond pays an annual coupon payment. Also, you know that the duration of the bond, at its initial yield, is 11.79 years, and that the bond's convexity is 231.2. Suppose that the bond's yield increases from 8% to 12%. (a) Predict how much the bond price would change (in percentage) by applying the duration rule. (b) Now predict how much the bond price would change (in percentage) by applying the duration-with-convexity rule. (c) Calculate how much the bond price will actually change if interest rates were to increase from 8% to 12%. (d) Which rule is a better approximation for the sensitivity of price changes? The duration rule or the duration with convexity rule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts