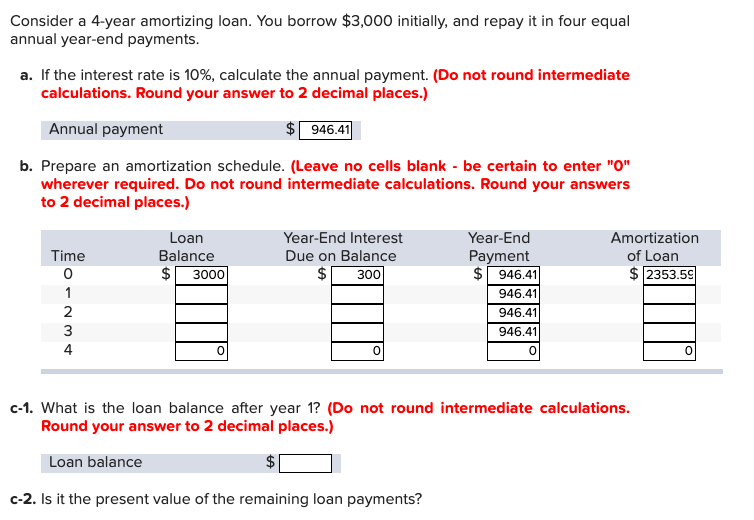

Question: Consider a 4-year amortizing loan. You borrow $3,000 initially, and repay it in four equal annual year-end payments. a. If the interest rate is 10%,

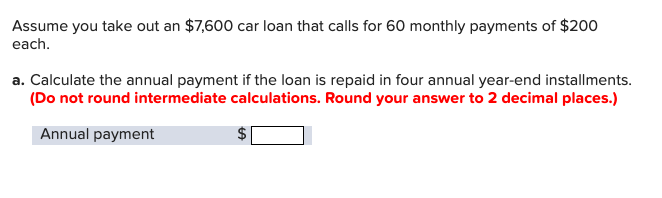

Consider a 4-year amortizing loan. You borrow $3,000 initially, and repay it in four equal annual year-end payments. a. If the interest rate is 10%, calculate the annual payment. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Annual payment 946.41 b. Prepare an amortization schedule. (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Round your answers to 2 decimal places.) Loan Year-End Interest Year-End Amortization Time Balance Due on Balance Payment of Loan 0 $ 3000 300 $946.41 $ 2353.59 1 2 3 4 own-01 946.41 946.41 946.41 C-1. What is the loan balance after year 1? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Loan balance c-2. Is it the present value of the remaining loan payments? Assume you take out an $7,600 car loan that calls for 60 monthly payments of $200 each. a. Calculate the annual payment if the loan is repaid in four annual year-end installments. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Annual payment $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts