Question: Consider a 3 year 10% coupon bond with a face value of $100. Suppose the yield on the Bond is 12% per annum with continuous

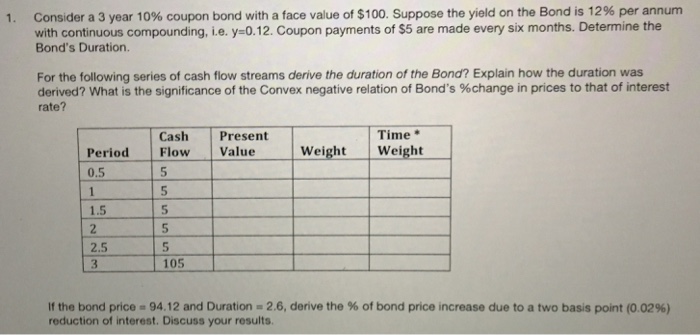

Consider a 3 year 10% coupon bond with a face value of $100. Suppose the yield on the Bond is 12% per annum with continuous compounding, i.e. y-0.12. Coupon payments of $5 are made every six months. Determine the Bond's Duration. 1. For the following series of cash flow streams derive the duration of the Bond? Explain how the duration was derived? What is the significance of the Convex negative relation of Bond's %change in prices to that of interest rate? Cash Present Time Period Flow Value 0.5 Weight Weight 5 1.5 5 5 5 105 2.5 If the bond price = 94.12 and Duration-2.6, derive the % of bond price increase due to a two basis point (0.02%) reduction of interest. Discuss your results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts