Question: Consider a 5-year maturity put option with a strike price of $100 on a 2.5s coupon bond of ten-year maturity from now. Let the

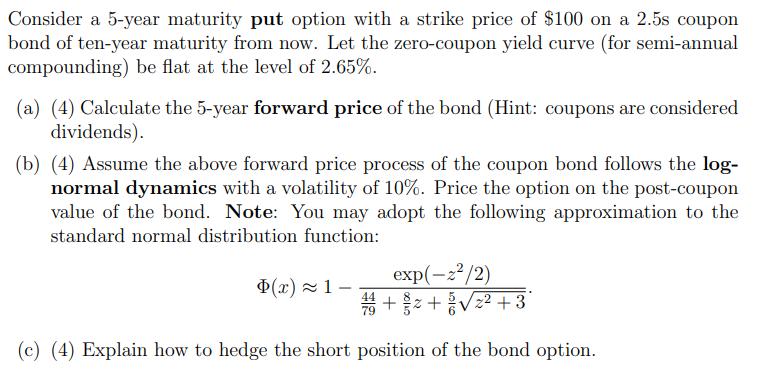

Consider a 5-year maturity put option with a strike price of $100 on a 2.5s coupon bond of ten-year maturity from now. Let the zero-coupon yield curve (for semi-annual compounding) be flat at the level of 2.65%. (a) (4) Calculate the 5-year forward price of the bond (Hint: coupons are considered dividends). (b) (4) Assume the above forward price process of the coupon bond follows the log- normal dynamics with a volatility of 10%. Price the option on the post-coupon value of the bond. Note: You may adopt the following approximation to the standard normal distribution function: exp(-2/2) 4+2++3 (c) (4) Explain how to hedge the short position of the bond option. (x) 1-

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

ANSWER GIVEN THAT a 5year maturit... View full answer

Get step-by-step solutions from verified subject matter experts