Question: Consider a bond that has a 30-year maturity, an 8% coupon rate, and sells at an initial yield to maturity of 8%. Because the coupon

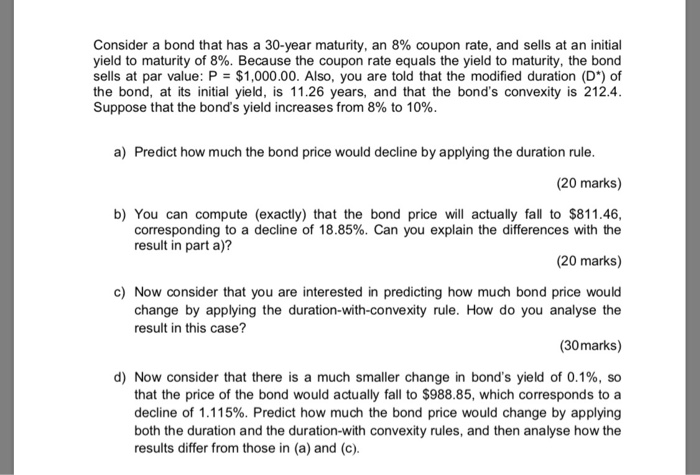

Consider a bond that has a 30-year maturity, an 8% coupon rate, and sells at an initial yield to maturity of 8%. Because the coupon rate equals the yield to maturity, the bond sells at par value: P $1,000.00. Also, you are told that the modified duration (D*) of the bond, at its initial yield, is 11.26 years, and that the bond's convexity is 212.4. Suppose that the bond's yield increases from 8% to 10%. a) Predict how much the bond price would decline by applying the duration rule. (20 marks) b) You can compute (exactly) that the bond price will actually fall to $811.46, corresponding to a decline of 18.85%. Can you explain the differences with the result in part a)? (20 marks) c)Now consider that you are interested in predicting how much bond price would change by applying the duration-with-convexity rule. How do you analyse the result in this case? (30marks) d) Now consider that there is a much smaller change in bond's yield of 0.1%, so that the price of the bond would actually fall to $988.85, which corresponds to a decline of 1.115%. Predict how much the bond price would change by applying both the duration and the duration-with convexity rules, and then analyse how the results differ from those in (a) and (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts