Question: Consider a 1000-strike put option on the S&R index with 6 months to expiration. At the time the option is written, the put writer receives

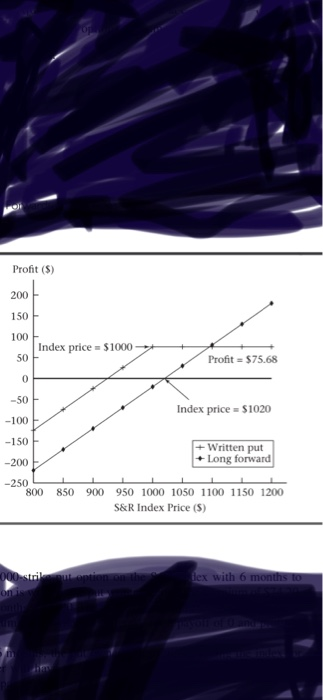

Consider a 1000-strike put option on the S&R index with 6 months to expiration. At the time the option is written, the put writer receives the premium of $74.20. Suppose the index in 6 months is $1100. The put buyer will not exercise the put. Thus, the put writer keeps the premium, plus 6 months interest, for a payoff of 0 and profit of $75.68 If the index is $900 in 6 months, the put owner will exercise, selling the index for $1000. Thus, the option writer will have to pay $1000 for an index worth $900. Using equation the written put payoff is

max[0, $1000 $900] = $100

The premium has earned 2% interest for 6 months and is now worth $75.68. Profit for the

written put is therefore

$100 + $75.68 = $24.32

Figure 2.9 (shown below) graphs the profit diagram for a written put. As you would expect, it is the mirror image of the purchased put

QUESTION: Show the numbers for each column and formulas necessary to duplicats the x,y graph (shown below) in excel. In addition, write the steps taken while navigating in excel needed to create the graph. (i.e.: What buttons to press from the tool bar and in what order) Answer is to be presented within excel.

Profit (5) 200 150 100 Index price = $1000 50 Profit = $75.68 0 -50 Index price = $1020 -100 -150 Written put +Long forward -200 -250 800 850 900 950 1000 1050 1100 1150 1200 S&R Index Price (5) 000-stri lex with 6 months to on Profit (5) 200 150 100 Index price = $1000 50 Profit = $75.68 0 -50 Index price = $1020 -100 -150 Written put +Long forward -200 -250 800 850 900 950 1000 1050 1100 1150 1200 S&R Index Price (5) 000-stri lex with 6 months to on

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock