Question: Question 5 (25%) Consider a 2-year credit default swap (CDS) on a single company. The contract's notional principal is normalised to $1. The company's

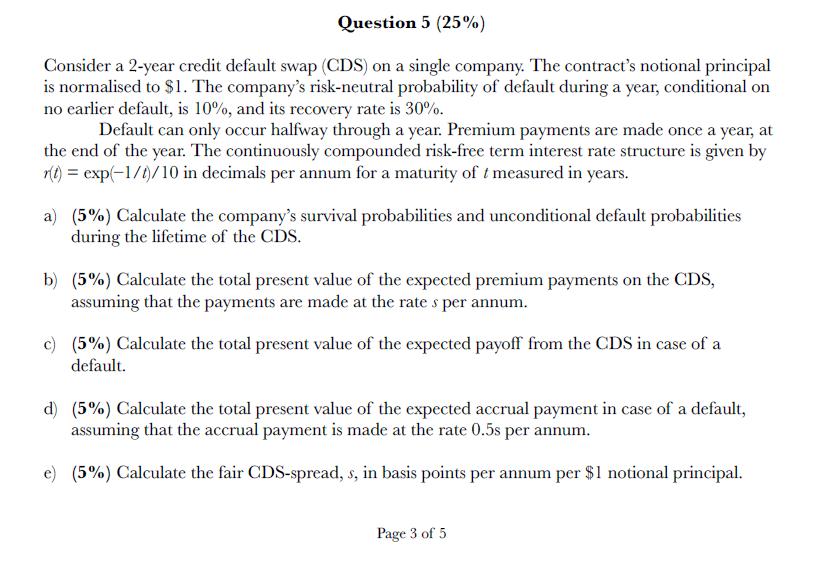

Question 5 (25%) Consider a 2-year credit default swap (CDS) on a single company. The contract's notional principal is normalised to $1. The company's risk-neutral probability of default during a year, conditional on no earlier default, is 10%, and its recovery rate is 30%. Default can only occur halfway through a year. Premium payments are made once a year, at the end of the year. The continuously compounded risk-free term interest rate structure is given by r(t) = exp(-1/t)/10 in decimals per annum for a maturity of t measured in years. a) (5%) Calculate the company's survival probabilities and unconditional default probabilities during the lifetime of the CDS. b) (5%) Calculate the total present value of the expected premium payments on the CDS, assuming that the payments are made at the rate s per annum. c) (5%) Calculate the total present value of the expected payoff from the CDS in case of a default. d) (5%) Calculate the total present value of the expected accrual payment in case of a default, assuming that the accrual payment is made at the rate 0.5s per annum. e) (5%) Calculate the fair CDS-spread, s, in basis points per annum per $1 notional principal. Page 3 of 5

Step by Step Solution

There are 3 Steps involved in it

a The companys survival probabilities are Pt 1 01t for t in 02 and its unconditional default probabi... View full answer

Get step-by-step solutions from verified subject matter experts