Question: Consider a 7-month forward contract on Apple Computer Inc. (AAPL). The current price of one share is $208, and the annual continuously compounded risk-free interest

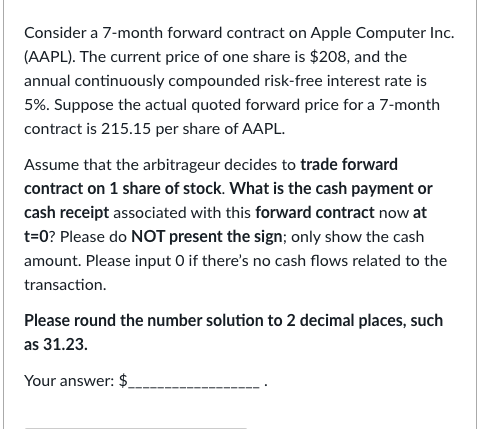

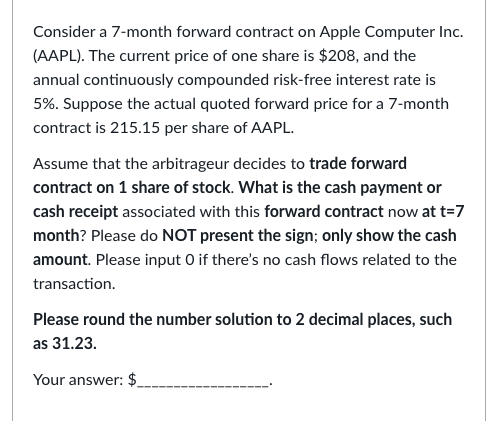

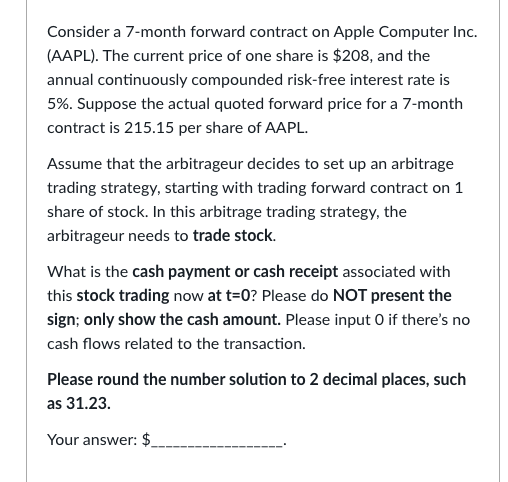

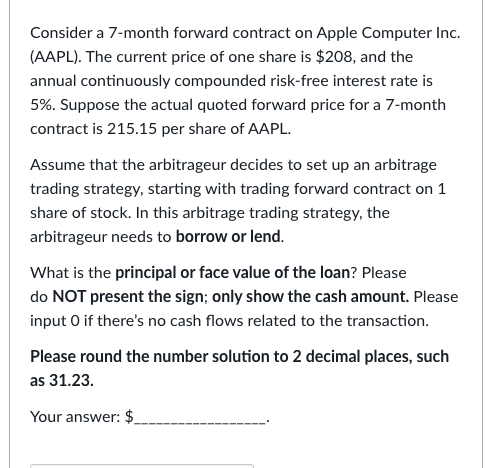

Consider a 7-month forward contract on Apple Computer Inc. (AAPL). The current price of one share is $208, and the annual continuously compounded risk-free interest rate is 5%. Suppose the actual quoted forward price for a 7-month contract is 215.15 per share of AAPL. Assume that the arbitrageur decides to trade forward contract on 1 share of stock. What is the cash payment or cash receipt associated with this forward contract now at t=0? Please do NOT present the sign; only show the cash amount. Please input 0 if there's no cash flows related to the transaction. Please round the number solution to 2 decimal places, such as 31.23. Your answer: $ Consider a 7-month forward contract on Apple Computer Inc. (AAPL). The current price of one share is $208, and the annual continuously compounded risk-free interest rate is 5%. Suppose the actual quoted forward price for a 7-month contract is 215.15 per share of AAPL. Assume that the arbitrageur decides to trade forward contract on 1 share of stock. What is the cash payment or cash receipt associated with this forward contract now at t=7 month? Please do NOT present the sign; only show the cash amount. Please input o if there's no cash flows related to the transaction. Please round the number solution to 2 decimal places, such as 31.23. Your answer: $ Consider a 7-month forward contract on Apple Computer Inc. (AAPL). The current price of one share is $208, and the annual continuously compounded risk-free interest rate is 5%. Suppose the actual quoted forward price for a 7-month contract is 215.15 per share of AAPL. Assume that the arbitrageur decides to set up an arbitrage trading strategy, starting with trading forward contract on 1 share of stock. In this arbitrage trading strategy, the arbitrageur needs to trade stock. What is the cash payment or cash receipt associated with this stock trading now at t=0? Please do NOT present the sign; only show the cash amount. Please input o if there's no cash flows related to the transaction. Please round the number solution to 2 decimal places, such as 31.23. Your answer: $ Consider a 7-month forward contract on Apple Computer Inc. (AAPL). The current price of one share is $208, and the annual continuously compounded risk-free interest rate is 5%. Suppose the actual quoted forward price for a 7-month contract is 215.15 per share of AAPL. Assume that the arbitrageur decides to set up an arbitrage trading strategy, starting with trading forward contract on 1 share of stock. In this arbitrage trading strategy, the arbitrageur needs to borrow or lend. What is the principal or face value of the loan? Please do NOT present the sign; only show the cash amount. Please input if there's no cash flows related to the transaction. Please round the number solution to 2 decimal places, such as 31.23 Your answer: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts