Question: handwriting Consider a 5 -year maturity put option with a strike price of $100 on a 2.5 s coupon bond of ten-year maturity from now.

handwriting

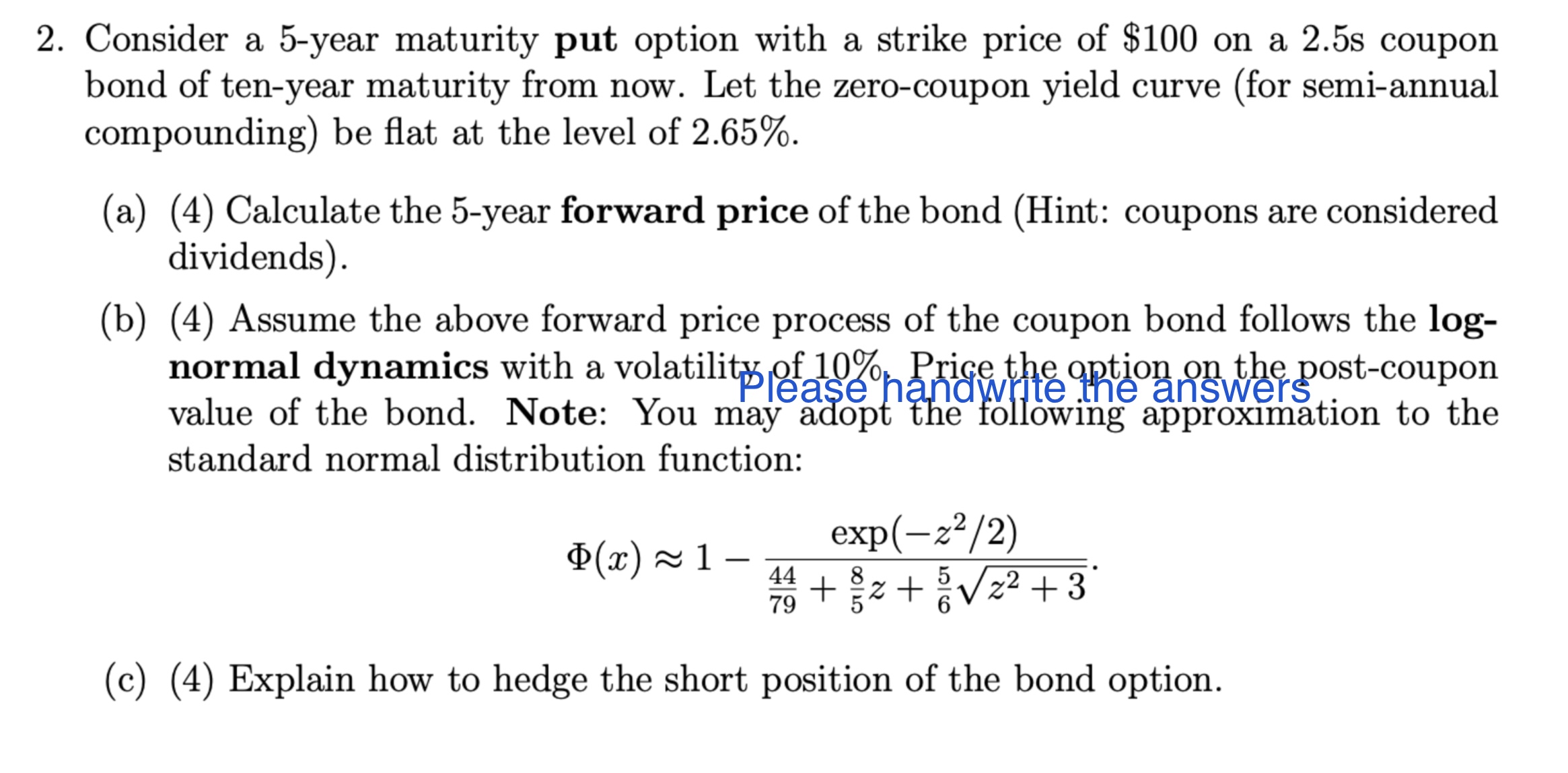

Consider a 5 -year maturity put option with a strike price of $100 on a 2.5 s coupon bond of ten-year maturity from now. Let the zero-coupon yield curve (for semi-annual compounding) be flat at the level of 2.65%. (a) (4) Calculate the 5-year forward price of the bond (Hint: coupons are considered dividends). (b) (4) Assume the above forward price process of the coupon bond follows the lognormal dynamics with a volatilit pof 10% Price the option on the post-coupon value of the bond. Note: You may adopt the following approximation to the standard normal distribution function: (x)17944+58z+65z2+3exp(z2/2) (c) (4) Explain how to hedge the short position of the bond option. Consider a 5 -year maturity put option with a strike price of $100 on a 2.5 s coupon bond of ten-year maturity from now. Let the zero-coupon yield curve (for semi-annual compounding) be flat at the level of 2.65%. (a) (4) Calculate the 5-year forward price of the bond (Hint: coupons are considered dividends). (b) (4) Assume the above forward price process of the coupon bond follows the lognormal dynamics with a volatilit pof 10% Price the option on the post-coupon value of the bond. Note: You may adopt the following approximation to the standard normal distribution function: (x)17944+58z+65z2+3exp(z2/2) (c) (4) Explain how to hedge the short position of the bond option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts