Question: PART II - Problems (70 pts total) Walmart has a 6.75 percent coupon bond outstanding that matures in 10.5 years. The bond pays interest semiannually,

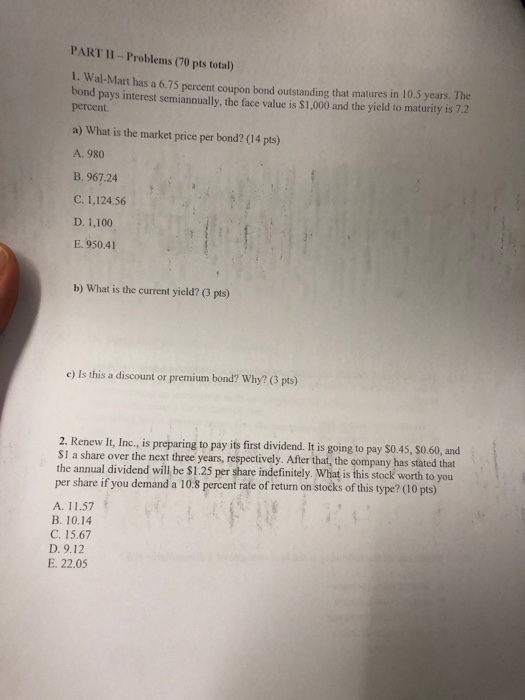

PART II - Problems (70 pts total) Walmart has a 6.75 percent coupon bond outstanding that matures in 10.5 years. The bond pays interest semiannually, the face value is $1.000 and the yield to maturity is 7.2 percent a) What is the market price per bond? (14 pts) A. 980 B.967.24 C. 1.124.56 D. 1,100 E. 950.41 b) What is the current yield? (3 pts) c) Is this a discount or premium bond? Why? (3 pts) 2. Renew It, Inc., is preparing to pay its first dividend. It is going to pay $0.45, $0.60 and $l a share over the next three years, respectively. After that, the company has stated that the annual dividend will be $1.25 per share indefinitely. What is this stock worth to you per share if you demand a 10.8 percent rate of return on stocks of this type? (10 pts) A. 11.57 B. 10.14 C. 15.67 D. 9.12 E 22.05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts